Legal entities are required to maintain cash discipline.

This requires filling out documentation on the receipt and expenditure of cash at the organization's cash desk.

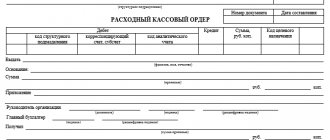

An expense cash order is a document of primary accounting documentation; it is used to issue money, including wages.

The procedure for filling out the RKO is strictly regulated; inaccuracies in compliance with the standards entail sanctions from the inspection authorities.

What is the best RKO - in Word or other format

The cash receipt form can be presented in 2 main formats - Word and Excel.

Each of them has its own advantages and disadvantages. Word documents open in a larger number of programs - in common operating systems (Windows, Linux, MacOS), as a rule, there is always pre-installed software that can work with files of the corresponding format.

Relatively few solutions work correctly with Excel files - Microsoft Excel, Open Office Calc and their analogues, including “cloud” types of software. As a rule, they are not installed by default in modern operating systems.

If you have solved the cash receipt order in Excel format, then you will have a more universal file at your disposal. For example, when it is created in one version of Microsoft Excel, it can be recognized without problems in any other, and in most cases also in third-party programs. While Word files, due to the peculiarities of their structure, are not always correctly recognized in programs other than those in which they were created.

Another argument for using RKO in Excel is the convenience of filling it out on a computer. The structure of files of this type is such that it is more difficult for an accountant to make a mistake when filling out the necessary data on a PC, since the cells for entering information are highlighted. When filling out a Word document, there is a possibility of mistakenly affecting other elements of the document formatting, as a result of which its structure may be disrupted.

How exactly are salaries paid?

Upon final payment of remuneration, the employee must be given a payslip (sometimes called a “footcloth”). This document has the force of a local act, it states:

- components of the salary (what exactly the amount came from - salary, bonus, allowances, compensation, etc.);

- information about withholdings (union dues, taxes, fines, etc.); amount exempt from tax;

- information about the amount already paid (advance) and to be paid.

The payslip must be issued at least once a month and no later than the date of final settlement.

If the day the final salary is issued falls on a weekend, the money should be handed out to the recipient or transferred to the account on the eve of this day, and not later, as is sometimes practiced.

If an employee goes on vacation, he must be given both a salary for this period (the so-called “vacation pay”) and a pay slip three days before leaving.

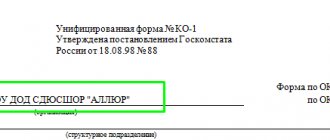

What unified form should the RKO form correspond to?

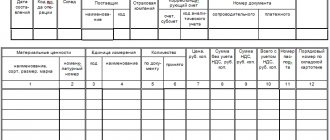

In accordance with the provisions of Bank of Russia Directive No. 3210-U dated March 11, 2014, Russian organizations are required to use the unified form KO-2 (corresponding to OKUD number 0310002) as a RKO form. This form was approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

Read more about the legal requirements for primary documents in the article “Primary document: requirements for the form and the consequences of its violation .

NOTE! As of August 19, 2017, new rules for conducting cash transactions are in effect, which you can read here.

Expert opinion on the issue of the procedure for paying salaries (letter of Rostrud No. PG/6310-6-1 dated June 20, 2014)

Through this document, the Federal Service for Labor and Employment communicates the following. The Labor Code of the Russian Federation does not regulate specific terms and amounts of advances on payments due to employees for work. In general, wages are paid to employees, as required by Part 6 of Art. 136 of the Labor Code of the Russian Federation, every half month, but not less often (Federal Law No. 272 of 07/03/2016). It is also noted that payments can be made more often than the specified interval.

The specific day (dating) of payment is determined by a labor or collective agreement or the rules of procedure in force in the organization. Separate deadlines can be established only for certain categories of workers (in accordance with Part 7 of Article 136 of the Labor Code of the Russian Federation).

In the listed legal documents, different dates for wage payments may be established and prescribed separately for each division (department). The Labor Code of the Russian Federation does not prohibit doing this. So, for example, as indicated in the letter, employees of one department can be scheduled to receive their salaries monthly on the 5th and 20th, and in another department - on the 7th and 22nd.

This letter is endorsed by the Deputy Head of the Rostrud Department L.N. Guzanova.

How RKO is free

You can download the expense cash order in form KO-2, that is, its structure fully complies with the requirements of the law, on our website using the link below:

NOTE! It is important not only to download the current RKO form in one of the presented formats, but also to make sure that the file does not have a “read-only” attribute (otherwise it will not be possible to edit it on a PC). To do this, you need to find it on the disk, right-click on it, select “Properties” and, if necessary, uncheck the corresponding attribute.

Downloading the cash receipt order is only half the battle; the next task will arise - to fill it out correctly.

Let's consider the key points of this procedure.

Features of filling out RKO

- You need to create a consumable before cash is issued from the cash register - it cannot be prepared in advance and cannot be used if necessary.

- If funds are issued from the cash desk on the basis of a power of attorney, this must be stated in the order.

- You can issue an expense order only in one copy. At the same time, there should be no blots or corrections in the document.

- The order must be formed on the basis of supporting documentation.

- It is not necessary to put a stamp on the order.

- An order generated for collection or remuneration of an employee is not certified by the management of the organization.

Do I need to print out the KO-2 cash order form?

Filling out the RKO can be done either on a computer - followed by printing, or manually - using an already printed form (clause 4.7 of instructions No. 3210-U). Automated solutions can also be used - in this case, printing out cash settlement orders is not necessary (order files are saved in the memory of the corresponding programs and signed using an electronic digital signature). True, in the latter case, the organization will have to buy electronic signatures for all persons who must sign on these documents: the manager, the chief accountant, the cashier, as well as other employees (including accountants).

A completed RKO sample may look like this, you can download it from the link below:

This completed sample cash receipt order can be used as a sample for the cashier of your organization.

What you should pay special attention to when filling out the cash receipt form:

- in the column “OKPO code” it is necessary to indicate data corresponding to what is contained in the state statistics registers;

- if the enterprise does not have structural divisions, then a dash must be placed in the corresponding column of the form;

- in the “Document number” column, the cash settlement number should be recorded in order; as a rule, calculation begins on January 1 of each year;

- the amount in the tabular part of the form can be indicated in rubles and kopecks, separated by a comma or hyphen (for example, 200.75 or 200-75);

- Data is entered into the “Purpose Code” item only if the organization in practice uses a system of codes that determines the expenditure and receipt of funds;

- in the “Amount” paragraph, which is located below the table, you should indicate the amount of funds issued under cash settlement services, in rubles - in words with a capital letter of the first word, in kopecks - in numbers;

- in the “Grounds” column you must indicate the content of the business transaction

- in the “Appendix” column, information is provided about the document that is the basis for conducting a cash transaction (for example, it could be a payroll when issuing salaries in cash), indicating the number and date of its preparation.

For more information about filling out a payroll sheet, read the article “Sample of filling out a payroll sheet T 49” .

If the cash register is filled out by an individual entrepreneur who does not hire cashiers, then the “Issue” column should contain his data. If the individual entrepreneur does not hire an accountant, only his signature as the head of the organization should be on the RKO.

Recommendations for filling

When filling out an expense order, you must follow the following rules:

- In the line “OKPO code” indicate the code that the organization received when registering.

- If money is issued from the cash desk of a branch, its code is indicated, if funds are issued from the cash office of the head office, a dash is added.

- The order number is entered in the “document number” field.

- The date of the order must be indicated, which must coincide with the date of issue of funds.

- In the lines “credit” and “debit” the corresponding accounting account numbers are indicated. accounting. If the company is on a simplified basis, it may not fill out these sections.

- The amount is written both in words and in numbers. When indicating the amount in numbers, kopecks are written separated by commas.

- In the “issue” field the initials of the person receiving the cash are written.

- The “grounds” column indicates the content of the operation (for which funds are issued).

- In the line “attachment” the details of the primary documents attached to the consumable are indicated.

- The “received” field is filled in by the direct recipient of the cash. He writes how much he received, the date of receipt and confirms this with his signature.

Innovations in the procedure for registering cash settlements for 2021 - 2021

Fortunately, there were no changes in the procedure for filling out cash registers in 2021 - 2021. They were there before. Thus, on August 19, 2017, the instruction of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-u came into force, which introduced a number of changes to the procedure for filling out and issuing cash receipts:

- The cashier has the right to draw up one cash settlement at the end of the working day for the entire amount issued during the day from the cash register, but provided that there are fiscal documents from the online cash register for the money issued.

- The cashier is obliged to check whether there are signatures of the chief accountant and accountant or director on the cash register, but signatures are now checked against samples only if the document was drawn up on paper.

- If the cash settlement is issued in electronic form, then the recipient of the money has the right to put his electronic signature on the document.

- You can issue money on account by order of the director; now it is not necessary to ask for an application from the accountable person. However, the chosen procedure for issuing funds (upon application or order) should be fixed in the Regulations on settlements with accountable persons.

- An employee’s debt on a previously received advance is no longer a reason for refusing a new issuance of accountable funds.

Read more about all changes in the procedure for issuing reports here.

If you have access to ConsultantPlus, check whether you are completing cash transactions correctly. If you don't have access, get a free trial of online legal access.

When you can do without a statement, and when you can’t

If only one employee receives a salary at the cash desk or you have few employees in your organization, then when issuing salaries, you can do without a statement, that is, create a separate cash register for issuing money to each employee. This will not be a violation, because the issuance of wages according to RKO is provided for in Directive No. 3210-U along with the issuance according to the pay slip. 6 Directions.

But then the expense order must be drawn up according to the general rules - indicating f. And. O. and passport details of the employee and obtaining his signature. Also, such a cash settlement order will have to be signed by the director, because in this case the expense order also serves as a written order from the manager to issue wages from the cash register.

You can also make a statement for a single employee, if for some reason it is more convenient for you. Then the employee must sign only the statement, and he no longer puts his signature on the RKO compiled on its basis.

At the same time, there is a case when it is impossible to do without a statement - if the employee for some reason did not come to collect his salary on the days it was issued. A statement with the entry “Deposited” opposite the name of this employee serves:

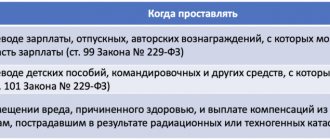

- additional evidence that the failure to pay wages on time was not the fault of the employer. Let us remind you: administrative fines are provided for failure to pay wages on time. 1 tbsp. 5.27 Code of Administrative Offenses of the Russian Federation and payment of compensation to the employee for each day of delay. 236 Labor Code of the Russian Federation.

The Labor Code specifically stipulates that the said compensation is payable even if the employer’s delay in paying wages is not his fault. 236 Labor Code of the Russian Federation. However, this rule does not work if the employee himself did not come to collect his salary, provided that at the beginning and end of the day of issue there was the required amount in the cash register and the money was prepared for issue according to a statement signed by the director. Indeed, in this case it is no longer possible to say that the employer delayed the salary;

- the basis for posting to the debit of account 70 and the credit of account 76, subaccount “Calculations for deposited amounts”;

- justification that personal income tax on wages was paid on time and not ahead of schedule.

Let us remind you: the tax agent must send personal income tax to the budget on the day the bank receives money for issuing salaries. 4, 6 tbsp. 226 Tax Code of the Russian Federation. But if one of the employees did not come for the money, then without a statement with the inscription “Deposited” there is no confirmation that the money withdrawn from the account was intended specifically for issuing a salary to this employee. , , tax authorities may regard the personal income tax transferred to the budget as an erroneous payment from the employer to the budget . since payment of tax at the expense of a tax agent is prohibited. 9 tbsp. 226 Tax Code of the Russian Federation. And fine the organization under Art. 123 of the Tax Code for the fact that personal income tax was not paid when the late employee finally came to collect his salary.

What should you do if you issued wages to present employees using “personal” cash settlements without drawing up a statement, and after that it turned out that one employee did not come for the salary? Then the payroll will have to be prepared only for this one employee. This is unusual, but there is no violation in this.

***

And finally, there is also a situation when there is a salary slip, but the cash register is not needed for it - if the entire amount indicated in the payroll has been deposited. After all, the money was never released from the cash register.

Other articles from the magazine "MAIN BOOK" on the topic "Cash register / cash desk / paying agents":

2019

- Who does not need to use cash register in 2021, No. 16 We understand the issuance of online checks, No. 16 We answer “check” questions, No. 16

- We are studying new amendments to the Law on CCP, No. 13

- Marking of goods in cash receipts, No. 1

2018

- CCT checks: to be or not to be, No. 7

- Hurry up to reflash the cash register, No. 23

- Loans and cash registers: when you need a check, No. 21

- The cost of a cash error, No. 20

- Should I punch a check?, No. 17

- Studying amendments to online cash registers, No. 14

- We answer “cash” questions, No. 13

- When you need an online cash register, No. 11

- Online cash register: buy or wait?, No. 10 Didn’t use cash register: how to avoid a fine, no. 10

2017

- Cash register receipts for goods in exchange containers, No. 24

- When “return of receipt” checks are needed, No. 22 VAT on the inter-price difference in cash register checks, No. 22 Indicator of the payment method in a cash register receipt, No. 22

- We answer the imputed people's CCP questions, No. 15

- How to save money at the online checkout, No. 13

- Online cash registers in online stores, No. 11

- How to get started with online cash register, No. 1 Cost of cash register violations, No. 1 Stages of transition to online cash register, No. 1

Results

An expense cash order is filled in when funds are issued from the cash register. The rules for filling it out are strictly regulated and are regulated for the most part by instruction No. 3210-U. In 2021, you need to fill out the RKO according to the well-known rules.

Sources:

- Directive of the Bank of Russia dated March 11, 2014 No. 3210-U

- Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Errors when filling out the T-53 payroll

Incorrect preparation of a payment document for issuing money from the cash register is a common mistake of many accountants. The statement is intended exclusively for social payments and salary payments. Other things (travel allowances, rent payments, etc.) are not specified in it. These amounts are issued according to the RVO.

It is also a mistake to pay wages according to the statement to foreign (temporarily staying in the Russian Federation) employees or citizens who worked under GPC agreements. For this category of workers, the money they earn should be transferred to a bank account.

For your information, the regular issuance of money according to the payroll to employees who have entered into a GPC agreement can serve as a pretext for transforming this type of contract into an employment contract. Then it will be necessary to charge additional compulsory insurance premiums (compulsory insurance premiums, compulsory medical insurance, social insurance contributions). Basis - Federal Law No. 173 of December 17, 2001.

Can an employer refuse to pay wages in cash?

The employer is obliged to regularly pay wages to its employees. At the same time, he himself decides in what form - cash or non-cash - to do this. An employee may ask to change the form of payment, but the employer is not required to agree to this.

Judicial practice shows that in most cases the courts do not satisfy the demands of employees to switch to cash payments. The main reason is that the employee initially signs an application for the transfer of salary to a bank account upon employment. Or this is immediately stipulated in the labor or collective agreement.

Moreover, if the employee did not sign an application to transfer his salary to the bank, and such a procedure is not enshrined in an employment or collective agreement, the employer cannot refuse to pay him a salary in cash. In fact, without these documents, the company did not even have the right to open a salary account.

The company may refuse to pay employees wages in cash if a decision has been made to liquidate the cash register. That is, the company uses only non-cash funds.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

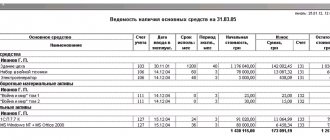

Checking mutual settlements

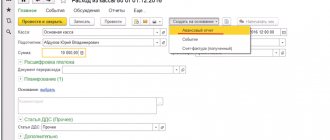

Checking mutual settlements with an employee

You can check mutual settlements with an employee using the report Balance sheet for account 70 “Settlements with personnel for wages” in the Reports section - Standard reports - Account balance sheet.

The absence of a final balance in account 70 “Settlements with personnel for wages” on the day of payment of wages means that the wage arrears to Gordeev N.V. absent.

Checking settlements with the budget

To check the calculations with the budget for personal income tax, you can create a report Analysis of account 68.01 “Personal income tax when performing the duties of a tax agent”, in the section Reports - Standard reports - Account analysis.

In our example, wages were paid on August 10, so the end date of the report should be August 13 (August 11 and 12 are Saturday and Sunday), i.e. the closest working day after the day of wage payment.

The absence of a final balance in account 68.01 “Personal income tax when performing the duties of a tax agent” means that there is no debt to pay personal income tax to the budget.

conclusions

If wages are issued to staff in cash, then upon issuance, an expense cash order must be drawn up.

RKO serves as the basis for filling out the cash book and reflecting the expense transaction in accounting.

The accountant fills out the order after closing the statement.

>> Self-instruction book “Accounting from Scratch” <

A unique, author's book. Without dry phrases and unclear definitions! Even a novice accountant will understand!

60 lessons on accounting, 60 problems with answers, example of accounting

It is very important for every company, organization, or individual entrepreneur that has employees to competently and correctly use the system of settlements with personnel. One of the key points in error-free document management of a company or individual entrepreneur is the correct completion of primary documents, such as payrolls. And the topic of our publication today is payroll form T-53. We will tell our readers how to correctly fill out this document, and at the bottom of the page there is a link that allows you to submit a payroll for free.

At the Library of Virginia, the state agency retention schedule requires that payroll forms be retained 5 years after the end of the state fiscal year. Supervisory forms and processes. Public service. Employees are entitled to 16 hours of on-duty leave at the start of the accrual period.

A reference ticket will be generated and a payroll representative will contact you for assistance. Request for special payment for teaching and administrative faculty. In the event that teaching and administrative faculty perform services for the University outside the scope of their normal full-time employment, they may be entitled to an additional special payment. The completed form is signed by all relevant employees and forwarded to Human Resources for final approval.

Accounting documents for payment of wages

Important: If to correct a defect caused by the fault of workers, only their labor costs are required, then an act is not drawn up and an order for correcting the defect is not issued, but work is accepted only after it has been corrected. If the defect is corrected by another employee who is not the culprit of this defect, then a regular work order is issued for such work, on which Fr. Downtime through no fault of the workers is documented with a downtime record sheet, which indicates the start, end, and duration of the downtime, the reasons and culprits for the downtime, and the amount of payment due to the workers for the downtime. Downtime due to the fault of workers is not paid and is not documented. To receive temporary disability benefits, the employee must present a certificate of incapacity for work. An employee may be transferred to another job in the organization or to another location together with the organization. In this case, an order (instruction) to transfer the employee to another job (Form No. T-5) and an order (instruction) to transfer the employees to another job (Form No. T-5a) are issued, copies of which are also transferred to the accounting department. At the same time, tariff rates, salaries and other indicators necessary for calculating wages may change. Based on such an order, appropriate entries are made in the personal account (Form N T-54 or T-54a). When granting leave, it is necessary to issue an order for granting leave in Forms N T-6 (Appendix 4) or T-6a and drawing up a vacation schedule (Form N T-7) (Appendix 5).

How are transactions processed?

According to the rules of the Bank of the Russian Federation, registration of cash settlements, cash registers and cash books is carried out on paper or in electronic form. Electronically executed documents cannot be corrected after signing. It is allowed to make corrections to paper documents by indicating the date of correction, signatures of the persons who compiled the corrected document with surnames and initials. The chief accountant oversees the maintenance of the book.

IMPORTANT!

Individual entrepreneurs have the right not to draw up cash documents and not to maintain a cash book (clause 4.1 of Bank of Russia instructions 3210-U).

Cash transactions are carried out by a cashier appointed from among the employees of a legal entity or individual entrepreneur, or by the manager himself. Familiarization with responsibilities and rights is carried out against signature. The cashier has a seal with details (to confirm the transaction) and sample signatures of persons who are authorized to sign cash documents.

Let's take a closer look at the procedure for processing cash withdrawal operations from the cash register:

- depositing cash proceeds to a bank account;

- issuing wages and other payments to employees;

- issuance of accountable amounts, etc.