Contributions for compulsory insurance to state extra-budgetary funds are the second largest financial burden after taxes, which every entrepreneur or organization bears. There are many nuances in the calculation and payment of insurance premiums, and for violations in the order of their calculation you can receive serious fines. What happened to social contributions in 2015 and how they may change in 2021 can be found in this material.

Insurance premium rates for 2015 were approved by Federal Law No. 212-FZ of July 24, 2009 and Federal Law No. 167-FZ of December 15, 2001. These rates will not change in 2021. The size of insurance premiums traditionally depends on the fund into which they are accrued, the size of the wage base that is accrued for each employee of the organization, as well as the category of the employee to whom certain payments were made. In addition, the composition and size of contributions differs for individual entrepreneurs and legal entities using different taxation regimes. Let's try to figure out how insurance premiums should be calculated and paid in 2021.

Insurance premiums in 2021: rates (table)

Fund

| Rates, % | ||||

| basic | for companies using the simplified tax system | for IT companies | ||

| FFOMS | 5,1 | — | 4 | |

| Pension Fund | From payments within 796,000 rubles | 22 | 20 | 8 |

| From payments over 796,000 rubles | 10 | — | — | |

| FSS RF | From payments within 718,000 rubles | 2,9 | — | 2 |

| From payments over 718,000 rubles | — | — | — | |

From April 1, 2021, employers must submit a new SZV-M form to the Pension Fund of the Russian Federation every month. No later than the 10th day of the month.

From July 1, 2021, the minimum wage increased from 6,204 to 7,500 rubles. Therefore, fixed insurance premiums for entrepreneurs have increased in 2021

- In the Pension Fund - 23,400-00 rubles (7500 x 12 x 26%)

- in the Federal Compulsory Medical Insurance Fund - 4,590-00 rubles (7,500 x 12 x 5.1%)

Additionally, the entrepreneur must transfer 1 percent of income to the Pension Fund. exceeding 300,000 rubles. The maximum amount of pension contributions that must be paid for 2021 is 187,200 rubles (7500 x 8 x 26% x 12).

Buh-Ved.RU

Useful articles » Insurance premium rates for 2021,

see rates for 2010, 2011, 2012, 2013, 2014, 2015 2017

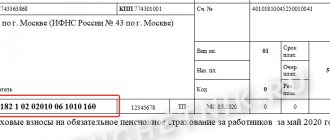

KBK, Deadline for submitting individual information and SZV-M for 2021.

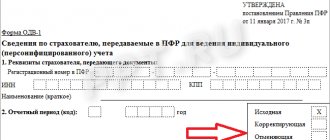

From April 1, 2021 a new reporting form SZV-M is being introduced

Federal Law No. 385-FZ of December 29, 2015 “On the suspension of certain provisions of legislative acts of the Russian Federation, amendments to certain legislative acts of the Russian Federation and the specifics of increasing the insurance pension, fixed payment to the insurance pension and social pensions” from April 1, 2021 In 2009, a new form of reporting to the Pension Fund was introduced for policyholders.

On a monthly basis no later than the 10th day of the month following the reporting period - month, the policyholder provides information about each insured person working for him (including persons who have entered into contracts of a civil law nature, for which compensation in accordance with the legislation of the Russian Federation on insurance premiums insurance premiums are calculated) the following information:

1) Insurance number of an individual personal account;

2) Last name, first name, patronymic;

3) Taxpayer identification number.

Taking into account weekends (holidays), the first reporting must be submitted no later than May 10, 2016.

Please note that for failure by the policyholder to provide within the prescribed period or provision of incomplete and (or) false information, financial sanctions in the amount of 500 rubles are applied to such policyholder in the amount of 500 rubles in relation to each insured person.

The collection of the specified amount is carried out by the bodies of the Pension Fund of the Russian Federation in a manner similar to the procedure established by Articles 19 and 20 of the Federal Law of July 24, 2009. No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

Reporting form approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 N 83p “On approval of the form “Information about insured persons”

The format of data on information about insured persons, approved by Order of the Board of the Pension Fund of the Russian Federation dated 02/25/2016 N 70r “On approval of the format of data on information on insured persons” for submitting reports in electronic form.

The result of receiving reports is a report acceptance protocol generated by the Pension Fund.

Main changes from January 1, 2021:

1. From January 1, 2021, insurance premiums are not charged for amounts of payments and other remuneration in favor of an individual (under employment or civil contracts (contracts, services)) exceeding 796,000 rubles , cumulatively from the beginning of the billing period ( Decree of the Government of the Russian Federation dated November 26, 2014 No. 1265 “On the maximum value of the base for calculating insurance contributions to state extra-budgetary funds from January 1, 2021”).

Note: When calculating insurance premiums at an additional tariff for certain categories of employers who have jobs in hazardous and hazardous industries, the provision for limiting the base for calculating insurance premiums does not apply.

| Contributions | Base size limit |

| Compulsory pension insurance (PFR) | 796 000 |

| Compulsory social insurance (FSS) | 718 000 |

| Compulsory health insurance (FFOMS) | The maximum amount has been abolished, contributions are collected from the entire salary at the rate established for the organization |

2. Since 2015, employers must determine the amount of insurance contributions to be transferred to the relevant state extra-budgetary funds accurately - in rubles and kopecks.

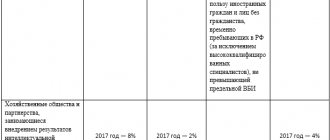

3. Since 2015, pension contributions are accrued from payments to foreign citizens and stateless persons (with the exception of highly qualified specialists) temporarily staying in the Russian Federation, regardless of the validity period of the concluded employment contracts.

4. Since 2013, an additional tariff for insurance contributions to the Pension Fund of the Russian Federation has been introduced for employers who have workplaces with hazardous and hazardous industries. Add. tariffs apply to payments and other remuneration in favor of individuals employed in the types of work specified in paragraphs 1 and 2-18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

In accordance with the law, working conditions are divided into four classes according to the degree of harmfulness and (or) danger (Federal Law dated December 28, 2013 No. 426-FZ):

- optimal (grade 1),

- acceptable (class 2),

- harmful (grade 3)

- dangerous (class 4).

The more dangerous or harmful the working conditions, the higher the additional allowance. the insurance premium rate will need to be paid by the employer to the Russian Pension Fund.

Assessment of working conditions and certification of workplaces is carried out by a commission of representatives of the employer’s organization at least once every 5 years.

The results of certification of workplaces based on working conditions are used when determining the amount of additional tariffs for insurance contributions to the Pension Fund of the Russian Federation until December 31, 2021 inclusive.

When calculating insurance premiums at an additional rate for certain categories of employers who have jobs in hazardous and hazardous industries, the provision for limiting the base for calculating insurance premiums does not apply.

- If a special assessment of working conditions has not been carried out, additional insurance premium rates indicated in Table 1 ;

- If a special assessment of working conditions has been carried out and a class of working conditions has been established, additional insurance premium rates indicated in Table 2 .

Additional rates of insurance premiums if a special assessment of working conditions was not carried out

Table 1

| Year | Additional insurance premium rate for payments and other remuneration in favor of persons indicated | |

| in paragraphs 1 clause 1 art. 27 Federal Law of December 17, 2001 N 173-FZ | in paragraphs 2 - 18 p. 1 tbsp. 27 Federal Law of December 17, 2001 N 173-FZ | |

| 2015 and subsequent years | 9,0% joint part of the insurance premium tariff | 6,0% joint part of the insurance premium tariff |

Additional insurance premium rates if a special assessment of working conditions establishes a class of working conditions

table 2

| Class of working conditions | Subclass working conditions | Additional insurance premium rate |

| Dangerous | 4 | 8,0% joint part of the insurance premium tariff |

| Harmful | 3.4 | 7,0% joint part of the insurance premium tariff |

| 3.3 | 6,0% joint part of the insurance premium tariff | |

| 3.2 | 4,0% joint part of the insurance premium tariff | |

| 3.1 | 2,0% joint part of the insurance premium tariff | |

| Acceptable | 2 | 0,0% joint part of the insurance premium tariff |

| Optimal | 1 | 0,0% joint part of the insurance premium tariff. |

Insurance premium rates in 2021

| Pension Fund of the Russian Federation | Social Insurance Fund of the Russian Federation | Federal Compulsory Medical Insurance Fund | |||||

| Within the established limit of the base for calculating insurance premiums | Over established limit value of the base for calculating insurance premiums | ||||||

| Organizations, individual entrepreneurs, individuals, not individual entrepreneurs under the general taxation regime ( Article 58.2 ) | |||||||

| 22,0 | 10 | 2,9 | 5,1 | ||||

| Part 1 of Article 58.3 Additional tariffs of insurance premiums for payers of insurance premiums specified in paragraph 1 of part 1 of Article 5 of this Federal Law in relation to payments and other remuneration in favor of individuals engaged in the types of work specified in subparagraph 1 of paragraph 1 of Article 27 of the Federal Law of December 17 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, the following additional tariffs for insurance contributions to the Pension Fund of the Russian Federation are applied from January 1, 2013, except for the cases established by part 2.1 of Article 58.3 (Commentary to Article 58.3 in the letter of the Pension Fund of December 30, 2013 No. NP-30-26/20622) | |||||||

| 9,0 | |||||||

| Part 2 of Article 58.3 Additional tariffs of insurance premiums for payers of insurance premiums specified in paragraph 1 of part 1 of article 5 of this Federal Law in relation to payments and other remuneration in favor of individuals engaged in the types of work specified in subparagraphs 2 - 18 of paragraph 1 of article 27 of the Federal Law dated December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, the following additional tariffs for insurance contributions to the Pension Fund of the Russian Federation apply from January 1, 2013, except for the cases established by part 2.1 of Article 58.3 (Commentary to Article 58.3 in the letter of the Pension Fund of December 30, 2013 No. NP-30-26/20622) | |||||||

| 6,0 | |||||||

| Part 2.1 Article 58.3 Instead of the additional tariffs established in parts 1 and 2 of Article 58.3, depending on the of working conditions established based on the results of a special assessment of working conditions , carried out in the manner established by the legislation of the Russian Federation, the following additional tariff is applied (Commentary to Article 58.3 in the letter of the Pension Fund of December 30, 2013 No. NP-30-26/20622) | |||||||

| 8.0% (Score 4) 7.0% (Score 3.4) 6.0% (Score 3.3) 4.0% (Score 3.2) 2.0% (Score 3.1) 0.0% (Score 2) 0, 0% (Rating 1) | |||||||

| Payers applying the simplified tax system and UTII (Organizations, individual entrepreneurs and individuals who are not individual entrepreneurs), with the exception of payers of insurance premiums specified in articles 58 and 58.1 | |||||||

| 22,0 | 10,0 | 2,9 | 5,1 | ||||

| Organizations with resident status of a technology innovation zone (Article 58, Part 1, Section 4-6) | |||||||

| 8,0 | 2,0 | 4,0 | |||||

| Organizations and individual entrepreneurs using the simplified tax system with the main type of activity listed in Article 58, Part 1, Clause 8 | |||||||

| 20,0 | 0,0 | 0,0 | |||||

| Vessel crew (Article 58 Part 1 Clause 9) | |||||||

| 0,0 | 0,0 | 0,0 | |||||

| For pharmacies, non-profit, charitable organizations ( Article 58, Part 1, Section 10-12) | |||||||

| 20,0 | 0,0 | 0,0 | |||||

| Individual entrepreneur on the Patent Taxation System (Article 58, Part 1, Clause 14) | |||||||

| 20,0 | 0,0 | 0,0 | |||||

| Participants of the Skolkovo project (Article 58.1) | |||||||

| 14,0 | 0,0 | 0,0 | |||||

| For insurance premium payers who have received the status of a participant in a free economic zone in accordance with the Federal Law “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol” (Article 58.4) | |||||||

| 6,0 | 1,5 | 0,1 | |||||

| For insurance premium payers who have received the status of resident of the territory of rapid socio-economic development in accordance with the Federal Law “On territories of rapid socio-economic development in the Russian Federation" (Article 58.5) (in the territories of the constituent entities of the Russian Federation that are part of the Far Eastern Federal District and single-industry towns (Federal Law of December 29, 2014 N 473-FZ) | |||||||

| 6,0 | 1,5 | 0,1 | |||||

| For payers of insurance premiums who have received the status of resident of the free port of Vladivostok in accordance with the Federal Law “On the Free Port of Vladivostok” (Article 58.6) | |||||||

| 6,0 | 1,5 | 0,1 | |||||

Calculation example

The salary of the head of the department is 220,000 rubles. Based on the results of his work for 2015, in January he was awarded a bonus in the amount of two salaries. As a result, the department head’s income for January was equal to 660 thousand rubles (220 thousand * 2 + 220 thousand). The accountant calculated the contributions:

- in the Pension Fund of the Russian Federation - 145,200 rubles (660,000 * 22%);

- in the Federal Compulsory Medical Insurance Fund - 33,660 rubles (660,000 * 5.1%);

- in the Social Insurance Fund - 19,140 rubles (660,000 * 2.9%).

The income of the head of the department next month has already reached 880 thousand Russian rubles (660 thousand + 220 thousand). The amount received exceeds the established limits. And as a result, the contributions for February were as follows:

- in the Pension Fund of the Russian Federation - 51,520 rubles (796,000 * 22% + (880,000 - 796,000) * 10% - 132,000);

- in the Federal Compulsory Medical Insurance Fund - 14,280 rubles (880,000 * 5.1% - 30,600);

- in the Social Insurance Fund - 3,422 rubles (718,000 * 2.9% - 17,400).

Please note that if an employee of an enterprise works under a contract, then only contributions to the Pension Fund and the health insurance fund must be paid from his income. If the contract does not include a clause on the withholding of contributions in the event of occupational diseases or accidents at work, then according to the law, contributions will not be withheld.

⭐ How it works

Reduced tariffs will not apply to the entire amount of income transferred to an individual, but only to amounts above the minimum wage. The minimum wage in 2020 is 12,130 rubles. In the regions, increased minimum wage amounts may be established, but they are not included in the calculations.

Salaries below the minimum wage are subject to insurance contributions at rates of 22%, 5.1%, 2.9%. When applying a preferential tax rate:

- Benefits are taken into account for each insured individual.

- The amount of payments is compared with the federal minimum wage on a monthly basis.

Government support for small businesses

Read

What changes await individual entrepreneurs in 2021

More details

Calculation example in 2021

Romashka LLC employs three sales managers with a salary of 30 thousand rubles, as well as a part-time cleaner for 10 thousand rubles. The company is included in the circle of small businesses and is included in the relevant register of the Federal Tax Service. Accordingly, Romashka LLC has the right to apply preferential tariffs.

Sales managers receive a salary of 12,130 rubles. Contributions are calculated at standard rates:

- For pension insurance: 12130 rub. * 22% = 2668.6 rub.

- For health insurance: 12130 * 5.1% = 618.63 rubles.

- For social insurance: 12130 * 2.9% = 351.77 rubles.

The total amount of contributions for one employee within the minimum wage will be 3,639 rubles.

The salary exceeding the minimum wage was (30,000 – 12,130) = 17,870 rubles. Reduced contribution rates will be applied to the specified amount of earnings;

- For pension insurance: 17870 rub. * 10% = 1787 rub.

- For medical: 17870 * 5% = 893.5 rub.

- Social security contributions are zeroed out.

The total amount of insurance premiums for 1 employee was (2680.5 + 3639) = 6319.5 rubles.

If the company calculated contributions without taking into account benefits, then for each employee they would have to pay 9,000 rubles. (30000 * 30%).

The amount of savings from the tax benefit will be 2680.5 rubles. monthly.

As for the cleaner's salary, it does not exceed the minimum wage. For this reason, preferential rates do not apply to it. Contributions to the funds will be calculated at the standard rate:

- In the Pension Fund: 10,000 * 22% = 2,200 rubles.

- In the Federal Compulsory Medical Insurance Fund: 10,000 * 5.1% = 510 rubles.

- In the Social Insurance Fund: 10,000 * 2.9% = 290 rubles.

The total amount of fees for the cleaning lady will be 3,000 rubles.

It turns out that Romashka LLC will pay insurance premiums for all employees for the month in the amount of 21,958.5 rubles.

Thus, the reduction in insurance premiums for employees from 30 to 15% will apply to representatives of small and medium-sized businesses. Preferential rates apply to wages exceeding the minimum wage. Ten percent will go to employee pension insurance and 5% to medical insurance. Reduced tariffs began to apply in April 2021 and were introduced for an indefinite period.

What 4 tax benefits can you get from the state?

Read

What income of individuals is taken into account by the tax authorities?

Look

Benefits when paying insurance premiums

The Government of the Russian Federation has identified certain categories of payers who have benefits when calculating and paying insurance contributions to the Pension Fund. These categories include:

Having a problem? Call a lawyer: +7

— Moscow, Moscow region

+7

— St. Petersburg, Leningrad region

The call is free!

The contribution rate to the Pension Fund is 20%:

- pharmacies (organizations and entrepreneurs with the appropriate license);

- legal entities, funds and individual entrepreneurs providing social services and healthcare;

- organizations working in the field of art and culture.

Contribution rate - 14%:

- participants of the Skolkovo state project.

Contribution rate - 8%:

- legal entities and individual entrepreneurs operating in special economic zones;

- enterprises working in the IT field, if the number of employees is more than 7 people.

If the annual income of the insured person who is a beneficiary is 711 thousand rubles or more, then insurance premiums are not required to be paid.

In 2014, benefits were also established regarding the calculation and payment of contributions to the Pension Fund for residents of Crimea and Sevastopol. For them the rate is 6%.