Employer reporting Denis Pokshan Expert in taxes, accounting and personnel records Current on 28

Transport tax for 2014 From this year, changes in legislation come into force,

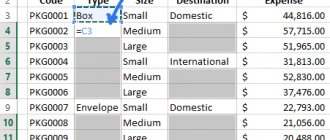

All organizations that pay income tax submit a profit declaration. In this declaration

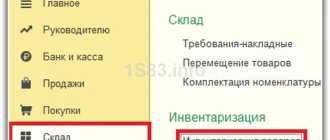

Organizations periodically conduct inventories. They are needed in order to obtain current balances of

Regulatory framework Federal Law No. 27-FZ of April 1, 1996 “On individual (personalized) accounting in the mandatory system

Tax amnesty for individuals transport tax Amnesty of transport tax in the broad sense of the word

From June 1, 2021, when paying wages and other payments to an employee, employers must

Free receipt of OS in 1C: Accounting department of a state institution 8th edition 2.0 Published 06/24/2017 00:08

You need to report on insurance premiums in 2021 to the Federal Tax Service, and not to off-budget agencies.

In what form should I submit my VAT return for the fourth quarter of 2021? What are the deadlines?