Taxpayers who pay tax according to the simplified tax system submit a declaration at the end of the calendar year. The procedure for submitting it is established by the Tax Code. Organizations submit reports at their location, and individual entrepreneurs – at their place of residence. Failure to timely submit a declaration under the simplified tax system may result in a fine and even suspension of account transactions.

Failure to file a tax return

This includes all declarations of entrepreneurs under different regimes - OSNO, simplified tax system, UTII, Unified Agricultural Tax, as well as calculations of insurance premiums submitted by employers.

If you do not submit any of this on time, be prepared to pay 5% of the tax on your return for each month that is overdue, even if it is incomplete. Maximum – 30%, minimum – 1,000 rubles. The minimum is worth paying attention to for those who were supposed to submit and did not submit a zero declaration.

The same sanctions are provided for failure to submit calculations for insurance premiums.

A fine for failure to submit reports is not everything.

10 days after the delay, the Federal Tax Service has the right to block the current account and most likely it will use this right.

To free your money from seizure, you will first need to make amends, that is, send a declaration, and then go to the Federal Tax Service inspectorate with an application to unblock the account. And until all this is done, you will not be able to use the money in your accounts, and this paralyzes your work.

And that is not all. The Code of Administrative Offenses also provides for liability for those who ignored the obligation to submit a declaration - from 300 to 500 rubles.

What is a reporting period

When submitting documents to regulatory authorities, there is such a thing as a reporting period. This term refers to the time period provided to an entrepreneur for the preparation of accounting documentation or other papers. Compliance with deadlines allows you to avoid a fine for failure to submit an individual entrepreneur’s declaration.

An individual entrepreneur bears personal responsibility for meeting deadlines for filing and filling out documents correctly. Usually, during the reporting period, an accountant or individual entrepreneur has a lot of other things to do, so quite often the deadlines are not met. This leads to errors and the imposition of a fine for failure to submit a declaration. To avoid additional problems with the fiscal service, its payment must be made according to the correct BCC (budget classification code).

If an entrepreneur works independently, that is, without employees, then he only needs to submit zero reports to the regulatory authorities. In other cases, the accounting department is responsible for filling out the documentation.

Non-payment or incomplete payment of taxes

This includes all taxes, workers' compensation and sales tax. The fine is quite large - 20% of the unpaid amount. If Federal Tax Service employees can prove that you did not pay intentionally, then it will increase to 40%. Confirmation in Art. 122 NK.

There are also penalties that begin to “drip” from the day of delay until the day preceding the day of payment of the debt. They are calculated based on a rate of 1/300 of the Central Bank refinancing rate.

Simply put, to calculate penalties for one day, you need to divide the refinancing rate by 300 and multiply by the amount of the debt. The total payment will depend on the number of days overdue.

If you do not pay the tax on time, then you will face both a fine and penalties, and if you make advance payments, then only penalties.

Another trouble for non-payment of taxes is the seizure of the current account for the amount of the debt. The tax authorities will give such an order to the bank if you do not comply with the requirement to pay taxes within 8 days.

Failure to pay on an especially large scale is subject to the Criminal Code and the threat of imprisonment. There we are talking about millions, so this rarely concerns individual entrepreneurs, but we still voiced it. Just in case.

Composition of reports submitted to the Federal Tax Service

Typically, reporting submitted to the Federal Tax Service Inspectorate generally refers to all Declarations, calculations, information, the submission of which to the Federal Tax Service Inspectorate is obligatory for taxpayers.

The deadlines for submitting individual declarations and calculations are specified in the relevant chapters of part two of the Tax Code of the Russian Federation. For local and regional taxes, the deadlines set by local and regional authorities must be followed.

Taxpayers are also required to submit financial statements to the Federal Tax Service once a year (no later than three months after the end of the financial year).

Gross violations of accounting rules

Serious Article 120 of the Tax Code of the Russian Federation with serious sanctions. What exactly is meant by gross violations is listed in the same article (lack of primary documents, etc.).

If such facts are discovered in one tax period, they will impose a fine of 10 thousand rubles, and if more than one period, then 30 thousand. Well, if these violations also lead to an underestimation of the taxable base, then you will have to fork out 20 percent of the unpaid tax or insurance premiums.

But don’t be happy if 20% of your arrears is only a few hundred, because the minimum you will pay is 40 thousand.

The Code of Administrative Offenses prescribes a penalty of 5 to 10 thousand rubles for such violations, and up to 20 thousand for repeated violations.

Current penalties for late submission

By law, tax reports are submitted in accordance with the chosen taxation system:

- when working on the simplified tax system, an entrepreneur should report for the past year. The deadline for submitting reporting documents is April 30;

- when choosing UNDV, you will have to report every quarter;

- a more complex system operates for entrepreneurs working under OSNO. They need to submit a document in Form 3-NDFL, and also report VAT every quarter. Additionally, reports are submitted in form 4-NDFL.

If the filing deadlines are not met or the required paperwork is incomplete, the tax agent may receive a fine for failure to file a tax return. The tax service is responsible for calculating fines for failure to submit an individual entrepreneur’s declaration. Since 2021, the functions of supervision regarding the timely submission of information on the payment of insurance premiums have been transferred to the Federal Tax Service. Now, when determining the terms and amounts of deductions, you must be guided by Article 431 of the Tax Code of the Russian Federation.

Process

How does the process of imposing penalties work? The tax inspectorate has the authority to independently impose fines and sanctions, as well as conduct business. If the violation goes beyond the scope of tax legislation, then the inspectorate cannot do without the help of the court.

- A tax violation has been committed (there is a suspicion that it has been committed).

- The tax inspectorate issues a resolution to hold the individual entrepreneur accountable for a specific violation.

- Having received the decision, the entrepreneur is obliged to voluntarily pay a fine.

- In case of refusal, the tax inspectorate submits a statement of claim to the arbitration court. The filing deadline is no later than six months from the date of the decision. This is precisely the statute of limitations for the collection of fines that is prescribed in Article 115 of the Tax Code of the Russian Federation.

- Next comes the trial and enforcement proceedings.

The Tax Inspectorate has the authority to independently impose fines and sanctions.

Should increased contributions be collected from individual entrepreneurs: the position of the Pension Fund of Russia

In Letter No. NP - 30 - 26/9994 dated July 10, 2017, the Pension Fund indicates that the provision of Law No. 212 - Federal Law on the collection of contributions from individual entrepreneurs that are several times higher than standard does not imply the possibility of recalculating the obligations of individual entrepreneurs arising as a result of failure to submit a declaration.

The Fund considers it legitimate to demand social contributions from an entrepreneur, even with zero income, for a fixed part of them, in the maximum amount. At the same time, the Pension Fund of the Russian Federation notes that when an individual entrepreneur submits a tax return, albeit late, but within the billing period for which contributions are calculated, recalculation of obligations is still possible. It is obvious that such a position still goes beyond the scope of Law No. 212 - Federal Law or, at least, reflects an attempt by the Pension Fund of the Russian Federation to interpret the provisions of this law in a certain way. In this case, the interpretation is not in favor of entrepreneurs.

The Federal Tax Service of Russia has a different point of view on the issue of recalculation of contributions.

Extenuating circumstances

The following factors can be identified as mitigating circumstances in case of failure to submit or not timely submission of a declaration:

- the offense was not committed intentionally and for the first time;

- the period of delay is very short;

- the ability to confirm a difficult financial situation;

- no consequences for the state. budget;

- maternity leave or temporary disability.

Mitigating circumstances allow you to apply for a waiver of the fine

If at least one circumstance is suitable, then it makes sense to write a corresponding petition to the Federal Tax Service. Perhaps, by decision of the tax office, the fine will be reduced, and for some, canceled altogether.

Filing a tax return is an important stage in the activities of an entrepreneur. Timely actions will save you from overpaying fines, thereby saving time, money and keeping your nervous system intact.

Conducting activities without a license

Of the licensed areas, only road transportation of passengers, pharmaceutical, medical, educational and private detective activities are available to entrepreneurs. The absence of a license, if it is required, is punishable under Article 14.1 of the Code of Administrative Offenses of the Russian Federation - in the amount of 4 to 5 thousand rubles with possible confiscation of manufactured products, production tools and raw materials.

As for strong alcohol, the sale of which is prohibited by entrepreneurs, there is a special article 14.17.1 in the Administrative Code for this purpose. According to this norm, sanctions for individual entrepreneurs for selling alcohol without a license range from 100 to 200 thousand rubles with mandatory confiscation of alcohol and alcohol-containing products.

An individual entrepreneur is not punished for selling alcohol without a license only if he sells beer, not strong alcohol. At the same time, certain requirements have been established for the sale of beer, which must also be observed.

Fines

Forgetting to submit a report is an accountant's nightmare. I keep a list in the form of a table, which indicates the organizations and individual entrepreneurs with whom I work, types of reports and deadlines. The accounting program also reminds you that the “X” date is approaching. You can additionally set up alerts on your smartphone (and still miss the signal). In this regard, I praise the Pension Fund - it always sends reminders about the transfer of SZV-M every month through the TKS operator. Sometimes it saves.

If you are unlucky and face punishment, you need to know what to prepare for. They are held accountable depending on the type of reporting.

Tax

The Tax Code for the main part of declarations (settlements) establishes a minimum sanction in the amount of 1000 rubles. Even when zero indicators are indicated, it must be paid.

If the report shows a tax (contribution) to be paid, but is not paid on time, then the fine will be 5% of the underpaid amount for each month of delay (including incomplete), but not more than 30% and not less than a thousand rubles. This rule applies to the following taxes: VAT, single tax on the simplified tax system, UTII, contributions to the Pension Fund, etc. In this case, Article 119 of the Tax Code of the Russian Federation applies.

Note! If there is no activity, no income is received and the taxpayer is not going to declare expenses (including a loss or VAT deduction), has no movements in accounts and in the cash register, then instead of several declarations, he can submit one - a single one.

If interim (advance) reports are submitted during the year, as for income tax, then the fine for them will be much lower - 200 rubles per document. You must be guided by another article of the Tax Code - 126th. Similar sanctions apply to income certificates in Form 2-NDFL, information about the average number of employees.

For late submission of 6-NDFL, an organization or individual entrepreneur will fork out 1,000 rubles per month of delay (clause 1.2 of Article 126 of the Tax Code). The amount is fixed and does not depend on the amount of tax.

Accounting

Until 2021, balance sheets and other forms of accounting statements were also submitted to statistics, but, thanks to the government, now there is no need to send another copy to Goskomstat.

Important! Starting from January 1, 2021, financial statements are submitted exclusively in electronic form. A relaxation has been made for small and medium-sized transport enterprises; the norm applies to them from January 1, 2021.

The report includes several forms:

- Balance sheet.

- Income statement.

- Statement of changes in equity.

- Cash flow statement.

- Report on the intended use of funds.

- Explanatory note (if necessary).

There is a truncated version - for those who have the right to keep simplified accounting and provide the same reporting, moreover, it is not necessary to include information about target funds or changes in capital in the absence of corresponding transactions.

Considering that the balance sheet and other annexes do not relate to declarations, they are subject to paragraph 1 of Art. 126 of the Tax Code and the fine will be only 200 rubles per document.

Statistical

It is useless to write about forms for Goskomstat. There is no universal list; it is necessary to focus on the specifics of the activity and the organizational and legal form. You can check whether a particular organization or entrepreneur needs to submit something on the official website. Please note that updates occur regularly; it is worth making a request at least a couple of times a month and writing out a list of regular reports.

Some accounting programs are able to generate them independently and remind you of the taxpayer’s obligation, but often the forms have to be filled out manually. A little advice - look at the instructions, it indicates in which cases you do not need to fill out the report or you can send it blank. Sometimes, in the absence of relevant indicators, it will be necessary to send an information letter.

By the way! The composition of statistical reporting forms is influenced by OKVED codes in the Unified State Register of Legal Entities. It is recommended to remove them when they are not in use, added “just in case,” the activity is terminated voluntarily or as a result of a decision of a government agency (for example, when a license is revoked) and the organization does not intend to resume it in the foreseeable future.

Fines according to statistics are specified in Article 13.19 of the Code of Administrative Offenses and are divided into two types:

- For the manager (or other responsible person, including the chief accountant) - 10,000 - 20,000 rubles, in case of repeated violation - from 30 to 50 thousand.

- For legal entities - 20,000 - 70,000 rubles, repeat - from 100 to 150 thousand.

More than substantial sums for a small organization, and they relate not only to late submission, but also to the provision of false information.

Pension Fund

To the Pension Fund of Russia, the number of documents submitted has been significantly reduced; now we submit three reports: SZV-M (monthly), SZV-STAZH (annual) and SZV-TD (in 2021, provided differently depending on the availability of dismissals/acceptances).

The simplest but most insidious is SZV-M. The only information is your full name, INN and SNILS, but in one of my first articles we already talked about errors in basic reports. Don’t forget: the data for SZV-M and SZV-STAZH must match the periods.

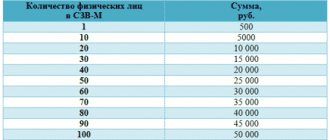

Article 17 of Law No. 27-FZ of 04/01/1996 promises to “reward” the company with a fine of 500 rubles for each individual for lateness, incomplete or incorrect information. If you forgot to include an employee in the SZV-M list, you must submit a supplementary form and pay sanctions for only one person. The same rules apply to SZV-STAZH and SZV-TD.

Important! We pay fines on personalized reports to the Pension Fund of Russia branch, and not to the tax office. The Pension Fund does not block the account on its own, but has the right to send documents to the bailiff service, which will remove the debt from the account.

From January 1, 2021, amendments to the Code of Administrative Offenses will come into force. Thus, Article 15.33.2 will provide for fines in the amount of 300 to 500 rubles for late submission or errors in information about work activity, and not just in the usual SZV forms.

FSS

The Social Insurance Fund accepts 4-FSS, which reflects contributions for accidents at work. Article 26.30 of Federal Law No. 125-FZ of July 24, 1998 establishes for failure to submit the same sanctions as for tax reporting - 5% of contributions accrued for payment (for the last quarter in the document) for each month of delay, but not more than 30 % and at least 1000 rubles.

Note! Some reports are submitted only electronically, for example, VAT returns. Sending a paper copy by mail is not considered fulfillment of the taxpayer's obligation.

If the 4-FSS calculation is submitted electronically according to the law, but is instead transferred on paper, you will have to go broke for 200 rubles, as stated in the second paragraph of Art. 26.30.

Ecology

To pass or not to pass, that is the question. Small organizations in which there was never a smell of production, as well as most individual entrepreneurs, decided to neglect the environment. In 2021, a number of amendments were made to the Administrative Code, increasing liability for violations of environmental protection, including for the lack of reports.

Article 8.5.1 of the Code of Administrative Offenses establishes sanctions separately for individual entrepreneurs and organizations:

- The reporting is presented, but it is unreliable or lacks some data. The individual entrepreneur will receive a fine of at least 100 thousand, but in general it is calculated in double the amount of collection for each group of goods (packaging of goods) for which the recycling standard is calculated. Organizations will be punished according to the same calculation, only the minimum for them is already 250,000.

- The report has not been submitted. An individual entrepreneur will pay from 50,000 to 70,000 rubles, and an organization will pay from 70 to 150 thousand. There is an administrative monetary penalty for officials - 3-6 thousand rubles.

If you work with government contracts, performing repairs, construction work, dismantling, then in the text of the contract look for a clause (there will probably be one) about storing and removing waste. Those. The contractor will have to answer for the disposal of old lamps, wiring, unusable equipment and furniture; he must enter into contracts and remove the waste, and not dump it in the nearest trash container. Here's environmental collection and recycling.

Military registration and enlistment office

In 2021, the Code of Administrative Offenses is undergoing another change - in the field of military registration. If you have never encountered reporting to the military registration and enlistment office, know that everyone must submit it. Of course, we are not talking about declarations or calculations, but special information. For example, on the hiring or dismissal of employees subject to military registration. When there are employees under 17 years of age on staff, their seventeenth birthday must be reported in advance - a year before their birthday.

Fines are provided for in the Administrative Code: Article 21.4 promises to punish administratively from one to five thousand rubles for failure to notify of admission or dismissal, the same amount will have to be paid if you do not respond to the request of the military registration and enlistment office. In Article 21.1, slightly smaller sanctions from 1000 to 3000 are established for an employer who does not report on time about 17-year-old employees.

Employment Center

In 2021, the list was replenished with reports to the employment service. More precisely, it was previously required to transfer information there, but only in certain cases: during the liquidation of an organization, staff reduction, when layoffs affected an enterprise with more than 500 employees, etc.

Due to the difficult epidemic situation (many enterprises are closing amid the coronavirus crisis), a large amount of labor is being released, and the state has promised to support the unemployed. For these purposes, the forms were supplemented with some data: wage arrears, the number of remote workers, working part-time, fired or expected to be fired since the beginning of quarantine.

You can submit information through the Work in Russia website. Registration using the State Services account of the individual manager to whom the organization is linked.

Important! They mainly require the transfer of information from those who have experienced changes: dismissal, layoff, transition to part-time work or remote work. If there are no changes to your work, you do not need to submit anything.

So far no sanctions have been applied, but the service is showing enviable persistence. In addition, the CZ needs to transmit information about vacancies, which is expressly stated in paragraph 3 of Art. 25 of Law No. 1032-1 of April 19, 1991. The Code of Administrative Offenses has Article 19.7, which establishes fines for failure to provide information for officials - from 300 to 500 rubles, for organizations - from 3 to 5 thousand rubles. Theoretically, it applies to information in the CZN.

Position of the Federal Tax Service

The Tax Department in Letter dated September 13, 2017 No. BS – 4 – 11/ [email protected] notes that:

- In the provisions of Law No. 212 - Federal Law there are no rules limiting the time limits for the taxpayer to submit information about income to the Federal Tax Service (of which the Pension Fund is subsequently informed).

- It turns out that an individual entrepreneur who has forgotten to submit a declaration for a certain period has the right to do so at any time later. As soon as the Federal Tax Service receives it, the department will have information about the taxpayer’s income at its disposal, which can then be transferred to the Pension Fund.

- The main purpose of the provisions of Law No. 212 - Federal Law, which allows the Pension Fund to increase contributions several times, is to establish legal grounds for additional control over the income of individual entrepreneurs in order to correctly calculate not the fixed part of contributions, but that which depends on income exceeding 300 thousand rubles.

- It turns out that, in the opinion of the Federal Tax Service, this norm, in principle, should not be used as justifying a multiple increase in contributions. The Pension Fund of the Russian Federation, therefore, may make sense to reconsider its approach to the interpretation of this rule.

- The competence of the Pension Fund is to establish the correctness of calculation of contributions.

- It turns out that if the Fund follows the policy of increasing payments requested from individual entrepreneurs without understanding the situation, then its actions can be regarded as not corresponding to the specified competence.

As a result, the Federal Tax Service admits that it supports the right of individual entrepreneurs to recalculate the obligations of individual entrepreneurs, in respect of which the law gives the Pension Fund the formal right to increase the requirements for pension contributions. But under one condition: the individual entrepreneur, one way or another, must submit to the Federal Tax Service a declaration for the period for which contributions were calculated in an amount that raises questions.

Recommendations from experts

Representatives of the Federal Tax Service of Russia in information letters repeatedly reminded entrepreneurs of the need to submit reports. Declarations should be sent to the inspectorates even if operations are completely stopped and there is no commercial income. Otherwise, violators face fines.

If it is not possible to run a business, lawyers recommend officially liquidating the individual entrepreneur. The legislator does not limit citizens in the number of registrations. You can resume activity at any time. Freezing your own business will not free you from formal responsibilities. Late submission of declarations will result in sanctions.