A civil contract is a written agreement on the provision of services or performance of work; in this case, this agreement is signed with a citizen of another country.

When engaging a foreign citizen to perform work or provide services, the question arises of which contract to draw up: civil or labor. If you plan to engage an employee from another country for specific one-time services, then the best option would be a civil law agreement with a foreigner (GPC).

Important!!! The document is more advantageous in comparison with an employment agreement, since it is not the fact of hiring an employee, which requires filing reports and paying taxes, but is only an agreement on the provision of services, which now needs to be reported only to the Federal Migration Service.

With whom can you enter into a GPC agreement?

Russian organizations may enter into a civil liability agreement with foreigners who:

- have reached the age of majority established in Russia;

- are in the country legally;

- have a work permit.

A document that confirms that a citizen has a work permit in Russia is:

- patent - for persons who entered the country under a visa-free regime (according to paragraph 16, paragraph 1, article 2 of Federal Law-115 of July 25, 2002, last edition dated April 24, 2021);

- admission - for persons who visited the country under general regime on an open visa (according to Article 2 of Federal Law No. 115).

On a note:

Obligations to obtain a patent or admission do not apply to foreigners staying in the country on the basis of a temporary residence permit, residence permit, or entering the Russian Federation as a refugee.

Concluding a GPC agreement with a foreigner who does not meet the conditions or does not have a work permit is a violation. For this, sanctions will be applied to the employer in accordance with clauses 1 and 4 of Art. 18.15 Code of Administrative Offenses of the Russian Federation. Fines will be imposed in the amount of:

- 2-5 thousand rubles. – for citizens and individual entrepreneurs;

- 25-50 thousand rubles. – for employees of the organization responsible for the violation;

- 250-800 thousand rubles. or suspension of activities for 14-90 days – of the company.

IMPORTANT:

An organization or individual entrepreneur, in order to conclude a civil process agreement with a foreign citizen, must have the appropriate permission to hire.

What taxes does an employer pay for foreign work in 2020?

The legal topic is very complex, but in this article we will try to answer the question “What Taxes Does the Employer Pay for Foreign Work in 2021.” Of course, if you still have questions, you can consult with lawyers online for free directly on the website.

In October 2021, you can already get acquainted with the plans of the Ministry of Finance for the future. It is noted that all the information in the published document about the main directions of budget policy also concerns the plan for 2021 and 2021. You can download and read it in full at this link.

- Foreign workers with high qualifications pay the same percentage as all working Russian citizens - 13%.

- A fixed fee is established for a patent, so the employee pays it.

- If the employee is in refugee status, then his interest rate will also be 13%.

Personal income tax in other countries

For more information about benefits on insurance premiums, you can refer to Section 427 of the tax code. the link to it is left above. More information about benefits can be found in the second table with the percentage of contributions from salary in 2021:

The employer must withhold income tax and transfer it once to the tax office, at the end of each month on the day of salary payment. Moreover, when calculating personal income tax, it is necessary to take into account all payments made to the employee during the month.

personal income tax

– this is the main type of direct taxes (when the state levies a tax directly on the income or property of the taxpayer). an employer paying income to its employee is recognized as a tax agent in such a situation.

personal income tax (NDFL)

Each employer is obliged to pay monthly insurance premiums from the income paid to its employees. starting from 2020, contributions must be paid to the Federal Tax Service (FTS) and the Social Insurance Fund (SFS).

The main disadvantage of the new calculation of tariffs for payments applied to foreigners is the fact that previously they were accrued only when the period of temporary stay of a migrant worker reached 6 months.

today such payment is made from the first day of employment. It goes without saying that previously, hiring foreign labor was more profitable for employers than hiring Russians.

in particular, there is a visa-free regime with the CIS countries and their citizens can work in the Russian Federation under a patent. Not long ago, the Eurasian Economic Union was formed. For Russia, Kazakhstan has become its closest partner. that is why its residents have a number of privileges when applying for work with a Russian employer.

employment contract with a foreigner

Russian legislation does not prohibit foreign citizens from finding employment in our country. a foreign specialist can come to Russia at the invitation of an employer.

or upon arrival in the country, start looking for vacancies, this is mainly for residents of the CIS and other countries with whom a visa-free regime has been established.

To do this, it is enough to issue a labor patent and, by paying advance payments for personal income tax, extend its validity and thereby your legal stay in Russia (for one year), without visiting the Federal Migration Service.

We recommend reading: Harness Inspection Form

The basic personal income tax rate is 13%. however, in cases with certain types of profit, other tax rates may apply.

The main share of this type of tax in the Russian Federation is transferred to the budget by tax agents (for the most part, personal income tax is paid from wages). If a citizen has made a profit from the sale of his property, then he must declare it independently.

as noted above, the employer, as a tax agent, is obliged to transfer this tax to the budget, however, the entire financial burden falls on the shoulders of the employee himself.

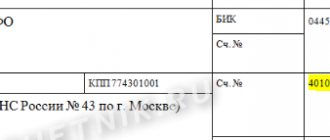

Contributions for insurance against work-related injuries are paid monthly within the time limits provided for receiving wages for the previous month. It is important for the employer to correctly indicate the cbk, as well as the name of the bank and company, when paying contributions. Otherwise, the obligation for insurance premiums will not be considered fulfilled.

If the deadline for payment of contributions falls on an officially non-working day, the transfer is postponed to the next working day. however, this does not apply to all contributions. for example, payment of contributions for injuries, on the contrary, occurs in advance.

that is, if the deadline for payment falls on a non-working day, then payment must be made on the next working day preceding the non-working day.

The amount of contributions paid by the employer depends on the category of taxpayer, as well as on the accrued amount of payments for the reporting period. The employer pays insurance premiums in the following amounts:

- standard (applied when there are children of a certain age);

- social (applies to the provision of documents for treatment or education);

- property (applied when purchasing housing).

employers have realized that the benefits from this are quite large: they cease to be tax agents for personal income tax in relation to an employee who has become self-employed, and get rid of the obligation to pay insurance premiums.

Accordingly, they are also not required to comply with any guarantees under the labor code. self-employed employees are left without severance pay, paid leave and benefits in case of temporary disability.

tax reduction

from January 1, 2021, those who registered as self-employed pay a tax of 4% on income from transactions with individuals and 6% on income from transactions with individual entrepreneurs and legal entities. Some employers decided to transfer some of their employees to payers of professional income tax, that is, to fire them and re-register relations with them using GPC agreements.

- tax paid by the employee. This is a personal income tax of 13%. it is deducted from accrued wages and reduces income received;

- taxes paid by the employer to the employee. These are additional costs for the organization and amount to more than 30%. These include insurance contributions to extra-budgetary funds - the pension fund, the social insurance fund and the health insurance fund.

what taxes need to be paid on salary in 2021

But the project remained a project that did not reach discussion. The same payroll income tax rates apply for 2020, regardless of the amount of income. Rates may change only depending on the status of the employee. If the employee is a resident of Russia, he will be calculated at the standard rate of -13%. The rate for non-resident workers reaches 30%.

Salary taxes in 2021: rates, interest

Insurance premiums are not a tax, but are required to be transferred to the budget. These are contributions to the Pension, Medical and Social funds. They are paid at the expense of the employer and are equal to 30% of the wage fund.

- Russian companies, including in relation to payments to foreign employees who have patents giving the right to engage in labor activities on the territory of the Russian Federation;

- IP;

- notaries who are engaged in private practice;

- lawyers who have established law offices;

Source: https://reg-jurist.ru/bez-rubriki/kakie-nalogi-platit-rabotodatel-za-inostr-rabotn-v-2019-godu

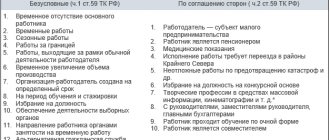

Differences between an employment agreement and a GPC agreement

The differences between the two types of documents concluded with foreigners are presented in the table:

| Index | GPC | Contract of employment |

| Legislative regulation of the process of concluding a document. | Ch. 37, ch. 39 of the Civil Code of the Russian Federation. | Labor Code of the Russian Federation, letter of the Ministry of Labor No. 17-3 / OOG-900 dated December 5. 2014 |

| Parties | The customer is a Russian company or individual entrepreneur. The performer is a foreign citizen. | Employer organization and employee. |

| The essence of the document | Regulations of obligations and rights to perform one specific task. | Regulations for permanent labor cooperation. |

| Providing conditions for completing the task | Performer (except for tools and equipment). | Employer. |

| Wage | A fixed one-time remuneration or staged remuneration paid upon fulfillment of obligations. | Permanent remuneration, calculation, accrual and issuance of which occurs in accordance with the norms of Russian labor legislation. |

| Financial liability for refusal of obligations, poor quality performance, non-fulfillment or failure to meet deadlines. | Cases in which financial liability is provided and the amount of recovery are determined by the provisions of the document. In this case, the contents of the document must satisfy both parties. | The employer does not have the right to fine for failure to fulfill obligations (he can use disciplinary action or dismiss “under the article”). |

| Insurance coverage | From the performer’s earnings, contributions are deducted to:

| All mandatory contributions to funds, in accordance with the norms of the Labor Code. |

Some specific situations regarding contributions from the income of foreigners

Art. 420 of the Tax Code of the Russian Federation, defining the object of taxation of insurance premiums, makes an exception regarding payments to foreigners, in which such contributions will not be charged:

- when a foreigner, under an employment or GPC contract, works in a structural unit of a separate nature, located outside the territory of the Russian Federation (clause 5).

The norm specified in paragraph 5 of Art. 420 of the Tax Code of the Russian Federation, allows not to impose contributions on income accrued to foreigners located outside the territory of the Russian Federation and performing work under a civil process agreement remotely (letter of the Federal Tax Service of Russia dated 02/03/2017 No. BS-4-11 / [email protected] ).

However, if income from a foreign company is received by a foreign employee who is temporarily in Russia, working in the representative office of this employer on the territory of the Russian Federation and who is not a highly qualified specialist, then his income must be paid contributions to OPS and OSS for disability and maternity (letter from the Ministry of Finance of Russia dated 02/06/2017 No. 03-15-05/6079).

From the income of a foreigner temporarily staying in the Russian Federation who has received refugee status, unlike other foreigners with a temporary stay, additional deductions will be made for compulsory medical insurance using the usual tariff for the Russian Federation of 5.1% (letter of the Ministry of Labor of Russia dated February 17, 2016 No. 17-3/OOG- 229).

To learn whether to charge contributions if a citizen of the Russian Federation works abroad, read the material “Distance worker abroad: we pay contributions, but we don’t pay personal income tax .

All details of the calculation and payment of insurance premiums, including against accidents, for payments to foreign employees are discussed in detail in the Ready-made solution from ConsultantPlus.

What documents will be required from a foreigner?

To conclude a civil liability agreement, a foreigner will need to provide a package of documents. Its composition depends on the status on the basis of which the citizen is in the Russian Federation.

Temporary stay

Required:

- foreign passport;

- SNILS or ADI-REG card;

- any document on existing education (if requested by the customer);

- a completed migration card - for those who entered the country under a special visa-free regime;

- open visa – for those entering the country according to the general procedure;

- a patent or permission to work (not needed for persons who are refugees, students who get a part-time job during the holidays, etc., the full list of exceptions is stated in clause 4 of article 13 of Federal Law-115).

Temporary residence

You must provide:

- foreign identification card;

- SNILS card (if missing, then ADI-REG);

- original temporary residence permit.

Permanent residence

Required:

- international passport;

- resident card;

- SNILS or ADI-REG.

What does this type of document mean?

A civil contract is a written agreement on the provision of services or performance of work; in this case, this agreement is signed with a citizen of another country.

The document is more advantageous in comparison with an employment agreement, since it is not the fact of hiring an employee, which requires filing reports and paying taxes, but is only an agreement on the provision of services, which now needs to be reported only to the Federal Migration Service.

The need for this document appears to formalize the labor relationship so that the Migration Service does not have any claims against the employer.

When using the labor of foreigners, one should take into account the status of their stay in Russia, since in different cases a different package of papers is required from a given citizen.

For example, if this is a foreigner temporarily staying in the Russian Federation, then it is necessary:

- Identification;

- Migration card for citizens of neighboring countries or visa for others;

- Work patent;

- Diploma;

- Qualification papers, if necessary.

Important: the employer must also have permission to employ certain categories of non-residents of the country.

Persons who have a residence permit in Russia for a certain period of time require a slightly different package of labor and permit papers.

For example, they do not need to have a patent, but they do need pension insurance.

The differences between an employment contract with a foreigner and a civil law one are discussed in this video:

https://www.youtube.com/watch?v=meSGCGiX7iA

What are the differences between the GPA and an agreement under the Labor Code

To understand which type of agreement will be more beneficial for the employer, you should understand the differences between these two documents.

Employment contract:

- For the most part, it has an urgent form, but the validity period does not always correspond to the period of the work permit;

- When concluding an agreement, you need to be aware that labor agreements are regulated by the Labor Code of the Russian Federation with the ensuing consequences;

- But at the same time, it is necessary to understand that the inability to regulate labor relations in accordance with labor legislation also has its disadvantages.

Civil agreement:

- Formed only for the period of provision of certain types of work and services, for example, seasonal;

- The legal relations that arise when concluding this agreement are not subject to the Labor Code of the Russian Federation, and this has many advantages for the employee, for example, he cannot be held accountable for failure to comply with discipline, and recovery for damage caused can only be obtained in accordance with civil law.

Notification of the conclusion of TD and GPA with a foreigner.

How a contract is drawn up

The document is drawn up in free form. The legislation does not provide a unified form for this. However, its content must reflect 10 sections.

- Registration information: name of the document, number assigned to it, date and address of preparation.

- Personal information of the parties: Full name or name of the organization, passport data or extracts from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, legal status.

- Subject of the agreement: description of the task.

- List of essential conditions: time allotted for completing the work, algorithm for receiving the result, description of the stages and rules for their implementation (if required), other information included in the document by agreement of both parties.

- List of rights and obligations of the customer and contractor.

- Payment provisions: amount of remuneration, timing of funds transfer, algorithm for issuing prepayment and amount (if used), amount of compensation for expenses (if provided).

- Penalties for failure to fulfill obligations.

- Algorithm for resolving conflict situations and disputes.

- The validity period of the document, the algorithm for its early termination.

- Signatures of the parties.

ATTENTION:

The Civil Code of the Russian Federation prohibits concluding GPC agreements for an indefinite period, since this will already constitute an employment relationship. In the case of foreign citizens, the period of validity of the contract cannot exceed the period during which the person can legally stay in the territory of the Russian Federation or legally work (validity of a visa, temporary residence permit, patent or admission).

Sample agreement for work performance:

dogovor_na_ispolnenie_rabot.docx

Sample agreement for the provision of services:

dogovor_na_okazanie_uslug.docx

Terms of agreement

The subject is what the parties agree on: what exactly the contractor must do and for what result or service the customer must pay.

The GPC agreement specifies the cost of the contractor’s work. They also describe how the procedure for handing over and accepting a work or service takes place and what consequences await the contractor if the work or service turns out to be of poor quality. You can agree on an advance payment or staged payment and indicate in the contract the amounts for each stage. If the cost of work is not specified in the contract, the customer pays the average market price for similar work or service.

In the GPC agreement, you can specify the place of work of the contractor: the accountant performs tasks in the customer’s office, and the lawyer provides consultations only in his office. It is also important to indicate whether the contractor can entrust the work to third parties or must complete it himself.

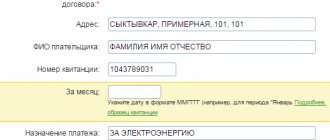

Notification of the Migration Service

A person who has entered into a civil liability agreement with a foreigner is obliged to notify the Federal Migration Service about this. This requirement is regulated in paragraph 8 of Art. 13 FZ-115.

To do this, the customer will need to draw up a special notice. To fill out, use the form specified in the appendix. 3 orders of the Ministry of Internal Affairs No. 363 dated June 4. 2021

The contents of the document indicate:

- the full name of the department of the Ministry of Internal Affairs to which the notification is sent;

- information about the organization, individual enterprise or individual acting as the customer (name or full name, registration number of their Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs or passport data, TIN number, customer status);

- the address of the place where the obligations under the agreement will be performed;

- information about the performer (full name, gender, current citizenship, date and place of birth, name of the personal identification document, its number and date of receipt);

- information about the profession or type of activity of the performer;

- date of conclusion of the GPC agreement;

- date of preparation of the notification and his handwritten signature.

Sample form used to draw up a notification:

obrazec_uvedomleniya_1.png

obrazec_uvedomleniya_2.png

obrazec_uvedomleniya_3.png

Sanctions for violating the notification rules

If the customer does not send a notification or does so without complying with the regulated deadlines, then he will be held accountable in accordance with Parts 3 and 4 of Art. 18.15 Code of Administrative Offenses of the Russian Federation. The following sanctions are possible:

- citizens - a fine of up to 5 thousand rubles;

- employees of the organization responsible for the violation - a fine of up to 50 thousand rubles;

- companies – a fine of up to 800 thousand rubles. or suspension of activities for a period of up to three months.

If the violation was committed in Moscow, St. Petersburg, the Moscow or Leningrad region, then the amount of fines increases:

- citizens – 5-7 thousand rubles;

- employees of the organization responsible for the violation - 35-70 thousand rubles;

- companies - 400-1000 thousand rubles. or suspension of activities for three months.

Filling out the document

To enter into an agreement with a foreigner you need to:

- Prepare a package of documents;

- Obtain permission to employ a foreigner and a patent to perform work;

- Negotiate all the details of the contract;

- Enter data into the agreement;

- If necessary, draw up an additional agreement;

- Sign;

- Notify internal affairs authorities within 3 days.

Is registration required?

The document must be signed by both parties indicating the details.

If a foreign citizen is hired by an enterprise, the document is registered in accordance with the rules for maintaining and recording documents and filed in a separate file.

How can the head of an organization conclude a contract with a foreigner?

Algorithm for concluding a GPC agreement, example of a manager’s actions:

- Checking the legality of a migrant’s presence in the country.

- Verification of the authenticity and integrity of the package of documents provided by foreigners.

- Drawing up the provisions of the contract in compliance with the number of sections.

- Coordination of the document with the contractor.

- Signing of the document by both parties.

- Drawing up a notification for the Federal Migration Service and sending it within 72 hours from the conclusion of the contract.

Termination procedure

The contract for the provision of services can be terminated unilaterally by both the customer and the contractor if one pays the other for the expenses incurred. Only the customer has the right to terminate the contract unilaterally if he pays the contractor’s expenses.

A GPC agreement can be terminated through the court only if the other party is against or does not respond to the notice of termination within the period established by the agreement or within 30 days if no period is established.

Taxation

All income received by a foreigner after fulfilling obligations under a civil liability agreement is subject to income tax in the amount of:

- 13% for: residents of the Russian Federation;

- persons with citizenship of a state that is part of the EAEU;

- refugees;

- citizens employed on the basis of a registered patent;

- persons who are highly qualified specialists;

- people who have been granted temporary asylum in Russia.

Personal income tax is withheld from the amount specified in the payment provisions in the contract. According to paragraph 6 of Art. 227.1 of the Tax Code, a foreign citizen can reduce the amount of income tax by an amount equal to the cost of the patent. To do this, he will need to draw up a corresponding application and send it to the Federal Tax Service.

Termination of a civil contract with a foreign worker

The reasons for termination of the GPA may vary. Among the most common are the following:

- Mutual consent of the parties, and this decision should not contradict other agreements and the Civil Code of the Russian Federation. This solution is only possible if both parties to the contract have no claims.

- Significant changes in circumstances that lead to the inappropriateness of this agreement.

- Refusal by one party to fulfill obligations under the contract. For example, if the contractor refuses to perform the work assigned to him, then the customer has the right to terminate the contract with him, or vice versa.

- The obligations under the contract were fulfilled ahead of schedule. If the obligations under the contract are fulfilled by the parties and neither party has any claims, then the contract can be terminated before the agreed period.

Insurance premiums

A person or enterprise acting as a customer in an agreement is obliged to deduct insurance premiums from the income of the contractor under the agreement. The amount of payments depends on the status of the migrant. They are presented in the table:

| Status | Contributions to the formation of a pension | Social insurance contributions | Contributions for compulsory health insurance |

| Temporary residence | 22% from total earnings up to 1 million 292 thousand rubles. 10% – over 1 million 292 thousand rubles. | Not paid | At least 5.1% with no restrictions on the maximum contribution amount. |

| Permanent residence | |||

| A person with citizenship of countries that are members of the EAEU. | |||

| Refugee. | |||

| Temporary stay. | Not paid | ||

Temporarily staying foreign citizens: features of contributions

The imposition of contributions on foreigners temporarily staying in the Russian Federation has its own rules, primarily because among them are highly qualified specialists, whose income under a contract (labor or civil service agreement) is not subject to any contributions, except for contributions for injuries.

The income of other foreign workers registered under the contract will not be subject to contributions to compulsory health insurance, but will be subject to payments to compulsory health insurance and compulsory health insurance. Tariffs for them will generally be equal (Article 426 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 28, 2017 No. 03-15-06/11189):

- on OPS - 22% from income not exceeding 1,150,000 rubles. (in 2019), and 10% of income above this amount;

- for OSS for disability and maternity - 1.8% from income not exceeding 865,000 rubles. (in 2021), contributions will not be accrued above this income.

At the same time, situations may arise for the contribution payer when he has:

- the obligation to apply additional tariffs due to the special working conditions of a foreign employee (Articles 428, 429 of the Tax Code of the Russian Federation);

- the possibility of using reduced tariffs in accordance with Art. 427 Tax Code of the Russian Federation.

Contribution rates for injuries will depend on the type of activity carried out by the employer.

For individual foreigners with a temporary stay, insurance payments will be determined in the same way as for individual entrepreneurs who are citizens of the Russian Federation and individual entrepreneurs who live (temporarily or permanently) in Russia.

Common mistakes on the topic

Error: Concluding an agreement with a foreigner without checking his documents.

By concluding a GPC agreement with a foreign citizen who does not meet the conditions of legislative norms, the customer not only receives a fine, but also loses guarantees for the fulfillment of the obligations of the document, since it is legally invalid.

Error: Specifying the contract value in one amount

By distinguishing payment provisions for income, the cost of materials and equipment, depreciation expenses and other expenses, the customer can reduce the tax burden, namely, reduce the amount of the contractor’s personal income tax and the amount of insurance premiums payable.

The legislative framework

Unlike an employment contract, which is regulated by labor legislation, the conclusion of a civil contract with a foreigner is regulated by the civil code of the Russian Federation. In addition, if an agreement of this kind is concluded with a foreigner, then it is also regulated by the federal law “On the legal status of foreign citizens in the Russian Federation.”

Important! As a template for a civil contract with a foreigner, a service agreement or a work contract can be used. At the same time, it is drawn up in the same way as if it was concluded with a Russian citizen.

Should a Russian employer report on income paid to a foreigner?

All tax agents are required to submit information to the tax office in Form 2-NDFL (clause 2 of Article 230 of the Tax Code of the Russian Federation), except for cases where individuals must themselves calculate and pay the amount of personal income tax on the income received to the budget.

In our case, the Russian organization that paid income to a foreign specialist is not a tax agent in relation to the payment made and does not submit information on Form 2-NDFL to the tax office at its place of registration.

A foreign citizen will have to independently pay tax to the budget of the state where he operates and submit a declaration at the place of business.