The role of the “Payment purpose” detail in a payment order

In accordance with clause 1.7.2 of Bank of Russia Regulation No. 579 dated February 27, 2017, the owner of a bank account is required to indicate the purpose of the payment in his payment orders.

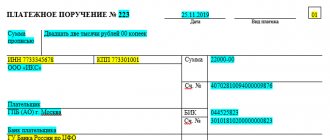

All payment documents must disclose the essence of the transaction being carried out, and correctly filled in field 24 (payment purpose) will help to do this. IMPORTANT! In the payment order there is another field with the purpose of the payment, but coded. This is field 20 “Name.” pl." From 06/01/2020, a code for the type of income is entered in it when making payments to employees. Read more about filling it out here.

When filling out this column, you should keep in mind that the maximum number of characters is set for it - 210. Such information is contained in Appendix 11 to the Bank of Russia Regulation “On the Rules for Transferring Funds” dated June 19, 2012 No. 383-P.

According to Appendix 1 to Regulation No. 383-P, attention should be paid to indicating the purpose of payment in the payment order. Thus, the name of works, goods, services, details of contracts, invoices, invoices or other primary documents can be given here. If there is a payment (prepayment) for the sale of goods and materials or services, it is important to indicate the necessary VAT information.

If a payment is made to the budget, field 24 may indicate the type of tax (insurance contribution), period, as well as other information important for the fiscal authorities.

In what cases is it compiled?

The obligation of current account owners to indicate the purpose of payment when issuing a payment document is regulated by the Regulations of the Bank of Russia.

This procedure is associated with disclosing the essence of transactions, making it more transparent and understandable for regulatory authorities and counterparties.

This field can contain the name of the work, details of the contract, and other primary documents (invoice for payment).

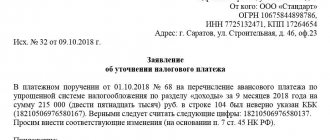

A letter to clarify the purpose of the payment is drawn up after an employee of the enterprise has discovered an error in a previously sent payment document.

Payment "for the wrong thing"

Let's look at the most insidious mistakes. For example, the purpose of the payment is incorrect, that is, the name of the goods or services is incorrect. Buyers clearly indicate the wrong name of goods or services on the payment order. For example, instead of “payment for installation” - “rent”. Sometimes instead of “ and vice versa. For example, they transfer money for the transportation of goods, but in the payment slip they indicate “payment for tools.” The larger your company, the higher the risk. And it’s really bad if the name of the goods for which the bank tracks cash withdrawals is mistakenly indicated. For example, a company receives payment for building materials. And he writes off money from the account mainly with the purpose of payment “for food products”, “rent of commercial equipment”. The bank will ask for clarification and may block the client-bank connection. In this case, it will refer to the Methodological Recommendations approved by the Central Bank of the Russian Federation on July 21, 2021 No. 18-MR.

And after comparing payment receipts with the company’s OKVED codes, bankers may be interested in a situation where the main receipts into the account are not related to the company’s activities. Sometimes questions arise from one-time payments, especially for large amounts. For example, if a wholesale company received payment for advertising services. And if deposits with an incorrect payment purpose become regular, suspicions will turn into confidence.

To reduce the likelihood of errors, it is better to include the text in the invoice that must be indicated in the purpose of payment. If your counterparty nevertheless manages to transfer money to you “for the wrong reason,” immediately inform him about it and try to get a written response in which the buyer confirms the correct purpose of the payment. You will forward this correspondence to the bankers if they have any questions.

Errors in the names of goods and services will also interest tax authorities. In this sense, such mistakes are especially risky for “simplifiers” and “imputers”, as well as entrepreneurs on the PSN. If the tax authorities see in the statement receipts for goods or services that do not fall under the special regime, they will demand that taxes be paid according to the general system. You will have to prove that the company or individual entrepreneur conducts only activities that fall under the special regime (Resolution of the Arbitration Court of the Volga District of October 25, 2021 No. F06-26038/2017). Therefore, for large payments, it is safer to agree with the supplier on the correct name of the goods.

But it is best to indicate the specific name of goods, works or services on the payment slip (Appendix No. 1 to the Central Bank Regulations dated June 19, 2012 No. 383-P). Take it from the contract, invoice or specification. If there are a lot of products, you can indicate a generic name, for example, “office supplies.” Or indicate the goods that make up the largest share of the purchase price.

The bank sent a request to confirm international payment details

Modern technology has led to a globalized economy. Transfers of funds to other countries of the world to pay for various goods and services have become a common occurrence for many companies, as well as individuals.

Almost all international payments are sent via SWIFT. It allows you to carry them out both from the client’s current (for example, current) accounts, and without opening an account.

Not only the sender’s and recipient’s banks, but also other credit institutions acting as correspondents can take part in the payment processing scheme.

Specifying details for international transfers is more difficult than for domestic transfers for the following reasons:

- The presence of correspondent banks complicates the exchange of messages between the sender and recipient banks. The request will most likely not be lost, but it may take longer to complete.

- Lack of strict regulations on the timing of sending and executing requests. Of course they exist. But each state may vary, and the recipient's banks will act according to the regulations in force in their country. They may be unknown to the payer’s representatives and even to employees of the bank serving him.

- Differences in legislation and business practices in different countries. Sometimes the recipient's bank can easily credit funds to his account with minor typos of 1-2 letters, but in other countries he will be forced to demand the absence of any errors, even those that are not significant.

Fortunately, advances in modern technology have made processing international payments much easier.

They usually also take 1-3 business days, and if errors are detected, the recipient's bank sends a request electronically, and it arrives at the sender's bank in 1-2 days.

If the payer promptly sends clarification of the details or their confirmation, then in a maximum of 1-3 days the money will still be credited to the account.

It should be taken into account that the procedure for clarifying details through the SWIFT system is also paid and generally costs more than sending a new payment.

We invite you to familiarize yourself with: Current payments in case of bankruptcy of individuals: features and timing of funds transfer

But in this situation, it is still better for the sender to use it to correct errors. This is due to the fact that the refund may be significantly delayed, and a commission will be charged according to current tariffs.

Conclusion: As part of the article, we looked at what to do when the bank sent a request to confirm details and how long to wait for it. But it is still better to carefully monitor the correctness of filling out payment orders and receipts in order to avoid unnecessary problems.

Have you ever encountered a situation where the bank sent a request to confirm details{q} How long did you have to wait for it{q} Share your experience in the comments below.

Now you know what to do if the bank has sent a request to confirm details and how long to wait.

When and what errors occur

Errors in payments between counterparties are made by the compilers of payment orders, i.e. employees of accounting departments. In this case, incorrect data can be in a variety of points in the document: for example, the number of the agreement under which funds are transferred is incorrectly indicated, the purpose of the payment is incorrectly written, or, sometimes, VAT is allocated where it is not necessary, etc.

This can be corrected unilaterally by sending a letter to the partner to clarify the purpose of the payment.

In this case, the other party is not obliged to send a notification of receipt of this message, but it will not be superfluous to make sure that the letter has been received.

Causes and common types of errors

Payment orders are usually drawn up by an employee of the accounting or financial department. When filling out a document manually, errors are inevitable. Most often, employees make mistakes in the contract number or its date, incorrectly indicate the name of the paid goods or services, and when transferring tax, they make mistakes in the BCC and payment period. In 2021, due to the change in the VAT rate from 18% to 20%, cases of errors in indicating the tax rate and amount have become more frequent. We will tell you how and in what cases to write a sample letter about an error in the purpose of payment.

Some details must be corrected, but in some cases this is not necessary. A clarifying letter must be drawn up if the translation cannot be clearly identified, that is, it cannot be determined for what and on what basis the payment was made. If the error is not critical, a clarification notice need not be drawn up.

How to submit an application

The application can be submitted in different ways:

- The simplest, fastest and most accessible way is to come to the tax office in person and hand over the form to the inspector.

- Transfer with the help of a representative is also acceptable, but only if he has a notarized power of attorney.

- It is also possible to send the application via regular mail by registered mail with acknowledgment of receipt.

- In recent years, another method has become widespread: sending various types of documentation to government accounting and control services via electronic means of communication (but in this case, the sender must have an officially registered electronic digital signature).

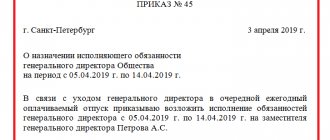

After sending the document

When tax inspectors receive the application, they will be required to check it. Sometimes (not in all cases) payments are reconciled with the taxpayer.

Five days after the application is submitted to the tax office, the inspectors will be required to make a decision and notify the applicant about it.

Decision to clarify payment

The law establishes a period of time during which the inspector is obliged to verify the information provided and provide a response. This is 10 days from the date of receipt of the application.

The tax authority may change:

- basis for payment (for example, TP on AP);

- ownership of the payment (if an error was made according to OKTMO or according to KBK);

- payer status>;

- other data (TIN, etc.)

If after this period no response is given, the payer has the right to contact the Federal Tax Service with an official request.

Who writes a letter to clarify the purpose of payment?

This letter is drawn up by the company that transferred the funds.

Usually the text itself is written by a specialist in the accounting department or another employee authorized to create this type of correspondence and who has access to the generated payments.

In this case, the document must be signed by the head of the company.

Who has the right to correct an incorrect payment purpose in a payment order?

The recipient of funds does not have the right to change the purpose of the payment at his own discretion; he can only clarify it with the payer. Banks also do not have the right to arbitrarily change the purpose of payment.

As a result, only one party has the right to change the purpose of payment - the payer (the owner of the funds). Such a change must be made in writing and certified by the persons who signed the payment document (Article 209 of the Civil Code of the Russian Federation, paragraph 7 of Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

Considering that the procedure for adjusting the purpose of payment is not established by law, judicial practice on this issue should be taken into account.

What errors can be corrected?

It is necessary to prepare a letter indicating the purpose of payment in the payment order if the defect is significant. For example, if a spelling or punctuation error is identified in the purpose of a payment, no notifications need to be drawn up. But there are categories of shortcomings that can negatively affect the company’s activities.

What errors need to be corrected:

- Invalid contract number. Of course, the payment will go to the recipient’s account, but mis-grading may occur in the accounting department. As a result, payment under a specific contract will not be taken into account. It is likely that penalties will be applied - the accrual of penalties for late payment under the contract.

- Invalid invoice or invoice number. A defect can cause similar problems as an incorrect contract number. The likelihood of accruing penalties and fines for late payment is quite high.

- VAT is indicated incorrectly. The payer may allocate tax at the wrong rate or may not indicate the VAT amount at all in the payment order. An error may provoke disagreements with the Federal Tax Service when presenting the tax for deduction.

If you find a defect, prepare a clarifying letter regarding the payment order to the counterparty. The document will exclude penalties on the part of partners due to failure to fulfill the terms of the agreement or contract. It will also protect the company from VAT tax risks.

Common mistakes when writing letters

A document clarifying the purpose of payment can be considered correct only if it is drawn up correctly. The document is sent by the person who transferred the payment.

Writing a letter is mandatory if there are errors in the contract, or if there are massive omissions in indicating the name of the product or service being sold. If the VAT tariff is displayed incorrectly, if a deficiency is detected, the payer has risks when offsetting the fee from the supplier's advance payment.

A common mistake when drawing up documentation is that there is no information that is displayed according to the rules in such a letter. This is the number and date of compilation, information about the sender and recipient of the letter. A serious mistake is the absence of data on a payment with errors, since it will not be possible to identify the document. Correct details must be provided instead of incorrect data, and the document must be signed.

If there is no information about the sending company, its location address, information about the addressee, a link to the order, or the essence of the inaccuracy, we can say that the document was drawn up incorrectly. The amounts must be written down in both numbers and words on the form.

We draw up a correction letter about the purpose of payment in the payment order to the supplier

When it is necessary to change the purpose of payment in a payment order, the letter is drawn up in any form. There is no approved form at the legislative level.

The document must indicate:

- document number and date;

- sender and recipient data;

- details of the payment document in which the error was made;

- correct name of erroneous details;

- signature of the responsible persons (the same ones who signed the payment).

You can send a notification in any convenient way. It is not necessary to receive notification from the counterparty about the receipt of the letter. But it’s better to get it to make sure that the recipient of the money has made accounting corrections.

Legal meaning of changing the purpose of payment

Today, in judicial practice there is an ambiguous situation regarding the recognition of the legality of making changes to the purpose of payment:

1. It is believed that the sender and recipient of funds must reach mutual agreement to change the purpose of the payment by exchanging letters. This position is supported by a number of courts.

Thus, the resolution of the Federal Antimonopoly Service of the West Siberian District dated December 2, 2011 No. A70-2105/2011 states that banks cannot interfere in the contractual relations of the parties to a transaction carried out using a payment order executed by the bank. In this connection, further disagreements that arose between the parties through no fault of the financial institution must be resolved without the participation of the bank. The court points out the need to obtain the consent of the party to make changes to the purpose of the payment document.

A similar position is reflected in the decisions of the following federal arbitration courts:

- Ural District dated June 23, 2011 in case No. A76-18273/2010-62-513;

- Central District dated July 13, 2011 in case No. A54-2219/2010С16.

2. The sender of funds has every right to change the purpose of the payment.

In the resolution of the Federal Antimonopoly Service of the West Siberian District dated December 23, 2010 in case No. A75-12877/2009, the court stated that since corrections in the payment order are unacceptable, changes to it must be made in another way, for example, in the form of a statement from the sender issued in the form of a letter money. In accordance with paragraph 2 of Art. 209 of the Civil Code of the Russian Federation, the owner of property can perform any actions with his property if they do not contradict the law and do not violate the rights of other persons.

Since the bank cannot control what and where the money is sent, the court found it sufficient for the sender to draw up a letter that should be used together with the payment order.

A similar position is reflected in the decisions of the following federal arbitration courts:

- FAS Volga-Vyatka District dated October 16, 2013 in case No. A31-7149/2012;

- East Siberian District dated 03/02/2010 in case No. A19-11526/2009;

- West Siberian District dated December 22, 2010 in case No. A03-2483/2010.

3. Changing the purpose of payment in an executed payment order is unacceptable.

This position of the court is set out in the decision of the Federal Antimonopoly Service of the Moscow District dated 06/09/2011 in case No. A40-15801/09-105-184.

Transfers within Russia

Transfers between client accounts in different Russian banks are carried out using specialized payment systems of the Central Bank of the Russian Federation.

In this case, you can send a payment from your current account using a payment order or without opening an account using a receipt.

Important! For organizations, due to accounting and tax requirements, there are certain restrictions on transfers without opening an account.

In most cases, they should use a payment order and send money from their account at the servicing bank.

The payment processing time between accounts in different Russian banks is 1-3 business (banking) days. Most often, the money arrives to the recipient within the current day or at most the next day.

If the sender did not indicate all the details in the payment order (receipt) or made a mistake, then the receiving bank will have to figure out which account the funds should be credited to.

Most often, for these purposes, a request is sent to the sending bank to clarify/confirm the details. And he already contacts the client and asks for corrections or clarifications.

The client can provide confirmation/clarification of details within 5 days from receipt of the request. This letter is sent to the receiving bank, which reviews it and makes an appropriate decision.

We suggest you read: Does the bank check the apartment for legal purity when taking a mortgage?

If all corrections are correct, the money is credited to the recipient's account.

For the service of clarifying details, a fee is charged in accordance with the tariffs of the sending bank. The credit institution servicing the recipient does not charge a fee for receiving clarifications.

If no clarifications are received within the period allotted by the regulations to the bank serving the recipient of the transfer, then the money is sent back to the sending bank.

When making a payment from the account, they will also be returned to it. And when paying using receipts, they will “hang” in unclear payments until the client contacts.

Often the cost of clarifying the details exceeds the price of the payment order, and significantly.

Many clients prefer not to use this service unless there is special need and simply wait for the return to the account and then send the correct payment.

Comment. The receiving bank may credit the recipient's account even though there are some errors.

For example, this can happen if a typo in 1-2 letters is clearly visible, and all other details (account, TIN, etc.) are completely correct. In this situation, the recipient's bank actually assumes responsibility for the transfer.

How to correct a tax payment

There are rules for clarifying tax payments:

- No more than three years have passed since the date of transfer.

- Clarification will not lead to arrears.

- The payment went to the budget.

It is impossible to clarify the payment if the payer made a mistake in the Federal Treasury account number or bank details. It is considered not to have been received by the budget, and can only be returned.

To correct an error in a payment order, you must compose a letter in any form and also attach a copy of the incorrect payment order to it.

Formatting a letter for the tax office: sample

It is recommended that you familiarize yourself with the sample letter before submitting it. This example is especially relevant if you are asked to send this letter to clarify the payment to the tax service. You can send a clarifying notification in writing to the Federal Tax Service, or through an operator in electronic format.

When composing a notification, it is mandatory to display the sender’s details, namely, company name, address. You will need to display the details of the fiscal authority, as well as the data of the payment where the errors were found. The information that needs to be corrected is recorded, and the correct indicators are displayed.

If it is necessary to make changes in the purpose of payment in the order, the clarification can be drawn up in any form. However, the number and date of preparation of the paper, data of the sender and recipient, data about the document being corrected, errors and signatures of the parties must be indicated.

There are different rules for clarifying tax payments. So, no more than three years should pass from the time of transfer, and the payment should go to the budget. The clarifying document can be drawn up in any form, but all data must be displayed.

Registration and sending

Prepare four copies of the document at once to change the purpose of payment in the payment order; be sure to have the letters certified by your manager. One copy will remain with the company, the second will be sent to the counterparty, and one copy each for the recipient and payer banks.

There are several ways to send a document. For example, in person at a meeting, send a letter by mail or courier delivery, or, as a last resort, by email. But online correspondence is considered the most unreliable way to send a message. After all, the recipient may not even read the letter.

After sending, the letter should be registered in the journal of outgoing documentation and filed together with the current primary document of the company. It is acceptable to attach a copy of the clarification letter to the payment order with an error. Keep the application for at least three years.

Sample letter about incorrect purpose of payment to the Federal Tax Service

When composing a notice, it must indicate:

- sender's details (name, address, TIN, OGRN);

- tax office details;

- data of the payment document in which there was an inaccuracy;

- details that need to be corrected with their correct values.

Sample form for incorrect VAT

Letter to clarify the purpose of payment

Dear Ivan Ivanovich!

On December 12, 2021, you transferred funds to the settlement account of Smena LLC in the amount of 150,050.00 rubles under contract No. 125 dated December 12, 2019. At the same time, in payment order No. 48, the purpose of payment erroneously stated: “Including VAT 18%.” The price of contract No. 125 is 150,050.00 rubles and does not include VAT, since Smena LLC applies a simplified taxation system, does not pay VAT, and does not issue invoices to buyers. Please inform your credit institution about the error and instruct it to replace the words “Including VAT 18%” with the phrase “Excluding VAT”. It is also necessary to send a notice of changes to the recipient's bank.

What to do if the bank made a mistake in the payment order

It happens that the taxpayer promptly submitted the correct paper version of the payment slip for taxes (contributions) to the bank. The bank executed it, but the payment went unaccounted for due to an error by the bank clerk.

As a rule, the taxpayer learns about arrears and penalties from a request from the Federal Tax Service. To correct the situation, you can do the following:

- Request a written explanation of the situation from the bank.

- Send an application to the Federal Tax Service to clarify the payment with a request to recalculate the accrued penalties and indicating the guilt of the bank employee.

- Attach to the application an explanation from the credit institution, a stamped payment slip and a bank statement for that day.

How and for how long to store a letter

After sending, all letters about clarification of the purpose of payment must be registered in the journal of outgoing documentation, and one copy must be placed in the folder of the current “primary” company. Here it must remain for the period established for such documents by law or internal regulations of the company, but not less than three years . After losing its relevance and expiration of the storage period, the letter can be transferred to the archive of the enterprise or disposed of in the manner prescribed by law.

conclusions

For each recipient, the amount in the letter should be written in both digital and text format. The wording in the message must be clear, concise and correct, strictly stating the essence of the appeal.

You can send a letter in person, by mail, by courier or electronically via secure communication channels (if you have an electronic signature).

The request is registered in the journal of outgoing documents, a copy is placed in the folder with the current primary documentation.

The document storage period is established for this type of documentation by law or local regulations of the company; it cannot be less than 3 years.

Having lost its relevance, the letter is sent to the archive or disposed of in accordance with the regulations of the current legislation.

In normal situations, changing the “Purpose of payment” parameter is carried out with the mutual consent of all parties and without any consequences.

But sometimes complications may arise as a result of an inspection of an enterprise by a supervisory authority.

Inspectors of the territorial division of the tax service may regard such a correction as a way to evade paying taxes, in which case the accrual of fines is inevitable.

Misunderstandings also arise between counterparties regarding the transfer of debt obligations and interest on them.

In most cases, the disagreeing party goes to court to challenge the corrections. It is impossible to guarantee a win in such a case; such stories have many unpredictable nuances.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 938-43-28 - Moscow - CALL

+7 - St. Petersburg - CALL

+7 — Other regions — CALL

Is it possible to challenge a payment change?

Sometimes the recipient of the money does not agree with the changes made by the payer. Unfortunately, it is quite difficult to challenge a letter of clarification. This must be done in court. It is advisable to resolve the problem through negotiations.

When making changes to the purpose of payment, you must remember that such transactions are carefully reviewed by regulatory authorities. If the Federal Tax Service sees signs of tax evasion in such letters, then claims may be made: additional taxes and penalties will be assessed. The most common issue that arises is prepayment under a supply agreement, which is later reclassified as a transfer under a loan agreement. This clearly shows a way to avoid paying VAT on the buyer's advance payment, and questions from the tax inspectorate are inevitable.

Drafting for the bank

Also, if errors are detected, a letter is sent to the servicing bank. The message form is arbitrary. The letter is signed by the persons whose autographs were on the incorrect document.

To make changes to the purpose of the payment, the number of copies of the letter must be 4: the first remains with the applicant, the second with the payer's bank, the third with the recipient's bank, and the fourth with the counterparty.

The letter is drawn up by the enterprise that transferred the monetary assets. As a rule, accounting department employees have access to prepare such a document. The letter is subject to mandatory registration.

Example for the Federal Tax Service

Letter to clarify the purpose of payment

“Smena LLC”, when transferring funds to the supplier Trud LLC under agreement No. 125, in the purpose of payment of payment order No. 56 dated December 10, 2019, the phrase “Including VAT 18%” was incorrectly indicated. Trud LLC applies a simplified taxation system and does not pay VAT. Please make changes to the purpose of payment and replace it with the words “Without VAT”. A copy of the payment document is attached.

Director of Smena LLC Petrov P.P.

15.12.2019

Will there be penalties and offset of overpayments against arrears?

When paying taxes, you should be more careful when indicating the purpose and details of the payment. Otherwise, a penalty will be charged on the amount of the debt. If the payer has provided a letter confirming payment, penalties can be avoided.

The penalty is charged regardless of the payer’s request in the following situations:

- An error was made when specifying the recipient's bank account. Tax authorities do not have the right to change this information, so the date of tax payment will be considered the date of the second transfer of funds. And you will have to pay a penalty for this period, if it was accrued.

- The inspector may change the details, but the original payment was sent late. All accrued fines must still be paid.

If the payer has an overpayment of taxes, it can be counted against the arrears. But this procedure is not carried out automatically, so you need to send the appropriate application.

The Federal Tax Service has 10 days to consider such an application, so it must be sent in advance. At least 10 days before the tax payment deadline. Then the overpayment will be counted.

Results

Summarizing the above, we can conclude that there is no direct prohibition on making changes to the purpose of payment in Russian legislation. You can correct the information in this column even after the payment has been made, if it does not correspond to the content of the transaction and was indicated by mistake or carelessness.

If making changes to the purpose of the payment does not infringe on the interests of the recipient of the money, but, on the contrary, helps to establish fairness and clarify unclear points, then obtaining consent from the recipient of the funds may not be required. But it is still better to enlist the written support of the counterparty.