It often happens that a company makes several dozen transactions in one day. And payment for goods does not always occur simultaneously with the transfer of goods. This option is possible when the goods have already been transferred, and the money for it will arrive only after a certain period of time.

To do this, accountants use a special way of accounting for such income and expenses: the principle of double entry. Every transaction with cash and goods has two sides: incoming and outgoing, which accountants call debit and credit, respectively. Posting is the process of carrying out an operation first on a credit account and then on a debit account.

How is financial assistance calculated?

Financial assistance is paid from the enterprise’s own funds, i.e. does not apply to the cost of products, works, services.

To summarize information about all types of settlements with employees of an organization, except for settlements for wages and settlements with accountable persons, the Instructions for the use of the Chart of Accounts for accounting financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) prescribes the use of an account 73 “Settlements with personnel for other operations.”

Financiers have repeatedly explained that the organization’s expenses for cultural and educational events, recreation, entertainment and other similar expenses, which include the payment of financial assistance, in accordance with the mentioned paragraph 11 of PBU 10/99, are other expenses (letters from the Ministry of Finance of Russia dated 10/20/2011 N 07-02-06/204, dated 06/19/2008 N 07-05-06/138, dated 12/19/2008 N 07-05-06/260). In this connection, such expenses should be taken into account in correspondence with account 91 “Other income and expenses”, subaccount 2 “Other expenses”:

Debit 91-2 Credit 73 - financial assistance accrued.

Many employers pay financial assistance to their former employees who have worked for a long time and retired. Settlements with them are reflected in account 76 “Settlements with various debtors and creditors”:

Debit 91-2 Credit 76 - financial assistance was accrued to a former employee.

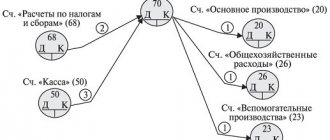

In the case where the payment of financial assistance is provided for by the regulations on wages (for example, the payment of financial assistance for vacation for all employees), its accrual is reflected in the credit of account 70 “Settlements with personnel for wages” in correspondence with the cost accounts: 20 “ Main production", 26 "General business expenses", 44 "Sales expenses", etc.:

Debit 20 (26, 44) Credit 70 - financial assistance for vacation has been accrued.

The accrual of financial assistance to employees of the enterprise is carried out in accounting using the following entries:

Debit 91 “Other income and expenses” Credit 70 “Settlements with personnel for wages” - financial assistance has been accrued.

If the shareholders or members of the company made a decision to spend the profit (in fact, a distribution of profit was made), then the accrual of financial assistance is Debit 84 “Enterprise profit” Credit 70 “Settlements with personnel for wages”.

Accrued financial assistance can be paid either together with wages on a single payroll, or separately.

If financial assistance is paid along with wages, there is no need to prepare a separate statement for its payment. If financial assistance is not paid on time for payment of wages and three or more people receive it at the same time, then it is necessary to draw up a payslip. In other cases, financial assistance is paid according to an expenditure cash order.

The payment of financial assistance to an employee through the company's cash desk is reflected in the accounting records as follows:

Debit 70 “Settlements with personnel for wages” Credit 50 “Cash” - financial assistance was paid to the employees of the enterprise from the enterprise’s cash desk.

If the shareholders or participants of the company decided to distribute part of the profit for the payment of material assistance, then the accrual of financial assistance to former employees of the enterprise, as well as other individuals who are not in an employment relationship with the enterprise:

Debit 84 “Profit of the enterprise” Credit 76 “Settlements with various debtors and creditors” - financial assistance was accrued to former employees of the enterprise.

Payment of financial assistance to non-employees of the enterprise can also be made according to a statement or an expense cash order.

Payment of financial assistance through the enterprise's cash desk is reflected in the accounting records as follows:

Debit 76 “Settlements with various debtors and creditors” Credit 50 “Cash” - financial assistance was paid to persons who are not employees of the enterprise.

Payment can be made not only through the company's cash desk, but also by transferring money from a current account to a personal bank account.

Posting in accounting:

Debit 76 “Settlements with various debtors and creditors” Credit 51 “Current account” - material assistance was transferred from the company’s current account to persons who are not employees of the enterprise.

If the accrued financial assistance is subject to personal income tax, then the taxable part of the financial assistance is added to the basic salary paid to this employee in this organization and is taxed in the generally established manner at a rate of 13%. In accounting, income tax accrual is reflected in the following entries:

Debit 70, 76 Credit 68, subaccount “NDFL” - personal income tax is withheld from financial assistance.

Postings for payment of wages

Labor legislation in our country provides for the right of citizens to receive wages at least twice a month. The first payment in the current month is considered an advance, and it must be at least 40% of the amount of income that employees are entitled to.

Payment can be made in several ways:

- Cash from the company's cash desk.

- Transfer of funds to the debit account of employees in the bank serving the organization.

- In kind.

The rest of the salary can be issued to the employee only after this salary has been credited to account No. 70 of the Loan, and all taxes have been withheld from debit account No. 70.

Salaries are paid either through the cash desk of the enterprise, or through the servicing bank by transferring money to a debit account in the employee’s bank.

Thus, the posting will take the form: D70 K50 (for the cash register) or 51 (for current accounts).

But this posting is only suitable for paying wages in cash.

The posting for wages in kind looks like this:

D 70 K 43 where account No. 43 is called “Finished products”.

It should be noted that wages in products or goods can be issued only if this is provided for in the labor or collective agreement. Such payment is made upon application from the employee. By law, it should not exceed 20% of the amount of earnings due to the employee.

Awards

Bonuses are incentive payments that are paid to employees for conscientious performance of job duties or achievement of certain performance indicators. Bonuses are paid within the time limits established by the collective agreement or local regulations of your organization (Articles 129, 191 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor dated 02/14/2017 N 14-1/OOG-1293, Information from Rostrud).

In accordance with Art. 144 of the Labor Code of the Russian Federation - bonuses may be provided for by the remuneration system. The remuneration system adopted by the enterprise may provide for the payment of bonuses to a certain circle of people based on established specific indicators and bonus conditions. It is these bonuses that are included when calculating average earnings. When paying one-time bonuses, the circle of bonuses is not defined in the remuneration system. These bonuses are not included when determining average earnings. Bonuses are awarded on the basis of the bonus order.

Bonuses provided for by the remuneration system must be approved in a local regulatory document, that is, in the regulations on bonuses adopted by the organization. This provision must contain: bonus indicators; bonus conditions; size and scale of bonuses; circle of employees receiving bonuses; source of bonuses. In accordance with the bonus regulations, the amount of the bonus is determined by the employee’s specific performance results.

One-time incentive bonuses are awarded by decision of the enterprise administration. To accrue them, a provision on bonuses is not required; their accrual is also formalized by order.

Depending on the source of financing, premiums can be paid out of profits, and can also be included in the costs of the enterprise.

Debit 84 Credit 70 - the shareholders or members of the company made a decision on the distribution of profits, in particular the payment of a bonus at the expense of the profits generated at the time of distribution.

In other cases, it is calculated from the same account as the employee’s salary directly:

Debit 20 Credit 70 - bonus payment to workers of main production.

Debit 23 Credit 70 - the accrual of bonuses to workers in auxiliary production will be reflected in the posting.

Debit 25 Credit 70 - bonus payment to employees servicing the main production.

Debit 26 Credit 70 - accrual of bonuses to management employees.

Debit 91 Credit 70 - accrual of bonuses for work, the costs of which are not taken into account as expenses.

Debit 08 Credit 70 - accrual of bonuses to workers for capital costs.

Accrued bonuses are taken into account in the employee’s total income when determining the tax base for personal income tax and are taxed in the generally established manner at a rate of 13%. In accounting, the accrual of income tax is reflected in the following entry:

Debit 70 Credit 68, subaccount “NDFL” - personal income tax is withheld from the premium.

Responsibility for violation of advance payment

As mentioned earlier, the employer is responsible for paying wages at least twice a month (he can pay five or six times a month, even every day). If an organization makes a payment contrary to the law only once, then its actions constitute a legal violation and the managers of this company can be held accountable.

Any employee of the company has every reason to contact the labor inspectorate regarding violation of his rights.

In accordance with the Code of Administrative Offenses (Article 5), the following penalties are provided in the form of a fine:

| Subjects of the offense | Amount of fine for the first violation, rubles | Amount of fine for repeated violation, rubles |

| Officials | 1 000,00 – 5 000,00 | 10 000,00 – 20 000,00 |

| Individual entrepreneurs | 1 000,00 – 5 000,00 | 10 000,00 – 20 000,00 |

| Legal entities | 30 000,00 – 50 000,00 | 50 000,00 – 70 000,00 |

Accounting for accruals for weekends and holidays in accounting

Additional payments for work on weekends, as well as holidays, are reflected in accounting in the same accounts as the calculation of the basic salary.

Debit 20 Credit 70 - accrual of additional payment for work on weekends (holidays) for workers of the main production is reflected by posting -.

Debit 23 Credit 70 - accrual of additional payment for work on weekends (holidays) for workers in auxiliary production.

Debit 25 Credit 70 - accrual of additional payment for work on weekends (holidays) to employees servicing the main production.

Debit 26 Credit 70 - accrual of additional payments for work on weekends (holidays) for management employees.

Debit 08 Credit 70 - accrual of additional payment for work on weekends (holidays) for capital costs, etc.

Amounts of additional payments for work on weekends and holidays are subject to personal income tax and are also subject to inclusion in the base for calculating insurance premiums.

Is it necessary to charge tax on bonuses from a public organization?

A bonus paid by a public organization for any achievements can be intended for both a legal entity and an individual. The tax on the bonus in both cases must be withheld by the organization that paid the bonus, taking into account that an individual will have a non-taxable amount not exceeding 4,000 rubles.

The income received by an individual in such a situation will not be reflected in any way by his employer. But if a legal entity received the bonus, then it will take it into account in its accounting system as other income:

Dt 76 Kt 91.

If, when paying bonuses, income tax is withheld by the organization that paid the bonus, then the recipient of the bonus will not take this income into account for tax purposes. But if there was no tax withholding, then you will have to calculate it yourself.

Calculation of temporary disability benefits

In accordance with Art. 183 of the Labor Code of the Russian Federation, in case of temporary disability, the employer pays the employee temporary disability benefits in accordance with federal laws. Thus, Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ) regulates the procedure for assigning and paying benefits for temporary disability.

According to paragraphs. 1 clause 1 art. 2 of Law N 255-FZ - the right to receive benefits for temporary disability are employees who are subject to compulsory social insurance in case of temporary disability and in connection with maternity:

1) persons working under employment contracts, including heads of organizations who are the only participants (founders), members of organizations, owners of their property;

2) state civil servants, municipal employees;

3) persons holding government positions in the Russian Federation, government positions in a constituent entity of the Russian Federation, as well as municipal positions filled on a permanent basis;

4) members of a production cooperative who take personal labor participation in its activities;

5) clergy;

6) persons sentenced to imprisonment and involved in paid work.

Temporary disability benefits are paid:

1) to insured persons for the first 3 days of temporary disability at the expense of the policyholder (employer), and for the remaining period, starting from the 4th day of temporary disability - at the expense of the budget of the Social Insurance Fund of the Russian Federation;

2) insured persons who voluntarily entered into legal relations under compulsory social insurance in case of temporary disability and in connection with maternity in accordance with Article 4.5 of Law N 255-FZ, at the expense of the budget of the Social Insurance Fund of the Russian Federation from the 1st day of temporary disability.

Temporary disability benefits relate to expenses for ordinary activities on the basis of paragraphs 5 and 8 of the Accounting Regulations “Expenses of the Organization” (PBU 10/99), approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n.

The accrual of temporary disability benefits is reflected in the following accounting entries:

Debit 20, 25, 26, 44, etc. Credit 70 - in part of the benefit paid by the company for the first three calendar days of temporary disability;

Debit 69, subaccount “Settlements with personnel for wages”, Credit 70 - in terms of benefits paid from the funds of the Federal Social Insurance Fund of Russia.

Displaying accrued wages in transactions

It is worth considering the main transactions that are used to display accrued wages (the indicated transaction amounts are taken arbitrarily).

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 (23, 25, 26, 29) | 70 | The amount of wages accrued to employees of the main production (auxiliary and maintenance, as well as management and maintenance employees of the enterprise and workshops) | 200,000 rubles | Help-calculation |

| 44 | 70 | The amount of wages accrued to employees in the trade sector | 85,000 rubles | Help-calculation |

| 69 | 70 | Accrual of benefits to employees from extra-budgetary funds (for example, due to illness, due to a work injury or maternity) | 17,000 rubles | Help-calculation |

| 91 | 70 | Wages are accrued to employees who work in an area of activity unusual for the enterprise (for example, they are engaged in servicing leased facilities) | 34,000 rubles | Help, calculation, lease agreement |

| 96 | 70 | Payments to employees are accrued from the reserve of funds for upcoming payments and expenses (this includes vacation pay, awards for long service, etc.) | 48,000 rubles | Help-calculation |

| 97 | 70 | Wages are accrued to employees who are engaged in work with expenses charged to future periods (most often these are various types of development and testing of new products, as well as scientific research) | 29,000 rubles | Certificate of calculation, certificate of work performed |

| 99 | 70 | Accrued wages for employees who are involved in eliminating the consequences of emergencies (accidents, natural disasters, catastrophes) | 19000 | Certificate of calculation, certificate of work performed |

Obviously, in this case, all transactions are displayed on the credit of account 70 and on the debit of the accounts corresponding to the situation.

How to get a sick leave certificate at a clinic - complete instructions. If you want to find out how long you will be paid maternity benefits, then our information will be useful to you.

What is a state pension and how to apply for it for disabled people, read here.

Accounting for vacation pay accruals

Accounting for vacation pay accruals in accounting is carried out on the same accounts where the employee’s wages are accrued. The exception is cases when vacation is accrued “in advance”, that is, for example, vacation pay is accrued in June, and the vacation period also includes the days of July. In such cases, the amount of accruals is calculated for each period separately and accrued in two transactions:

Debit 20 Credit 70 - accrued vacation pay for March;

Debit 97 Credit 70 - accrued amount of vacation pay for April.

In the future, at the end of April, deferred expenses will be classified as current expenses. This will be reflected in the accounting by the following entry:

Debit 20 Credit 97 - the amount of vacation pay for April is taken into account in the current expenses of the enterprise.

Types of bonuses that affect how they are reflected in accounting

The concept of “bonus” implies a fairly wide range of applications of this definition, despite the fact that in each specific case it will correspond in meaning to the same meaning: remuneration.

Remuneration, called a bonus, can be awarded as:

- monetary or other material rewards for any achievements received by specific people or organizations;

- difference in price set for the same product;

- the amount paid by the buyer to the seller for the right, during a specified period of time, to buy from him a specific asset (securities) at an agreed price;

- funds paid by the policyholder to the insurer upon concluding an insurance contract.

Each of these groups has its own characteristics of reflection in accounting (BU) and tax (TA) accounting.

ConsultantPlus experts explained in detail how to prepare documents for a bonus for an employee. To do everything correctly, get trial access to the system and go to the Ready solution.

Compensation for training costs at the expense of the employer upon dismissal of an employee

The employee is obliged to reimburse the costs of your organization for his training in the event of dismissal without good reason before the expiration of the period established by the student or employment contract. Calculate the amount of compensation by the employee for training costs in proportion to the time actually not worked after completion of training, unless otherwise provided by the employment contract or training agreement, and reflect the employee’s debt in accounting as of the date of dismissal.

Include the amount reimbursed by the employee as part of other income (clause 7 of PBU 9/99 “Income of the organization”). Such income must be reflected in accounting in the reporting period, obtaining the employee’s written consent for partial reimbursement of training costs (clause 10.2, 16 PBU 9/99).

To account for settlements with employees for transactions not related to wages, including reimbursement of training costs upon dismissal, account 73 “Settlements with personnel for other transactions” is intended.

An employee can repay the debt by depositing cash into the cash register or transferring it to the organization’s current account.

He can also submit an application to the accounting department with a request to withhold the existing debt to the employer or part of it from wages. Such an operation will not constitute forced retention within the meaning of Art. 137 Labor Code of the Russian Federation. Therefore, the norms provided for by the provisions of Art. Art. 137, 138 of the Labor Code of the Russian Federation, on limiting the types and amount of deductions from wages. A similar point of view regarding the possibility of repaying the amount of the loan provided at the expense of wages at the request of an employee is expressed in the Letter of Rostrud dated September 26, 2012 N PG/7156-6-1.

The entries for recording employee compensation for training expenses are as follows:

Debit 73 Credit 91-1 - Reflects the debt recognized by the employee for partial reimbursement of expenses for his training;

Debit 70 Credit 73 - The amount of partial reimbursement of training expenses was withheld from wages;

Debit 50 (51) Credit 73 - The employee’s debt was repaid by depositing cash into the organization’s cash desk (by transferring money to the current account).

If you receive compensation for training costs after the dismissal of an employee, then settlements with him should be carried out on account 76 “Settlements with various debtors and creditors”. In this case, on the date of dismissal of the employee, transfer the amount of debt from account 73 to the debit of account 76.

Typical mistakes made by employers

Mistake #1. Non-payment of compensation for delayed wages

Even if the employer is not guilty of delaying wages, he will still have to pay compensation in the amount of no less than one three hundredth of the current refinancing rate. Payment must be made from the next day after the salary payment is due until the debt to the staff is repaid. At the same time, if the period of delay in wages is exceeded, the staff has the right to suspend the performance of their official duties.

Mistake #2. Neglecting payslips

Each organization must have an officially approved pay slip form.

Calculations for deductions and deductions from wages

Home Favorites Random article Educational New additions Feedback FAQ⇐ PreviousPage 3 of 9Next ⇒

1. The main objectives of labor accounting and payment are:

— accurate accounting of the personnel of employees, the time they worked and the volume of work performed;

— correct calculation of wages and deductions from it;

— accounting for settlements with employees, the budget, social insurance authorities, compulsory health insurance funds, and the pension fund;

— control over the rational use of labor resources and wages;

— correct distribution of labor costs among costing objects;

— compiling labor reports and submitting them to the relevant authorities, etc.

Each substation must develop and adopt its own Regulations on remuneration in accordance with the collective agreement concluded between

administration and representatives of the workforce. It provides for forms of remuneration for all categories of workers, rates and prices, as well as a system of rewarding each category of workers for the results of their work. The Regulations should be based on principles under which every employee, without coercion, becomes interested in constantly increasing labor productivity.

— Salary should become the main motive for active work;

- The salary must be no less than a certain amount established by law - the minimum wage;

— The salary should stimulate the employee’s work activity;

— A worker’s income should provide him with a decent life—the principle of social security.

2. All financial and economic operations of the organization, including the calculation of wages, must be documented and justified. The primary accounting of the number of personnel of the organization is carried out on the basis of the following documents:

— Order (instructions) on hiring (form No. T-1

), which is the basis for hiring. The person responsible for accounting for the personnel of the organization’s employees, in accordance with the hiring order, fills out a personal card for each new arrival (form number T-2), makes an entry in the work book, and opens a personal account in the accounting department;

— Personal card (form number T-2),

it contains general information about the employee, full name, date and place of birth, education; information about military registration, appointment and transfer, advanced training, retraining, leave and other additional information;

— Order (instruction) on transfer to another job (form No. T-5)

used when registering the transfer of an employee from one structural unit to another;

— Order (instruction) on granting leave (form No. T-6)

used for registration of annual and other types of leave provided to employees in accordance with the Labor Code of the Russian Federation, legislative acts and regulations, collective agreement and vacation schedule;

— Order (instruction) on termination of an employment agreement (contract) (form No. T-8)

issued when dismissing employees;

— Sheet for recording the use of working time and calculation of wages (form No. T-12), sheet for recording the use of working time (form No. T-13)

record the use of working time of all employees in a given organization. The report card according to form T-13 is used in conditions of automated data processing. Timesheet f.T-12 is filled out manually by the timekeeper. These timesheets are compiled in one copy and submitted to the accounting department. Based on the timesheets, wages are calculated and statistical reports on labor are compiled.

Notes on the reasons for absence from work or part-time work, about working overtime, about downtime, about fulfilling government duties and other deviations should be entered into the timesheet only on the basis of documents (certificates of incapacity for work, certificates, orders for the performance of government duties, downtime sheets, etc.).

3. Settlements with personnel for remuneration are recorded in account 70 “Settlements for remuneration”. The credit of this account reflects accruals for wages, bonuses, benefits from the Social Insurance Fund, pensions for working pensioners and other income, and the debit of the account reflects deductions from the accrued amount of wages and the issuance of amounts due to employees.

Analytical accounting of the accrual of these payments is maintained in the personal accounts of employees (Form No. T-54) and payroll statements (Form No. T-49). Personal accounts for each employee are opened upon hiring and maintained throughout the calendar year; at the end of the year, the employee’s personal account is closed and a new one is opened. The shelf life of personal accounts is 75 years. Every month, the organization's accounting department enters into personal accounts information about accrued wages, deductions made and amounts to be paid. The basis for filling out personal accounts is the time sheet.

The operation of distributing the amount of remuneration included in production and distribution costs is recorded as an accounting entry depending on the type of production in which the employee is employed, namely:

D07 K70 - for work related to the delivery and unloading of equipment requiring installation;

D08 K70 - to employees performing work on delivery, modernization and reconstruction, creation of fixed assets and intangible assets, as well as the acquisition of animals;

D10 K70 - workers performing robots for the procurement of materials;

D20K70 - workers of main production;

D23 K70 - employees of auxiliary production;

D25 K70 - for maintenance and management personnel of workshops;

D26 K70 - administrative and managerial personnel of production organizations;

D28 K70 - for correcting the marriage;

D29 K70 - employees of service industries and farms on the balance sheet of the organization (canteens, laundries, etc.);

D44 K70 - employees of the commercial department of production organizations;

D84 K70 - when calculating dividends to employees of the organization;

D86 K70 - when calculating wages using targeted funding;

D91/2 K70 - when calculating wages that are not included in the costs of production and sales (for example, payment of bonuses from net profit; or for work on dismantling a liquidated facility);

Vacation pay is accrued in correspondence with various expense accounts depending on the structural unit in which the employee going on vacation works:

D20,23,25,26,29,44…K70.

But if the vacation falls on two months (part in one month, and part in the next), then the part that relates to the next month should be reflected as follows: D97 K70 .

The accrual of temporary disability benefits paid from the Social Insurance Fund is recorded as: D69/1 K70.

That. , payroll is reflected in the credit of account 70 , and the corresponding account is determined based on what work the employee performs.

Various types of deductions from wages in accounting are calculated as follows:

D70 K68/1 - personal income tax;

D70 K71 - accountable amounts;

D70 K73/1 - amounts to repay previously issued advances;

D70 K73/2 - amounts to pay off debt for compensation for material damage caused by an employee of the organization;

D70 K73/3 - for goods sold by the organization to an employee on credit;

D70 K76/1 - amounts of insurance payments for the purpose of their subsequent transfer to the insurance company (for example, at the request of an employee);

D70 K76 - alimony, other deductions under writs of execution, etc.

4. There are two types of wages: basic and additional

.

To main

This includes wages accrued to employees for time worked, the quantity and quality of work performed: payment at piece rates, tariff rates, salaries, bonuses for piece workers and time workers, additional payments and allowances.

Additional salary

represents payments for unworked time provided for by labor legislation: payment for regular vacations, breaks in the work of nursing mothers, preferential hours for teenagers, severance pay upon dismissal, etc.

The main forms of remuneration are time-based, piece-rate and piece-rate.

Time-based

is a form of remuneration in which the employee’s salary depends on the actual time worked and the employee’s tariff rate.

There are two types of time-based wages: simple time-based and time-based bonuses.

With simple time-based wages, a worker's earnings are determined by multiplying the hourly or daily wage rate of his grade by the number of hours or days he worked.

With time-based bonus wages, a bonus is added to the amount of earnings at the tariff, which is set as a percentage of the tariff rate.

With piecework

Workers' labor is paid at piece rates in accordance with the quantity of products produced (work performed and services rendered).

• direct piecework - when workers are paid for the number of units of products they produce and work performed, established taking into account the required qualifications;

• piecework-progressive - in which payment increases for production above the norm;

• piecework-bonus - remuneration includes bonuses for exceeding production standards, achieving certain quality indicators: delivery of work from the first request, absence of defects, saving on materials;

Chord form

- this is a salary for the volume of work performed, indicating the deadline for their completion in complex teams (mechanics, turners, adjusters, etc.). The amount of work and payment are given. Lump sum wages should be introduced for certain groups of workers in order to create material incentives to further increase labor productivity and reduce the time required to complete work.

5. 1) Documentation and payment for downtime.

The time of forced breaks in work, during which workers are at the enterprise but cannot be used, is called downtime.

The culprits of downtime may be workers, plant administration, workshops, suppliers of materials, energy, etc.

Downtime due to the employee’s fault is not paid and is not documented. Downtime not caused by the employee, if he warned the administration about the start of downtime, is paid at the rate of not less than 2/3 of the tariff rate of the category or salary established for the employee.

This time is documented with a sheet of downtime, it indicates the reasons and culprits of the downtime, its duration, the worker’s tariff rate, the amount of payment and the amount.

2) Documentation of product defects and payment for them.

Complete defects due to the employee’s fault are not paid, but partial defects are paid at reduced rates depending on the degree of suitability of the product.

In this case, the employee’s monthly salary cannot be lower than 2/3 of the tariff rate of the category (salary) established for him.

If the defect occurred as a result of a hidden defect in the processed material, as well as a defect not due to the employee’s fault discovered after acceptance by the quality control department, this employee is paid on the same basis as good products.

3) Additional payment for night work.

In accordance with Art. 96 of the Labor Code of the Russian Federation, the time from 22°° to 6°° in the morning is considered night. The following are not allowed to work at night: pregnant women, women with children under 3 years of age, workers under 18 years of age, other categories of workers in accordance with the law, and disabled people are involved with their consent in the absence of medical care. contraindications. The duration of the night shift is reduced by one hour without further work.

Hours of night work are paid at an increased rate as provided for in the collective agreement of the enterprise, but not lower than that established by labor legislation (Article 154 of the Labor Code of the Russian Federation).

4) Payment for overtime work.

Overtime is considered to be work in excess of the legally established working day.

Overtime work is allowed in exceptional cases and with the permission of the trade union committee of the enterprise.

Pregnant women, women with children under 3 years of age, workers under 18 years of age, workers studying on the job, etc. are not allowed to work overtime.

Overtime work is paid for the first two hours at least one and a half times the amount, and for subsequent hours - at least twice the amount for each hour of overtime work or, at the request of the employee, payment can be replaced by additional rest time, but not less than the time worked overtime (Article 152 of the Labor Code of the Russian Federation). Overtime work should not exceed 4 hours for each employee for two consecutive days and 120 hours per year. The amount of payment for overtime work can be established in an employment or collective agreement

For example:

A 6th grade turner, his hourly wage rate is 10,711 rubles, he worked overtime in January:

January 10 — 4 hours 2 + 2

January 12 — 3 hours 2 + 1

January 18 — 2 h 2

January 26 — 1 hour 1

7h 3h

(1.5 size) (double size)

10.711*7* 1.5+10.711*3*2 = 112.46 + 64.26 = 176.72 rub. — payment for overtime work.

5) Payment for work on weekends and holidays.

Work on weekends and holidays is compensated to the employee by providing another day of rest or, by agreement of the parties, in cash. Paid at least double the amount of Article 153 of the Labor Code of the Russian Federation.

6) Payment for the time spent performing government duties

.

The time spent performing state duties is noted in the report card and confirmed by a certificate (people's assessor in court, work in the military registration and enlistment office, etc.).

A salaried worker is paid for the days he performs government duties at the average daily wage.

For pieceworkers based on average daily earnings for the previous two months.

Payment of sick leave.

Its source is funds from social insurance authorities. The basis for the calculation is the work time sheet and a sheet of temporary incapacity for work from the medical institution.

From January 1, 2008, the maximum amount of temporary disability benefits is 17,250 rubles per calendar month.

For calculating maternity benefits, the maximum amount is 23,400 rubles for one calendar month.

To calculate benefits, you need the number of days of illness, insurance coverage and average earnings calculated for the last 12 calendar months preceding the month of illness.

The insurance period includes periods of work of the insured person under an employment contract, state civil or municipal service, as well as periods of other activities during which the citizen was subject to compulsory social insurance in case of temporary disability and in connection with maternity. The insurance period is calculated on a calendar basis.

For insurance work experience of up to 5 years, the benefit amount is 60% of average earnings, from 5 to 8 years - 80%, over 8 years - 100%.

Benefits are accrued at 100%:

— due to a work injury or occupational disease;

- working disabled people of the Great Patriotic War and other disabled people who are equal in benefits to disabled people of the Great Patriotic War;

- persons who have three or more dependent children under 16 years of age (students - 18 years old);

- Chernobyl victims;

- for pregnancy and childbirth, etc.

For example:

Employee Makarov M.M. temporary disability lasted from January 5 to January 15, 2008 (11 calendar days). The employee's salary is 25,000 rubles; there were no other payments during this period. All 12 months have been fully worked out. The employee's insurance period is 6 years 2 months.

The total amount of payments taken into account when calculating average earnings is: 25,000 rubles * 12 months = 300,000 rubles.

Calendar days – 365 days.

1) Average daily earnings are: 300,000 rubles. : 365 = 821.92 rub.

2) Daily allowance is: 821.92 rubles. * 80% = 657.54 rub.

3) Time allowance. not difficult. will be: 657.54 rubles. * 11 days = 7232.94 rub.

4) The maximum amount of temporary disability benefits is: (RUB 17,250: 31) * 11 days = 6,120.96 * 80% = RUB 4,896.77.

Due to the fact that the calculated benefit amount exceeds the maximum amount, temporary disability benefits are paid in the minimum amount of 4896.77 rubles.

Postings:

D20 K70 – 890.32 rub. – temporary disability benefits have been accrued at the expense of the company (the first two days);

D69/1 K 70 – 4006.45 rub. — temporary disability benefits were accrued at the expense of social services. insurance (subsequent days).

Vacation pay.

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days). This norm is effective October 6, 2006.

To calculate vacation pay, this average daily earnings is multiplied by the number of vacation days. If the employee did not work the entire billing period, then first the average monthly number of calendar days (29.4) is multiplied by the number of months fully worked. The number of calendar days in those months that are fully worked is added to this result. To calculate this number of days, it is necessary to multiply the number of days actually worked according to the calendar of a five-day working week by a factor of 1.4.

If the employee did not have actually worked days and no amounts accrued for this during the billing period and before it, then the average earnings are calculated based on the salary accrued for the actually worked days in the vacation month.

Example.

The organization has a 5-day work week. The employee is granted regular leave for 28 calendar days from November 1, 2007. The calculation period will be the time from November 1, 2006. The employee's salary is 10,000 rubles. In September 2007, she was on a business trip for 5 days. In total, during the billing period, the employee was paid 117,619 rubles (excluding time and amounts on a business trip).

In September, 16 working days were worked (21-5), this will amount to 22 calendar days (16x1.4).

Average earnings will be:

117619 rub. : (2904 x 11 months + 22 days) = 340.53 rubles.

Calculation of the amount of vacation pay: 340.53 rubles. x 28 days = 9534.84

D 20 K 96 – creation of a reserve to pay for vacations of workers in the main production departments.

D 96 K 70 - the employee’s vacation pay was accrued at the expense of the previously created reserve.

D 20 K 70 - vacation pay is accrued if there is no reserve created.

⇐ Previous3Next ⇒

Types of bonuses

A bonus payment is an additional remuneration for achieved production or other indicators; in accounting, bonuses are included in wages.

The payment procedure is regulated by the regulations on remuneration, regulations on bonuses or other local regulations of the organization. The bonus accrual is:

- permanent (paid monthly) or one-time;

- established as a percentage of the salary or in a fixed amount;

- related to the employee’s performance or paid in connection with a holiday.

Answers to common questions

Question No. 1. Which authorities have the right to inspect the work of a payroll accountant?

- Everything related to personnel and compliance with labor laws will be checked by the Labor Inspectorate;

- If there are identified violations regarding wages, the organization can count on an audit by the Tax Inspectorate;

- As part of checking the correctness of the calculation of insurance contributions to extra-budgetary funds, the Inspectorate of Social Insurance Funds may organize an audit;

- The prosecutor's office can also organize both scheduled and unscheduled inspections to monitor compliance with labor laws.

Question No. 2. If a company uses a special regime, is it necessary to pay advances on wages?

Payment of wages is regulated by the labor code and in no way depends on the tax regimes used by small and medium-sized businesses. The special regime provides benefits only for paying taxes to the state budget, but does not exempt from paying wages.

Question No. 3. Do I need to include advance wages in expenses?

The advance is a part of the salary, which in turn is calculated once a month. The expenses take into account the entire salary; in fact, the amount of the advance is already taken into account there, so taking the advance into account separately will lead to doubling the amounts and unreasonably inflating expenses.