Good afternoon, dear readers! Today we will highlight a small, but important for many simplified question: how much to consider income if the buyer pays for the purchase through a bank terminal installed in the store or online on the website of an online store that accepts payment using an Internet acquiring system?

Description of acquiring, advantages and disadvantages

How acquiring occurs: (click to expand)

- During the transaction, the cashier activates the client’s card through the payment machine;

- Account status data is sent to the information center;

- The remaining funds are checked, the cashier enters the payment amount, and the buyer enters a PIN code, the terminal issues a slip (check) in 2 copies.

- The cashier signs one copy and gives it to the buyer, and the buyer signs the second copy and gives it to the seller. The signatures on the card and on the slip must be the same; this must be checked.

- The cashier punches the check through the cash register and gives it to the client.

- Non-cash transactions are recorded in a separate section of the cash register and are included in the Z-report as non-cash revenue.

- Non-cash payments are entered in the cash register: in column 12 - how many transactions, in 13 - the amount of settlements.

- Revenue from cash and non-cash payments is entered into the cashier's certificate report.

- At the end of the day, the organization sends an electronic journal printed from the terminal to the servicing bank.

- The bank checks the transactions, during the day (or the next day) transfers its proceeds minus the commission (its remuneration) to the organization’s personal account.

Advantages and disadvantages of non-cash payments:

| Advantages | Flaws |

| Protection against counterfeit bills and theft | Possible server failure |

| Customer convenience | The danger of hacking by hackers |

| Turnover increases by an average of 30% | The organization shares part of the proceeds with the bank |

| Saving the organization's money on collection | The need to purchase a terminal or whether to rent it |

Comparison of commissions of TOP-15 banks

To choose an inexpensive tariff, we recommend using the table. It shows the interest rates on transactions and the cost of equipment.

| Organization | Percent | Cost of equipment | |

| Sberbank | 1,8-2,5% | 1,700-2,200 rub./month. | |

| Dot | 1,3-2,3% | From 5,000 to 20,000 rubles. + 500 rub. months – for online enrollments | |

| Tinkoff | 1.59-3.6% Separate tariffs are provided for the transport sector and housing and communal services | 1,990-3,990 rub./month. | |

| Alpha | From 2% and above | Free rental. The tariff is selected individually | |

| VTB | 1,8-3,5% | Negotiated individually + 3 months of free PC service | |

| Opening | 1,9-2,5% | The tariff is selected individually (no Internet acquiring) | |

| Raiffeisen | From 1.99% and above | From 23,000 to 33,000 rubles. | |

| RFI | 1.8% and above | From 20,000 to 23,000 rubles. | |

| UBRD | From 1 to 2.5% | RUB 25,900 – single price | |

| Module | From 1.5 to 2% | Terminal rental is free. You can buy from 16 to 27 thousand rubles. | |

| Russian standard | 1,8-2,2% | From 13,300 to 42,000 rubles. | |

| Uralsib | 1.65-2.6% (RUB 2,600 per month minimum) | The terminal is rented free of charge | |

| MTS | 1.69% + 499 rub. for service | Free rental | |

| ICD | 1.6-1.95%, or 2500 rub. | Rent free | |

| Vanguard | 1,7-2,3% | Rent from 200 to 750 rubles. months First 4 years, then free | |

To choose a suitable acquiring service, you need to take into account all the nuances and features of your business. If Sberbank’s conditions become suitable for one organization, then another will choose Avangard.

The lowest percentage may not always bring benefits to the entrepreneur. Choose a bank taking into account the cost of equipment and current account maintenance.

Accounting for individual entrepreneurs without a cash register

Individual entrepreneurs who are UTII have the right to make cash and non-cash payments without using cash registers (in accordance with Federal Law No. 290-FZ, Article 7). In this case, the entrepreneur accepting non-cash payments must fill out a strict reporting form and issue a cash receipt at the client’s request.

Funds received through payment by plastic cards are recorded as “Revenue”, and the bank commission goes to “Expenses”.

Category “Questions and answers”

Question No. 1. If a buyer decides to return an item that he purchased by bank transfer, can the cashier return his cash?

For goods paid for with a plastic card, the money must be returned in the same way, otherwise it will be an illegal cash out. In this case, only the cardholder with his passport can apply for a refund.

Question No. 2. Does the amount of commission paid to the acquiring bank affect the amount of revenue?

No. Revenue is accounted for in full, and commission is included in Other expenses. Under the simplified tax system “Income”, revenue is taken into account in full in the income section and the commission does not affect this. Under the simplified tax system “Income-expenses”, the commission is taken into account in “Expenses”.

Question No. 3. Is an organization that accepts payments by plastic cards required to issue a KKM receipt?

Yes. Non-cash payments do not exempt you from issuing a check. If an organization is a UTII payer and provides a list of services specified by law that exempts from the use of cash registers, then at the buyer’s request a sales receipt must be issued.

Question No. 4. On what day is income taken into account: on the day of payment by card or on the day the funds are received in the current account?

Under OSNO, income is taken into account at the time a transaction is made with a plastic card. And with the simplified tax system - on the day the bank credits the organization’s funds to its account.

Question No. 5. Does acquiring accounting differ depending on how soon the money arrived in the current account?

Yes. If the money was received on the day of payment, then account 57 is not used. If the next day or later, then account 57 must be used.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓

Free legal advice Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

Taxation under OSNO and simplified tax system

Expenses associated with paying a commission to the bank are classified as other expenses or may be included in non-operating expenses. They reduce the tax base for calculating the Income Tax and are not subject to VAT.

| With OSNO | VAT | Income tax |

| The tax base | Full revenue, including bank commission | Income (revenue minus VAT) minus bank commission |

| Base definition date | Date of transfer of the goods to the client | Date of transfer of the goods into ownership of the buyer |

| With simplified tax system | "Income" | "Income - expenses" |

| The tax base | All revenue is included in the “Revenue” section | The acquiring fee is included in “Expenses” |

| Base definition date | Date of receipt of funds on the account | Date of receipt of funds on the account |

How to connect acquiring profitably: pitfalls

Volume of sales. You connect to a good tariff and suddenly it turns out that in your case the conditions change, since your sales volume is less than 300,000 per month. It turns out there are also fines for reducing sales. To avoid ending up in a similar situation, like many others, pay attention to all the terms of the service agreement. Essential information may not be disclosed to you.

Equipment costs. Many banks charge money for the purchase and installation of terminals or provide them on a rental basis. If you were not told the terms and conditions for the provision of equipment, this does not mean that it is free, it is better to clarify. If the terminal is leased, then there is a high probability that you will not receive a new terminal, so it is better to find out right away what to do if it breaks down.

Checking account. Some banks provide acquiring services only if you have an account with their bank.

Connection and timing. Please note that after submitting an application for connection, it must be approved; it is possible that your application may be rejected by the bank for its own reasons. Check the terms for consideration of the application and the terms for connection in case of a positive response.

Money transfer. Pay attention to the deadlines for transferring money to the account in the contract. It’s better to discuss everything with a consultant in advance than to wonder later why not today, but within a week. Read reviews on the Internet.

Payment systems and payments. Please note that work with major payment systems is supported. Nowadays, smartphone payments are becoming increasingly popular. It is important that there is support for Pay Pass for contactless payments.

Training issues. Find out whether employee training is provided and in what form, free or paid, and what is needed for this.

Taking into account all these points, you can connect acquiring for individual entrepreneurs on favorable terms. Also, some banks conduct incentive promotions that can be beneficial.

Return of goods upon acquiring

If the product was purchased by bank transfer, then when it is returned, the funds must go back to the buyer’s card. Documents that the buyer must provide to the seller: (click to expand)

- Passport;

- Check;

- Plastic card;

- Statement.

Only the cardholder can apply for a refund. The application indicates: client’s full name, circumstances of return (reason), amount, receipt details, card details. A copy of the passport and the original receipt are attached to it. If the item is returned on the day of purchase and the report has not yet been withdrawn from the terminal, then payment for it is canceled by the cashier using a special operation on the terminal.

A KKM check for return is punched, a return certificate is issued f. KM-3, in the cashier-operator’s journal, line 15 reflects the refund amount.

If the item is returned the next day or later, the refund will be processed as follows:

- The seller prepares a return invoice and a receipt for the return;

- The seller sends the buyer’s application with attached documents to the servicing bank;

- Documents are reviewed by the bank within 3 working days and submitted for execution;

- The next day, the acquiring bank transfers the buyer’s money to the general account of the bank servicing his card.

- The receipt of funds on the buyer’s card depends on the policy of his bank.

Postings when returning goods

Operations are reversed:

- Dt62 – Kt90.1 – returned goods;

- Dt90 – Kt68 – for the amount of VAT on the returned goods;

- Dt90 – Kt41 – cost of returned goods;

Accounting for returned goods:

- Dt90 – Kt62 – goods are returned;

- Dt62 – Kt57 – the bank received a return application from the buyer;

- Dt57 – Kt51 – refund to the buyer minus commission;

- Dt57 – Kt91 – refund of the commission amount.

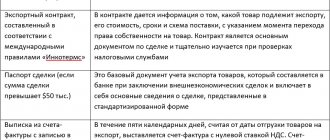

Retail sales of goods (ATT) under UTII

When selling goods through ATT, the sale is documented in the document Retail Sales Report, transaction type Retail Store in the Sales – Sales – Retail Sales Reports section.

Payment Card Transaction document using this example.

The title of the document states:

- Warehouse – a warehouse from which goods are sold. Selected from the Warehouses ; when selling at retail, it must be of the Retail Store ;

- Price type – type of retail prices, selected from the directory Price types of items . Prices of the selected type will be automatically entered when selecting items into the tabular part of the Retail Sales Report .

On the Products , select items, enter price and quantity.

On the Non-cash payments , you must fill in the Payment Type and the amount that the buyer pays by card. The payment type is selected from the Payment Types directory .

Postings according to the document

Reporting and documents for acquiring

Documents for acquiring:

| Documentation | Forms to fill out |

| Source documents | Cash receipt, slip from the terminal |

| Cash documents | Z-report |

| Accounting documents | Cashier-operator's journal, electronic journal from the terminal, register for non-cash payments |

The results should be reconciled at the end of the working day every day. You also need to check every day whether the amounts of their Z-report are correctly allocated to accounts 50 and 57; not only daily receipts are compared, but also the cumulative total. To determine the correct distribution of the bank commission, the turnover on credit 57 and debit 91 is compared daily.

If card transfers are made on the same day, then account 57 should not have a balance. If the transfer arrives the next day, then the balance should be equal to the debit turnover of the previous day.

Regulations:

- Federal Law No. 161-FZ dated June 27, 2011;

- Instructions for using the Chart of Accounts;

- Tax Code of the Russian Federation

Results

Acquiring allows you to make payments using bank cards without using cash.

Nevertheless, merchants using acquiring, including online acquiring, must use modern cash registers (online cash registers), if, according to Law No. 54-FZ, they have an obligation to use cash register systems in calculations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Typical Accountant Mistakes

- Reflection of revenue at the time of receipt of funds to the current account, and not at the time of transfer of ownership of the goods to the buyer. This distorts reporting, especially when payment by card and transfer of funds occur in different reporting periods.

- Reflecting revenue minus commission to the bank is also a mistake. There is an underestimation of sales revenue and expenses, which leads to distortion of accounting and tax reporting. Under the simplified tax system, such an error underestimates the tax base.

- Violations include the sale of goods without the use of cash registers, failure to reflect revenue from non-cash payments in the cashier-operator's journal or in the certificate report.

Online payment acceptance scheme

If you understand what Internet acquiring is, you can come to the conclusion that it is a completely virtual service. All operations are carried out remotely:

- The buyer goes to the online store website or mobile application, selects products and puts them in the cart, and then proceeds to place the order.

- In the order form, the buyer indicates that he wants to pay for the purchase with a bank card, after which the system automatically sends him to the authorization page. Here he enters the card details: its number, CV2 code from the back, the last month of validity, it may be necessary to enter the first and last name of the card holder in Latin.

- Transaction data is sent to the payment provider, which in turn sends a request to the acquiring bank providing the service.

- The acquiring bank sends a request to the issuing bank, which services the card. At this stage, the feasibility of the transaction is checked. It may not be processed if the card is blocked, there are not enough funds on it, etc.

- If there are no problems with the card, the verification procedure takes place. Nowadays, 3-D Secure technology is almost always used. The buyer is redirected to a page to enter a password, which is simultaneously sent to him on the phone linked to the card. If the password is entered correctly, the system gives the go-ahead for the operation.

- The store receives information about the successful receipt of the payment, which it informs the buyer about.

Important! The entire payment processing scheme consists of many requests between banks and the provider, but for the buyer the payment operation lasts several seconds. All actions are carried out automatically.

Banks often offer entrepreneurs online acquiring with expanded functionality. The holding option will be useful: the bank does not write off funds from the card, but simply freezes them. This will be necessary if, for example, a store needs to check the availability of goods in stock. If it is not there, the funds will defrost without problems.