From the beginning of its activities, each individual entrepreneur is required to maintain a KUDiR or, as it is also called, an accounting book. In it, he must record all actual business transactions regarding income and expenses. This is evidenced by the main legal document that regulates issues related to tax accounting of individual entrepreneurs on OSNO. We will further discuss the Procedure for accounting for income and expenses and household expenses. operations for individual entrepreneurs (hereinafter abbreviated as Procedure). This Procedure was introduced by Order of the Ministry of Finance of the Russian Federation No. 86n, Ministry of Taxes of the Russian Federation No. BG-3-04/430 dated August 13, 2002 (now applied as amended on June 19, 2017).

As established, an individual entrepreneur acquires KUDiR independently and uses it for the purpose of generalization, systematization, and accumulation of information that is recorded in the primary documentation. Before making entries in the accounting book, the individual entrepreneur at OSNO must have it certified by the Federal Tax Service. If he decides to keep KUDiR on an electronic medium, which is not prohibited by the Procedure, then at the end of the tax period he must put it on paper and again have it certified by an authorized official at the Federal Tax Service.

Important! Order, approved. By order of the Ministry of Finance and the Ministry of Taxes of the Russian Federation dated August 13, 2002, it does not apply to individual entrepreneurs who work on the simplified tax system, UTII or Unified Agricultural Tax. It should also be taken into account that legal entities should not maintain KUDiR on OSNO.

Meanwhile, the absence of an accounting book for an individual entrepreneur on OSNO or the presence of gross errors in it entails the imposition of a fine under Art. 120 of the Tax Code of the Russian Federation and Art. 15.11 Code of Administrative Offenses of the Russian Federation. Penalties are applied by the Federal Tax Service upon detection of these violations.

Why do you need KUDiR IP?

KUDiR is recognized as a tax accounting register, although it combines accounting and tax accounting. The document reflects the following data:

- information about fixed assets and depreciation;

- calculation of wages and taxation;

- utilities and other expenses;

- taxation of business transactions with identification of the difference, which is ultimately subject to personal income tax.

KUDiR IP is needed to form the tax base for personal income tax (NDFL) for the tax period, which is considered a calendar year. Individual entrepreneurs pay 13% of the calculated difference between income and expenses to the budget.

If at the end of the tax period the financial result is negative, i.e. There is a loss, then no tax is paid. Also, the loss is not carried forward to a future tax period and is not covered by the profits of subsequent years.

What is the document for?

The book of accounting for income and expenses (abbreviated as KUDiR) is necessary to calculate the tax base of an individual entrepreneur, on the basis of which tax deductions for the reporting period will be calculated.

For each taxation system that requires maintaining KUDiR, it will have its own characteristics. An individual entrepreneur located on a common system (OSNO) must be guided by the relevant requirements. Entrepreneurs using PSN and USN will fill out KUDiR differently.

REMEMBER! In the general taxation system, only individual entrepreneurs are required to maintain KUDiR; companies are exempt from this obligation.

Maintaining KUDiR on OSNO

KUDiR on OSNO is formed from the beginning of the tax period. The accounting book is kept either by the entrepreneur himself or by an accounting employee; it is kept for 4 years. Individual entrepreneurs provide an accounting book along with 3-NDFL reporting. Thus, KUDiR is submitted to the tax office at the place of registration until April 30.

The magazine has a unified form. However, the entrepreneur has the right to independently create the form of the document. Coordinate all changes with the tax authority. If the developed version of the register is not approved, the tax office may not count the bookkeeping.

KUDiR is maintained in paper or electronic form. The book, issued in electronic form, is printed at the end of the calendar year. It is also laced, numbered and signed. Do all this with the book, which was kept in paper form. Previously, KUDiR had to be certified by the tax office, and the paper book was certified before filling out, and the electronic book after printing. Now the law does not require a certification procedure.

Who is obliged to maintain it, does it need to be certified?

KUDiR is maintained by the entrepreneur himself or by an accounting employee in the accounting department. Regardless of what the journal is used for, it must be stored for 5 years .

If KUDiR is maintained electronically, at the end of the period it must be printed and flashed. The period is set independently within the enterprise, but cannot exceed a year. The book must be numbered and bound in the prescribed order indicating:

- number of sheets;

- signature of the individual entrepreneur with a decoding of the name;

- print, if available and used.

If the turnover in an individual entrepreneur is significant, stitching is done monthly. For small businesses, one firmware update per year is enough.

The taxation and accounting form is not sufficiently covered by service programs, so it is often filled out manually. Before manual journaling begins, it is numbered and stitched.

Clause 8 of the Procedure for maintaining KUDiR indicates the need for the book to be certified by the Federal Tax Service inspection, but the Tax Code of the Russian Federation does not give precise instructions on the deadline. Most individual entrepreneurs submit the journal for certification to the Federal Tax Service together with the 3-NDFL declaration. There is no penalty for failure to submit a book. The book is submitted for control during an on-site or desk inspection.

What does the personnel management system in an enterprise consist of and how is it used? See here. How the general taxation system for individual entrepreneurs is applied - read in this article.

Contents of KUDiR

KUDiR reflects information about the individual entrepreneur, the contents of the document, as well as six sections. The type of tables and sections of the book depends on the type of activity of the organization. The document reflects all income and expense procedures. Here are the requirements for the responsible person when maintaining the book:

- checking the receipt of cash and non-cash funds;

- control over payment to the supplier for each type of product sold during the work shift;

- correct write-off of product costs as expenses, which is carried out using the FIFO method or the average unit cost.

Entries in the accounting book are made continuously on the basis of primary documents at the time of the transaction, i.e. on a cash basis. Business transactions are reflected in chronological order in ruble equivalent. For transactions in foreign currency, their value is translated at the rate of the Central Bank of the Russian Federation into rubles on the day of receipt or disposal of funds.

If errors occur in KUDiR OSNO, they are corrected: the incorrect information is carefully crossed out, substantiated by the correct entry, certified with the signature of the individual entrepreneur and the date of the correction is indicated. The tax office may not accept KUDiR when submitting reports due to serious filling errors.

Why the book is not needed by UTII payers

The obligation of businessmen on the simplified tax system and unified agricultural tax to keep a journal is prescribed in tax legislation. The requirement is related to the peculiarities of taxation. Such entrepreneurs calculate payments to the budget based on gross revenue or net profit. Patent holders maintain books of accounts to document their income. The document is necessary to eliminate the risk of losing the right to apply a special regime.

You don't need an individual entrepreneur log on UTII. The tax burden of these merchants does not depend on the actual profitability. They calculate payments to the budget using the approved base, coefficients and information about taxable objects. Payers of UTII keep records of physical indicators (letter of the Ministry of Finance of the Russian Federation No. 07-01-06/55941 dated December 19, 2013).

Procedure for filling out KUDiR IP OSNO

Each section of KUDiR IP OSNO includes many subparagraphs, the completion of which is mandatory.

The title page includes information about the individual entrepreneur: full name, INN, address, information about the tax authority at the place of registration of the individual entrepreneur, data from the registration certificate, bank details, as well as the individual entrepreneur’s signature, date and other data.

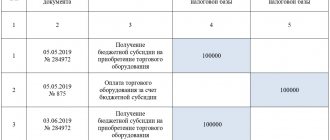

Section 1 displays all income that was actually received in the tax period, including advances, as well as expenses actually incurred in this period. This reflects raw materials, semi-finished products and other inventory items acquired by the individual entrepreneur for subsequent financial gain. Moreover, costs during the manufacture of products are written off as expenses only in relation to the products sold. They can also be written off according to the standards established by the legislation of the Russian Federation.

Sections 2 - 4 include information on depreciation of fixed assets, low-value wear-and-tear items (IBP) and intangible assets. The initial cost of fixed assets and intangible assets is determined based on the cost of acquisition, delivery costs and putting the property into operation. Depreciation is written off as expenses only in the amount accrued for the tax period. Depreciation deductions are made only in relation to the individual entrepreneur’s own property, i.e. which was purchased for a fee. Income from the sale of fixed assets and intangible assets is the difference between the sale price of the property and its residual value.

Section 5 covers payroll and taxes. The table in this section resembles a payroll sheet; it is generated for each month. The table displays the following information:

- the amount of calculated and paid wages;

- incentive and compensation payments;

- the cost of goods that are issued as remuneration in kind;

- payments under copyright and civil law contracts;

- other payments;

- calculated personal income tax;

- other deductions;

- date of payment;

- signature on receipt.

Section 6 calculates the tax base for personal income tax, which is formed based on the results of the calendar year. On its basis, 3-NDFL reporting is completed.

A book of income and expenses for individual entrepreneurs: is it necessary to keep it, regulatory requirements, what is it used for?

The basic regulatory act regulating the tax accounting of individual entrepreneurs registered in the state business register as individual entrepreneurs and applying the main tax regime (OSNO) is the Procedure for accounting for income and expenses of individual entrepreneurs, approved by Order of the Ministry of Finance of the Russian Federation No. 86n dated August 13, 2002 (as amended by June 19, 2017).

The main requirement of the law is here: every businessman registered with the Unified State Register of Individual Entrepreneurs, from the moment he begins his activities, must reflect all business transactions when conducting business in the Book of Accounting for Income and Expenses (KUDiR). The main goal of this action is full control of the taxable base (TB) by the fiscal regulator and, of course, by the entrepreneur himself.

At the same time, 3 main goals are recognized as the purpose of the Accounting Book:

- generalization;

- systematization;

- accumulation of data contained in primary documents accepted for tax accounting.

But these are the key tasks of maintaining KUDiR, which can be applied to any of the modes, but the specific purpose of the Accounting Book for individual entrepreneurs on OSNO is to check the calculations of the tax base of a business for personal income tax.

The final data of individual entrepreneurs on OSNO, entered into KUDiR, are transferred to the tax return for 3_NDFL

I would like to note that, receiving feedback from entrepreneurs in the regions today, only one indisputable and disappointing conclusion can be drawn: from the end of April 2021, total and unprecedented inspections of small businesses began. Desk audits based on the results of 2021 are being carried out with particular zeal. My friend at this moment is giving comments to the inspectors on thirty-eight points that arose during the audit of her tax return. Note: it is simplified with a base of 6%, that is, everything should be quite simple there. Without exaggeration, I will say: every contract, invoice, every fiscal receipt is checked and analyzed by tax authorities. And all individual entrepreneur reporting consultants speak with one voice: the situation with inspections and fiscal control will worsen every year. State controllers need to collect taxes for the budget. By fulfilling their KPIs, tax authorities will increasingly “tighten the screws” when checking reporting, including individual entrepreneurs’ tax accounting books.

Responsibility for violation of the procedure for maintaining KUDIR

Gross violations of the requirements for accounting for income, expenses, as well as the object of taxation are regulated by Article 120 of the Tax Code of the Russian Federation. The following types of fines have been established: 10,000 rubles - a fine for a gross violation committed during one tax period; 30,000 rubles - a fine for the same act committed during more than one tax period; 20% of the amount of unpaid tax, but not less than 40,000 rubles - a fine for a violation that resulted in an underestimation of the tax base.

Author of the article: Ekaterina Moguchaya

Work in the cloud service for small businesses Kontur.Accounting: there is simple accounting, payroll, taxes and reporting via the Internet. Work for free for the first 14 days and learn about all the capabilities of the service.

Briefly about the changes

With the publication of Order No. 227n of the Ministry of Finance of Russia dated December 7, 2016, Russia began to use an updated journal form for the simplified tax system. The document came into force in January 2021. Entrepreneurs and organizations already have experience in filling out the register. Let us recall that the book now contains a section on trade fees paid to the budget. In addition, the department recognized the legality of entrepreneurs’ refusal to use seals.

It was prescribed that only receipts in favor of the businessman himself be included as income. Profits from controlled foreign enterprises do not need to be reflected in the register.

In 2021, businessmen who do not have employees will continue to accept insurance premiums “for themselves” without fear. We are talking about amounts transferred to the Pension Fund additionally (1% of income over 300 thousand rubles). Previously, the ministry refused to reduce the tax on such costs

Accounting

According to the current legislation, individual entrepreneurs have the right not to keep accounting records (clause 1, clause 2, article 6 of the Federal Law of December 6, 2011 N 402-FZ). But if you look at this fact from the other side: the “stick” was removed, but the “carrot” remained.

First of all, accounting for individual entrepreneurs is a means of early warning about the real state of the business and evaluation of its results. A timely analysis of the state of affairs will warn about the irrational use of assets, and will also help prevent bankruptcy.

In properly organized accounting, three main groups are distinguished.

| № | Types of accounting | Problems to be solved |

| 1 | Accounting | Control over material and labor resources Distribution of financial flows Identification of profits (losses) |

| 2 | Managerial | Planning for effective use of funds Profitability assessment |

| 3 | Tax | Preparation of tax reports |

The benefits gained from accounting clearly compensate for the labor costs. The absence of a legal requirement for accounting allows an entrepreneur to focus on management accounting, emphasizing only the positions that interest him: for example, the safety of assets, the efficient use of funds and the distribution of financial flows.

In this article we will not dwell on accounting methods; today there are many publications devoted to this topic.

“Non-entrepreneurial” ways to reduce personal income tax

In addition to the considered professional deduction, which arises for an individual entrepreneur as a result of business activities, an entrepreneur can also reduce his personal income tax through standard, social and property deductions. Their list is given in Art. 218–220 Tax Code of the Russian Federation.

Let's look at the features of using deductions using the example of training expenses.

Thus, the right to receive a deduction for children’s education expenses remains until they reach 24 years of age. When calculating the deduction for children's education, the amount of expenses for each child of 50,000 rubles can be taken into account.

Example

Entrepreneur D.B. Mikhailov has two children.

My son attends the preschool department of school No. 2025 in Moscow. Expenses for the year for his maintenance at school amounted to 30,000 rubles.

He also attends an art school, where annual tuition is 25,000 rubles.

The daughter attends the State Budgetary Educational Institution “Sports School No. 7”, where the cost of classes per year is set at 54,000 rubles.

In connection with the expenses incurred by the individual entrepreneur, D.B. Mikhailov intends to claim a deduction for training expenses in the amount of 100,000 rubles. (50,000 rubles × 2), which will give him the opportunity to reduce the tax paid for the year by 13,000 rubles. (RUB 100,000 × 13%).

The total amount of expenses for which an entrepreneur can be provided with a social deduction, with the exception of expenses incurred for expensive treatment and education of children, cannot exceed 120,000 rubles.

Example

In 2021, individual entrepreneur D.B. Mikhailov paid for his studies under the MBA program in the amount of 60,000 rubles. and an annual service program at a medical clinic in the amount of 80,000 rubles.

The total expenses incurred by IP Mikhailov D.B. for social needs amounted to 60,000 + 80,000 = 140,000 rubles.

However, due to existing restrictions on the amount, only 120,000 rubles can be taken into account as social deductions out of 140,000.

More information about the use of social deductions can be found here.

What expenses reduce personal income tax from the activities of individual entrepreneurs?

According to paragraph 2 of Art.

54 of the Tax Code of the Russian Federation, individual entrepreneurs keep records of expenses in the manner determined by the Ministry of Finance of Russia. The expenses that an individual entrepreneur makes as a result of his business activities are called professional deductions for the purposes of calculating personal income tax (Article 221 of the Tax Code of the Russian Federation).

In accordance with paragraph 1 of Art. 221 of the Tax Code of the Russian Federation, the composition of the expenses of individual entrepreneurs is determined by Ch. 25 of the Tax Code of the Russian Federation, i.e. these include:

- Material costs.

- Labor costs.

- Depreciation.

- Other expenses related to business activities.

- Amounts of insurance contributions for pension and social insurance.

- Amounts of taxes, excluding personal income tax and VAT.

The taxes that are included in the professional deductions of individual entrepreneurs also include fixed contributions for compulsory health insurance and compulsory medical insurance.

Property tax for individuals is included in deductions if the property is used in business activities.

For information on calculating property tax for individuals, read the material “How is the property tax for individuals calculated?”