Documentation

Any company, in accordance with current legislation, must submit an accounting report after a certain period of time.

Which section of the declaration includes line 170 and what is its interpretation Line 170 in

Rules for filling out the form Samples of filling out the application are available on inspection websites and at stands in the department.

A balance sheet is one of the most important and necessary forms of a financial report (it also includes

Income proof is required in many different cases. It is used for obtaining mortgages, tax

Business lawyer > Accounting > Taxes > How to round personal income tax when preparing returns

The purpose of today’s publication is to provide a detailed presentation of the practical aspects of creating and using business cards,

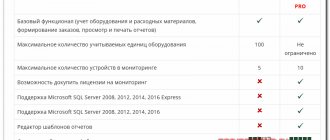

Laptops and PCs have long been part of our lives. However, issues related to computer accounting

Technological progress is modernizing the office management system, but in government agencies the “paper code” still has a significant

Accounting for VAT on payment and shipment in 2021 has not changed. In letter no.