Who borrows money and why? If there are not enough personal funds to open or

Order of the Federal Tax Service of Russia dated July 16, 2020 No. ED-7-2/448, effective August 30, 2021, approved a new

What and how to reflect in the calculation A tax deduction is an amount that reduces the tax base

What is the 6-NDFL declaration and what is Form 6-NDFL used for - this is a type of reporting,

In the case when an organization uses the services of installing any devices, an equipment installation certificate comes in handy.

Invoice, invoice and certificate of completion of work The legislation does not contain a requirement that dates

Accrual When issuing a loan, the lender prescribes in the agreement the procedure and terms for paying interest. Depending

Calculation of insurance premiums must be submitted to the Federal Tax Service to all policyholders making payments and other

Basics of payment Objects covered: Residential buildings, apartments, shares in an apartment. Land,

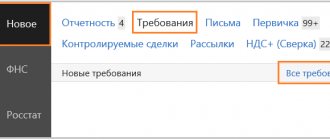

Astral November 22, 2021 10541 Taxes The company may disclose information that is protected under the