Control of receivables and payables is one of the important areas of management accounting. We provide a cheat sheet for controlling accounts receivable and accounts payable in 1C 8.3 Accounting 3.0.

You will learn:

- how to view accounts receivable;

- how to view accounts payable;

- how to view the breakdown of accounts payable and receivable in 1C.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

General information about accounts receivable

Order No. 34n dated July 29, 1998 regulates the formation of receivables. Such amounts that various counterparties owe our organization (enterprises, individuals, budget, extra-budgetary funds, etc.) can be seen in the organization’s balance sheet in the form of a debit balance for accounts 60, 62, 66, 67, 68, 69 , 70, 73, 75, 76.

Thus, debts can arise as a result of:

- sale (shipment) of goods subject to deferred payment

- purchases of products (raw materials) on prepayment

- when overpaying taxes

- issuance of accountable amounts to employees

If the taxpayer has a counter-obligation to a counterparty (accounts payable), doubtful debt is recognized as the part of the debt that exceeds the taxpayer's payables to this counterparty.

Expert of the Legal Consulting Service GARANT O. Tkach

How to prevent doubtful and bad debts

There are several ways to prevent or minimize bad debt.

Prepayment

If there is a risk of problems with the buyer, it is better to conclude an agreement with him on an advance payment basis. Moreover, the prepayment in this case must be 100%. Then you, as a supplier, will not have problems with debts.

Security in the form of collateral, surety, bank guarantee

Counter debt (accounts payable)

When there is a counter-debt, you can relatively safely ship products without prepayment, without collateral or other safety net options. If there are accounts payable and accounts receivable arise, it is always possible to cover them through offset.

Letter of Credit

This is a rather exotic option, although undeservedly forgotten. A letter of credit is one of the forms of non-cash payments, the meaning of which is as follows: when both parties to a contract (for example, for supply) do not trust each other (that is, the supplier does not trust the buyer, because he is afraid that he will not pay, and the buyer is afraid make an advance payment because you are not sure that the supplier will ship the goods), the problem can be solved by a third independent party represented by a bank (issuing bank).

In this case, the bank opens a letter of credit: part of the funds in the buyer’s current account is transferred to a special account in this bank, and the buyer does not have the right to dispose of this money for a certain period. The bank then informs the supplier that the money is “reserved” for him in a separate account and this money will be transferred to him as soon as he submits documents confirming the shipment.

Unfortunately, this service is not very popular. Probably because it's not cheap. But from a financial and civil legal point of view, this is a good option for preventing the accumulation of debts.

The role of accounts receivable in an organization

Achieving the main goal of the enterprise may not be fully realized due to the growth of accounts receivable. To overcome this problem, each organization must resolve the issue of reducing accounts receivable, primarily related to monitoring its dynamics.

The program used in many enterprises, 1C, allows you to analyze accounts receivable by generating reports for a certain period.

Based on the Chart of Accounts and the Instructions for its use, the debt can be reflected in the following synthetic accounts: 60, 62, 63, 66, 67, 68, 69, 70, 71, 73, 75, 76, etc. At the same time, analytics are carried out for each account for each buyer, supplier, account, etc.

How does debt arise?

The mechanism for the occurrence of such a process at various enterprises is most often standard. The company wants to expand its activities and increase profits, so it tries to sell goods on any terms.

In the modern market situation - with high competition - entrepreneurs strive to be loyal in order to attract customers. Therefore, goods are often offered in installments. Unfortunately, not all clients turn out to be decent payers and repay the debt. In this situation, there is a high risk of non-repayment of funds and, accordingly, the appearance of receivables.

It turns out that two factors influence the occurrence of this phenomenon:

- desire to increase profits;

- high competition.

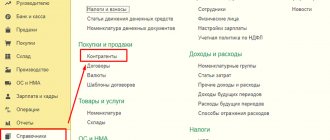

The procedure for characterizing the status of accounts receivable in 1C

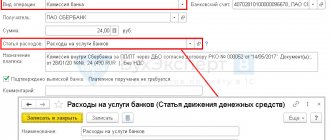

In 1C: Accounting it is possible to check accounts receivable. The section “Accounts receivable and payable” includes reporting for the bank, which is filled out automatically and cannot be edited manually, but only by entering documents into the database in the program.

The section details information on each:

- to the counterparty indicating the TIN

- agreement with the counterparty

- debt from the date of occurrence

Debt is also divided according to terms of execution: long-term (over 12 months) and short-term.

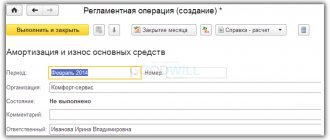

The organization must create reserves for doubtful debts if such debt is considered doubtful, which can be automated in 1C.

For example, let’s take account 60 and 62 based on the 1C: Accounting chart of accounts.

In account 60, analytical accounting is kept for suppliers and contractors (sub-account “Counterparties”) and the basis of calculations (sub-account “Contracts”), and each supplier and contractor is an element of the directory “Counterparties”, and the basis of calculations is “Contracts”. By analogy, analytical accounting is maintained for account 62 - for buyers and customers (sub-account “Counterparties”) and the basis of calculations (sub-account “Agreements”), and each supplier and contractor is an element of the directory “Counterparties”, and the basis of calculations is “Contracts”. This complies with the requirements of the Chart of Accounts.

In the “Agreements” directory, debt is divided into short-term and long-term (according to the details “Date of occurrence of the obligation” and “Date of repayment of the obligation”) and here information is generated on accounts to and from counterparties, as well as existing contracts.

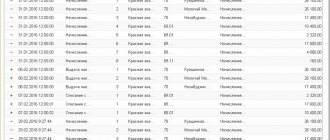

To account for debt, use the “Account balance sheet” report:

| report setup | score 62.1 |

| field “Type of subconto 1” | "Counterparties" |

| field “Type of subconto 2” | "Treaties" |

This reflects the initial balances, turnover and final balances of mutual settlements with customers. If the buyer has a debt, you can see the basis for the formation (invoice or agreement). If there is no need to consider turnover by accounts or contracts, then when setting up the report, the “Type of subaccount 2” field remains blank.

| Counterparty | Agreement (account) | Amount, rub. |

| LLC "Firm" | Invoice No. 01 dated 10/11/2021 | 50000,00 |

| IP Valeeva V.V. | main contract | 5000,00 |

| Total | 55000,00 |

Based on the data obtained, a conclusion is made about the existence and amount of debt.

Accounts receivable are a quickly realizable asset and it is necessary to evaluate their conversion into cash and take into account the share of bad debts according to the average statistical data of previous periods. For example, the amount of accounts receivable is 200,000.00 rubles, including the unpaid amount - 20,000.00 rubles. The share of unpaid debt in the total amount is 10%. This means that according to the “Turnover balance sheet for account 62.1” the conclusion will be that 10% of the debt has not been paid and it is advisable to create a reserve for the next period.

To monitor the payment schedule and maintain settlement and payment discipline, the “Turnover between sub-accounts” report is used to track the repayment of debt during the period between all sub-accounts. In report settings:

| Type of subconto (main) | "Counterparties" |

| "View of subconto (corresponding)" | "Flow of funds" |

| "Subconto" | "Payment to supplier" |

The report will show the amounts of repayment of accounts payable by creditors and the repayment procedure. If, when setting up, instead of “Payment to supplier”, “Receipts from buyers” is indicated, then the report will reflect the receipt of funds from buyers.

Additionally, visualization tools are provided in the form of a “Diagram” report: when setting up the report on the “Data” tab, the account 60.1 is indicated, the type of totals is selected (closing balances, credit, amount), and on the “Diagram” tab the parameters for generating the report are set.

To account for debt, it is necessary to carry out an inventory, usually at the end of the period, and makes it possible to identify debt balances. For this purpose, there is a report “Inventory of settlements with counterparties”: Reports – Specialized – Inventory of settlements with counterparties. The unified form INV-17 or a self-developed form can be used, which is checked with a checkbox on the tab and the relevant inventory information is entered into this form. The debt table is filled in automatically based on the available accounting data entered by clicking the “Fill” button (in this case, both the confirmed and the expired date of obligation are indicated). The “Not confirmed” column must be filled in manually.

Thus, the use of reports in 1C makes it possible to regularly monitor and analyze mutual settlements with buyers and suppliers, assess the status of debt and take measures to optimize it.

Control of planned payments

Payment schedule

The main tool for planning receipts and payments in 1C. It allows you to analyze not only settlements with customers and suppliers, but also other payments: payment of taxes and wages.

It has its own nuances and features, which you will read in more detail in a separate article Payment calendar.

Control of unpaid invoices

There are two ways to control invoice payments:

- payment statuses in the document journal;

- management reports - Invoices not paid by customers, Invoices not paid to suppliers.

For more information on management reports, including answers to popular questions, see Setting up payment terms for suppliers and buyers.

Answers to common questions

Question No. 1 : Under the assignment agreement, the organization acquired receivables at nominal value. The debtor is an individual entrepreneur who has ceased business activities (excluded from the Unified State Register of Individual Entrepreneurs). Does the assignee have the right to recognize this debt as bad and include it in non-operating expenses?

Answer : It is important to take into account that the extract from the Unified State Register of Individual Entrepreneurs about the termination of the individual entrepreneur does not apply to the basis for recognizing this debt as bad and writing it off as expenses.

Question No. 2 : The organization switched from UTII to OSNO. In the course of activities on UTII, accounts receivable were formed. Under the new regime, does the organization have the right to create a reserve for debt incurred?

Answer : When switching to OSNO, an organization cannot create a reserve for doubtful debts for previously existing debt.

General description of the balance sheet for account 70

This register groups information about balances at the beginning and end of the period, turnover for the reporting period in account 70 “Settlements with personnel for wages”. Data in the statement must be disclosed for each employee. The procedure for recording transactions on account 70 is regulated by Section VI of the Order of the Ministry of Finance of the Russian Federation “On approval of the chart of accounts for accounting…” dated October 31, 2000 No. 94n:

| Transactions reflected in the debit of the account. 70: | Operations reflected on the credit account. 70: |

|

|

* The “Salary Deposit” operation is becoming less and less common these days. Its meaning is to close the payroll compiled for a group of employees when paying wages in cash. Since currently most organizations use non-cash forms of payment to pay wages, the formation of a unified payroll is losing relevance.

As of November 30, 2020, the Bank of Russia’s directive No. 5587-U dated October 5, 2020 eliminated the rule about reflecting in the payroll the deposit of unpaid wages on time.

The balance can be anything: active, passive and active-passive. Basically the balance of the account. 70 can be passive, this is due to the fact that wages are calculated on the last day of the reporting (worked) month, and are issued to the employee in the subsequent month. An active or active-passive balance can be when an excessive payment of wages to an employee exceeds its accrual, for example, in the event of an erroneous transfer to a salary account.

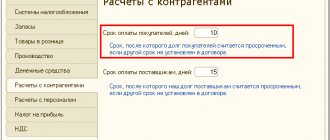

Automatic identification of overdue accounts payable

“1C: Accounting 8” (rev. 3.0) provides a number of settings for accounting for accounts payable:

- keeping records of contracts;

- setting deadlines for repaying debts to suppliers;

- the ability to select specific documents when offsetting advances and repaying debts;

- operating instruments for adjusting debt, offsetting advances, writing off debts, etc.

- control of deadlines using the document “Invoices from suppliers”

Three ways have been implemented to indicate acceptable deadlines for paying our debts to suppliers:

Method No. 1. Individual deadlines for fulfilling obligations to the supplier under the contract

If accounting is carried out according to contracts, then the payment period to the supplier can be indicated directly in the contract card with the supplier. To do this, you need to set the “Payment deadline has been set” detail.

Method No. 2. Single deadline for all suppliers

The system allows you to set up a single repayment period for the organization's debt to all suppliers (Payment due date to suppliers register >> field Due date for payment of our debt to suppliers).

Method No. 3. Individual deadlines for fulfilling obligations on invoices from suppliers

It is possible to keep records using the “Invoices from Suppliers” document. The “Payment by” attribute allows you to set the deadline by which this invoice must be paid. If an invoice is not paid on time, the line with this invoice in the invoice journal for payment will be highlighted in red. Paid bills will be highlighted in green. Also, the status of “Paid”, “Partially paid”, “Not paid” will automatically change in invoices, depending on whether payment documents have been entered based on this invoice. Based on the invoice, you can quickly issue procurement documents.

All described methods can be combined, taking into account the fact that the payment deadline specified in the contract card has priority.

If you need help making these settings, contact the First Bit specialists.

Act of reconciliation of mutual settlements with counterparties

In controversial situations, before demanding payment from debtors, an inventory of settlements with counterparties should be carried out. To identify possible discrepancies in 1C: Accounting 8, the document Reconciliation Act for settlements with the counterparty is used.

The act of reconciliation of mutual settlements is filled out automatically according to the documents contained in the accounting system and saved in the program. You can detail the reconciliation by agreement (Advanced tab >> Break down by agreement flag).

Often the reason for data discrepancies during reconciliation is the physical absence of a document confirming the operation (for example, if the documents were sent by mail and are still on the way). Electronic document management (1C:EDO service) will allow you to increase the speed of exchange of primary documents with clients and suppliers.