Value added tax (VAT) is a type of indirect tax levied by the government. It refers to a certain share of the cost of goods and services, paid in the form of a fee by an organization or entrepreneur to the state budget. We will talk in detail about VAT in Kazakhstan, its rate for 2021, objects and other intricacies of working with this tax in the following sections of the article.

Who should pay VAT in 2021 in Kazakhstan

According to the legislation of the state of Kazakhstan, persons liable for VAT payments in the current year are:

- engaged in individual entrepreneurial activities;

- legal entity (except for government agencies and organizations);

- non-residents, that is, persons (organizations) not registered and not residing in the Kazakh state, but carrying out commerce within its borders and having branches and offices operating on a permanent basis in the country;

- branches and divisions of legal entities recognized as independent taxpayers and obligated to pay this type of payment.

When importing a product, VAT is paid by organizations or individual entrepreneurs that are directly involved in import supplies on the territory of the Kazakh state in strict accordance with the provisions of customs law.

Taxpayer rights

According to the current norms of the Tax Code of the Republic of Kazakhstan, all taxpayers, regardless of the regime used, have the right to use the following opportunities:

- timely receipt of clarifications from tax authorities regarding accrued amounts;

- free consulting support;

- receiving reporting forms;

- checking the appropriateness of accrued amounts;

- concluding additional agreements to conduct an audit;

- timely receipt of tax control results with transcripts.

A key condition for the implementation of the payer’s rights is the provision of open data regarding the location of the businessman. In addition, the entrepreneur is obliged to provide the tax authorities with current contact information (telephone, email). This is necessary so that the resident can receive the necessary information online directly from the tax authorities.

Objects of taxation

According to regulatory documentation, the objects of this type of tax payment are:

- import - that is, products imported or already imported into the territorial limits of the country and subject to the declaration procedure in accordance with the requirements of customs law;

- turnover – that is, the amount received by the person, the payer, during the sale of collection objects in Kazakhstan. In this paragraph, the following explanation must be given: if a tax resident received collection objects from a non-resident who is not included in the category of persons liable to pay VAT within the Kazakh state, then the tax amount will be obliged to be paid by the person who is the recipient of the VAT objects.

What is the generally established order

All categories of individual entrepreneurs listed in the previous paragraph are united by the fact that they are required to pay taxes according to the generally established regime. It is characterized by the following:

- the tax base is the difference between the revenue received and the expenses that were incurred to generate income;

- individual income tax (IIT) is 10%;

- The individual entrepreneur pays for social services for himself. tax - 2-month calculation index (MCI);

- Social benefits are paid for each employee. tax in the amount of 1 MCI;

- if the minimum turnover of 30,000 times the MCI is exceeded during the year, 12% VAT is paid;

- pension contribution in the amount of 10% of income for the owner and each employee.

The main purpose of the transport tax is to compensate for the harm that transport causes to roads and the environment.

All listed payments are considered by the Tax Code of the Republic of Kazakhstan and the “Law on Pension Security”.

You can learn more about taxes in Kazakhstan on our website.

Collection benefits for 2021

An organization, individual entrepreneur or other person may not register with the inspection authorities for state tax under the following circumstances, if the turnover of goods and services during the accounting period (the duration of the period is no more than 365 days) did not exceed the minimum turnover rate. The minimum turnover is determined by the monthly calculation index of thirty thousand times.

Attention! Data on MCI changes, and the exact value of the indicator can be found on the official resource of the Tax Service of Kazakhstan.

Labeling of other tobacco products.

From April 1, 2021, mandatory labeling of other tobacco products will be introduced. Let us remind you that cigarette labeling has already been introduced since October 1, 2020 (the sale of unmarked packs produced before the introduction of mandatory labeling is permitted until October 1, 2021).

Manufacturers (importers) are required to apply the markings, and wholesalers and retailers are required to record and write off such products along the entire route of movement of the goods to the final consumer. To do this you need:

- purchase a 2D scanner;

- or use the Naqty Sauda mobile application developed by Kazakhtelecom JSC.

Registration regulations

It is necessary to register for this type of tax collection with the fiscal service when the minimum turnover is exceeded. The registration procedure is carried out in the subsequent reporting period, which will occur after the exceeded amount of the minimum financial turnover is received. The taxpayer is given exactly fifteen days to contact the fiscal accounting authorities. You cannot violate these deadlines; severe fines may follow.

An individual or legal entity who currently has no obligations to pay VAT, but intends to sell goods or provide services subject to this type of tax, should also write a corresponding application to the inspection. And again - only with an increase in the minimum financial turnover.

Peculiarities

Patent

- simultaneous payment of all taxes at the time of registration of the patent;

- no need to issue fiscal receipts;

- there is no need for a cash register;

- There is practically no tax reporting.

Simplified declaration

- taxes are paid upon receipt of income, and not by prepayment, as under a patent.

Dear users! The information in the article complies with the legislation of the Republic of Kazakhstan in force at the time (date) of publication.

Value added tax rates in Kazakhstan in 2021

VAT has clearly defined rates:

- for taxable imports and turnover, the tax rate on added value is 12%;

- for export (except for the export of scrap metal) the interest rate is zero. There will also be a zero rate when performing work or supplying goods related to international transport.

There is also a turnover category that is exempt from paying the value added fee. Such turnover may include financial services, leasing of funds or property, investments in authorized capital, work in the field of geological exploration, import of currency, medicines, rent or sublease of a residential building (or part thereof). A complete list of financial transactions exempt from VAT can be found on the website of the Tax Service of Kazakhstan.

Possible difficulties:

One of the main dangers that awaits a product supplier is problems with documents. They may be drawn up incorrectly or the tax office may consider that some of the documents are missing. In this case, the supplier may simply not have time to prepare and submit all the necessary documentation to the tax authorities within 180 calendar days. In such circumstances, you will have to pay taxes at normal rates.

To avoid such annoying troubles, novice exporters are advised to seek help from specialists in the field of foreign trade and taxation.

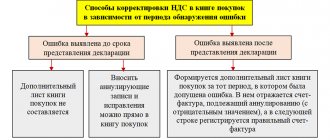

VAT reporting period

The reporting period for VAT is a quarter. In order to correctly prepare reports for the tax service, you need to clearly know the cases in which VAT is taken as a credit, and in which situations the tax will not be taken into account.

The payer has the right to offset VAT if goods, services, work or fixed assets were (or will be used) in taxable turnover, as well as if the following conditions are met:

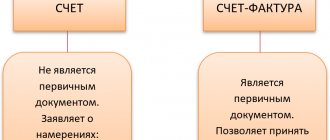

- the recipient of goods, works or services is officially a tax payer on the date of issuance of invoices;

- the supplier of goods, works or services has issued invoices;

- if we are talking about taxable imports, then the tax in the reporting period was paid to the budget of Kazakhstan.

VAT will not be taken into account in the following cases:

- works, goods or services will not be involved in taxable turnover;

- when purchasing passenger vehicles, which are placed on the balance sheet of the enterprise as a fixed asset;

- in case of incorrect execution of invoices;

- if the amount in the invoice exceeds the MCI by 1000 times. We are talking about a situation in which work or services are paid in cash and with VAT added to the final amount;

- if a person received property, services, work, goods free of charge. In this case, the party that carried out the act of gratuitous transfer is required to pay VAT.

Tax return

The VAT return, Form 300.00, is submitted by taxpayers for each tax period by the 15th day of the second month following the reporting period.

- Declaration for the 1st quarter (January-March) – until May 15

. - Declaration for the 2nd quarter (April - June) - until August 15

. - Declaration for the 3rd quarter (July – September) – until November 15

. - Declaration for the 4th quarter (October - December) - until February 15

of the next year.

In the “Accounting 8 for Kazakhstan” configuration, the VAT return (form 300.00 and its attachments) is generated according to the data reflected in specialized VAT accumulation registers.

You can generate a Declaration in the “Regulated and financial reporting” form by selecting form 300.00 in the list of tax reporting forms.

Foreign taxpayers of Kazakhstan

Kazakhstan is interested in increasing investment inflows. Therefore, it offers foreign companies quite favorable terms of interaction. This helped to significantly strengthen the level of cooperation of the republic with large legal entities of other states.

The key advantages in Kazakhstan for foreigners include:

- clear rules that do not change annually;

- a system of additional guarantees for investors operating in the republic;

- transparent tax system;

- the opportunity to receive benefits and bonuses from the state.

Foreign payers in Kazakhstan are characterized by the following features:

- no need to pay for property resources that have foreign registration;

- fixed constant tax rate.

It is also worth noting the Republic of Kazakhstan’s commitment to international business standards, which translates into respect for the rights of investors.

Legislation of CIS countries on taxes

Kazakhstan is an active member of the CIS and, along with other states of the former USSR, uses tax principles characteristic of these countries. In addition, the Republic of Kazakhstan is part of the economic association of the EAEU along with Russia, Belarus, Armenia and a number of other states.

According to accepted international standards, the group of countries that forms the basis of the EAEU has priority access to each other’s markets and is free from additional tax charges and increased rates.

One of the most important norms is considered to be clause 6 of Article 72 of the Treaty on the EAEU, which states that VAT is waived in full if the transfer of goods from one state to another is carried out within the same legal entity. This standard made it possible to significantly expand the scope of interaction with Russians and Belarusians, which led to the opening of various interstate representative offices in the EAEU zone.

Conditions for their use

Certain types of tax regimes require certain circumstances to be implemented. The legislator establishes a number of restrictive conditions for the use of a specific regime.

| Patent | Here the conditions of application are considered to be the following:

|

| "Simplified" | The legislation establishes the following features of the use of the mechanism:

|

| Fixed deduction | Here the grounds are somewhat different from other modes:

|

Restrictions are set for certain types of activities. Entrepreneurs may use exclusively the general procedure or other regimes approved by law:

- work with excisable commercial products;

- lotteries and drawings;

- procurement and reception of glass, paper, ferrous (non-ferrous) metal;

- consulting services in the areas of accounting, auditing, financial, insurance and intermediary sectors.

This category also includes jurisprudence, advocacy and financial leasing.