A cash book is a special internal journal of enterprises and organizations, which records all transactions carried out using cash. That is, all legal entities and individual entrepreneurs using cash payments are required to use a cash book in their activities. At the same time, the volume of cash turnover does not matter; if at least one or two such transactions occur during the reporting period, this document must still be filled out. What form of taxation is used also does not matter.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What documents are needed for online checkout?

According to the Directives of the Bank of Russia dated March 11, 2014 No. 3210-U, all cash transactions are documented in the following documents:

- cash book;

- PKO - cash receipt order;

- RKO - expense cash order.

- Setting up an online cash register

2 reviews

1 000 ₽

1000

https://online-kassa.ru/kupit/nastrojka-onlajn-kassy/

OrderMore detailsIn stock

- Training to work on CCP

1 review

2 000 ₽

2000

https://online-kassa.ru/kupit/obuchenie-rabote-na-kkt/

OrderMore detailsIn stock

- Technical support for 3 months.

3 600 ₽

3600

https://online-kassa.ru/kupit/tehnicheskoe-soprovozhdenie-na-3-mes/

OrderMore detailsOut of stock

Results

There are two possible ways to maintain a cash book on a PC: with printing, subsequent stapling and storage on paper, or completely electronically using certain mechanisms against unauthorized access and electronic signatures.

Which one to choose depends on your technical capabilities and willingness to use new technologies in your work. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Cash book for online cash register

The cash book keeps records of all amounts received and spent: revenue, cash issued, cash deposited at the bank.

Individual entrepreneurs maintain a cash book at will and can refuse it. But for companies, a cash book is required, even if there is an online cash register.

How to keep a cash book for online cash registers

According to the Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88, the cash book is kept in the KO-4 form. But the company can approve its form according to its accounting policies.

What does a cash book look like?

The cash book can be in 3 formats:

- paper;

- electronic with file printout;

- only electronic on PC.

The cash book on paper forms must be stitched and numbered. It is operated by a cashier throughout the working day. He fills it out, having received receipt and expenditure orders from the accounting department. They allow the cashier to receive and issue funds.

How to flash a cash book and its sample

In the electronic version, the cash book is also filled out by the cashier or a responsible person appointed by management. An electronic signature issued to an official in accordance with the law dated 04/06/11 No. 63-FZ is used for it.

The cash book is filled out only once a day when funds are posted to the company. For example, if salaries were issued through the cash register on May 1 and May 15, then the corresponding dates will be recorded in the book.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

If you don't keep records, the tax office may fine you. According to paragraph 1 of Art. 15.1 Code of Administrative Offenses of the Russian Federation:

- for organizations - a fine of 40–50 thousand rubles;

- for individual entrepreneurs and heads of companies - 4–5 thousand rubles.

Step-by-step cash book maintenance

Is it possible to make corrections to the cash book?

Yes, but only on paper forms. To make corrections, cross out the incorrect entry and enter the correct value. You cannot erase entries in the book. According to Instructions No. 3210-U, all corrections are certified by the cashier or chief accountant.

Corrections cannot be made to a book formatted and signed in electronic format.

How to correct an error in the cash book

How many cash books should be kept?

If you are an individual entrepreneur and optionally keep a cash book, then one is enough for you.

For organizations, the number of cash books depends on the number of branches, according to Directive No. 3210-U. If they are not there, then keep 1 book, even when combining tax regimes.

Who should lead it?

A cashier at an enterprise is a financially responsible specialist in the financial sector who manages the cash register, issues and receives material assets and securities. The cashier accepts and issues accountable money, in the case of receiving cash - salaries, financial assistance, bonuses, etc., fills out income and expense papers.

The chief accountant monitors the implementation of cash transactions and the work of the cashier. There are cases where there is no position of chief accountant in an organization, then financial control is carried out by the director (general director), the head of the enterprise.

Documents KM-1—KM-9 are no longer needed

Before the mandatory introduction of online cash register systems in July 2021, trading enterprises used unified document forms. But maintaining an online cash register allows you to send fiscal documents to the tax office automatically - via the Internet.

- Connection to OFD

1 review

1 800 ₽

1800

https://online-kassa.ru/kupit/podklyuchenie-k-ofd/

OrderMore detailsIn stock

- Registering a cash register with the Federal Tax Service

1 review

1 500 ₽

1500

https://online-kassa.ru/kupit/registratsiya-kassy-v-fns/

OrderMore detailsIn stock

What documents are not needed at online checkout?

According to the letter of the Federal Tax Service of Russia dated September 26, 2016 No. ED-4-20 / [email protected] , 9 unified documents are optional for registration:

- Form No. KM-1 - act on the translation of cash register meter readings.

- Form No. KM-2 - an act on taking readings from KKM control meters when handing over the cash register for repairs and when returning it to the company.

- Form No. KM-3 - act of returning money to the client.

- Form No. KM-4 - journal of the cashier-operator.

- Form No. KM-5 - register of cash registers operating without a cashier-operator.

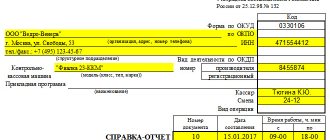

- Form No. KM-6 - certificate-report.

- Form No. KM-7 - information about cash register meters and the company’s revenue volume.

- Form No. KM-8 - call log for technical specialists.

- Form No. KM-9 - act on checking cash at the cash register.

The following documents are required for online checkout:

- cash book (individual entrepreneurs are kept at will);

- PKO and RKO.

The cash book reflects data on cash inflows and outflows. It records the details of the PKO and RKO, the recipient, and the one who deposits the funds.

Stitching rules

The cashier appointed as the person responsible for maintaining documentation must understand not only the rules for filling out the cash book, but also the specifics of stitching it together. All sheets must be numbered and stitched. For this, high-quality special threads are used. After tying them, they should be on the back of the document.

A small piece of paper containing information about the number of sheets is glued to the unit. The information is certified by the company seal, after which the sheet is signed by the director.

Cashier-operator journal for online cash register

The cashier-operator's journal is an optional form of filling out according to the letter of the Federal Tax Service of Russia dated September 26, 2016 No. ED-4-20 / [email protected] Because the data that was previously recorded in the journal is now sent to the Federal Tax Service online.

Why do you need a cashier-operator’s journal and who should have it?

The cashier-operator's journal is needed for the online cash register to take into account the receipt and expenditure of cash. Despite the fact that since July 2017 it is optional, it will be useful for internal accounting.

The log is kept by an employee who serves customers using cash registers. The document is kept by the manager or chief accountant.

If you still decide to conduct it, then read the instructions below.

Filling out the book

There are some features of filling out KO-4 forms. So, on the title page, details regarding the enterprise are entered, including the company name, OKPO code, and structural unit, if any. After this, the period for maintaining the book is recorded - this can be a month or a year.

Information that needs to be entered on sheets inside the book:

- Date the page was completed.

- In the “balance” line, write down the amount of funds that are in the cash register at the beginning of the day. In this case, you need to take the “remaining” record from the previous day.

- Next, enter data on issued orders.

- In the “transfer” line, enter the data on the income and expense amounts from the previous lines.

- Next is the total amount for orders and the balance in the cash register.

- At the very end of the completed sheet, data is entered in words regarding the number of orders issued on the current day.

If any lines are left blank, they are crossed out. When entering data, corrections are prohibited, as this may indicate fraud. When an error is made, you should obtain a confirmation signature from the cashier who fills out the book.

Below you can download a sample of entering data into the KO-4 forms.

When an incoming and outgoing cash order is issued

Receipt cash order (PKO)

According to the resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88, a cash receipt order is issued when the company receives cash. The PKO consists of two parts:

- the order itself;

- tear-off receipt.

Cash receipt order form

The cashier enters the information and signs both parts of the document. You cannot correct a completed form.

Step-by-step algorithm for filling the PKO

Account cash warrant

According to Directive No. 3210-U, an expense cash order is issued when cash is issued from the cash register. You cannot make corrections to a completed form.

Account cash warrant

Step-by-step algorithm for filling out RKO

What is it for - purpose

The main purpose of maintaining a cash book is to record the realized cash flows of the enterprise (receipt, expense).

That is, this form serves, first of all, to record cash transactions of the enterprise.

These records help track the movement of cash within an organization.

Any ambiguities that arise during the inspection by regulatory authorities, with the help of a cash book presentation, will be able to clarify the situation and see the true picture of the operational accounting of cash.

In addition, on the eve of drawing up annual reporting, it is necessary to carry out an inventory of funds, documents, and strict reporting forms.

The inventory is also aimed at checking the completeness, correctness and accuracy of the display in cash accounting of transactions for the period under review and compliance with the norms of current legislation aimed at regulating cash discipline.

Management accounting of an enterprise cannot do without a cash book; here the company’s income and expenses are displayed in as much detail as possible, which can influence the decision-making regarding the use of the company’s profits.

Let's summarize

- Until July 1, 2021, when working with cash registers, 9 unified documents were mandatory: KM-1 - KM-9. After the introduction of online cash registers, they are no longer needed, because the cash register system sends this data to the Federal Tax Service automatically via the Internet.

- The following are required for registration: cash book, incoming and outgoing cash order.

- Individual entrepreneurs keep a cash book at will, as well as a journal for the cashier-operator. These documents are useful for internal accounting.

- For companies, maintaining a cash book is mandatory, but the cashier-operator's journal is optional.

- Registration of cash receipts or expenditures without orders is prohibited.

Technical support of equipment. We will solve any problems!

Leave a request and receive a consultation within 5 minutes.

Corrections

Typos, typos, corrections, cross-outs and other errors are never welcome. But we are all human and sometimes we make our mistakes. Of course, this is not critical, but it is better to pay close attention to filling out the cash book. Any corrections are considered a violation, in connection with which you can receive a reprimand or incur some kind of punishment.

There are two types of mistakes that can be made:

- Not related to the amount reflected in the document and not affecting the outcome. This problem is solved by crossing out the incorrectly specified element and writing the correct option above it. The specified error is certified by the signature of the cashier preparing the report, as well as the checking accountant.

- Related to incorrect indication of the balance amount. This option is more global in nature. In case of such errors, the sheet completely filled out by the cashier is crossed out, the mark “canceled” is indicated, and a new sheet is filled out. Since the cashier is responsible for incorrectly indicating this data, he draws up a memo (report) addressed to the accountant stating that he discovered an error of this nature. This report is reviewed by the established commission, which is responsible for making any corrections or adjustments. After this, the cashier makes the above corrections and, as a result, draws up a certificate of the changes made.

conclusions

Despite the existence and rapid increase in the flow of non-cash payments between enterprises and individuals, many businessmen still do not deny the use of transactions with financial assets in cash.

The cash book is always subject to detailed inspection by all kinds of regulatory authorities; its correct completion must be controlled by the chief accountant or director of the enterprise with the utmost attention.

This obligation must be reflected in the company's accounting policies.