The filling height is taken to be the average measurement value, rounded to 1 cm. 4.2.5. Determining the filling height remotely (from the control panel) during inventory is not allowed. 4.3. Sampling 4.3.1. Fuel samples are taken in accordance with GOST 2517-85. 4.3.2. Fuel samples must be taken sequentially from top to bottom. 4.3.3. Point samples from vertical tanks to compile a combined sample (see Appendix 1) are taken with portable samplers from three levels: the top - 250 mm below the fuel surface; middle - from the middle of the height of the fuel column; lower - 250 mm above the bottom of the tank. Samples from the upper, middle and lower levels are mixed in a ratio of 1:3:1. 4.3.4. When the fuel level in the tank is no more than 2000 mm, spot samples are taken from the upper and lower levels according to clause 4.3.3.

Inventory of fuels and lubricants at the enterprise

Attention

The act of removing residual fuel from car tanks is used to monitor the use of fuel and lubricants by drivers. Each enterprise establishes with its accounting policies the rules and deadlines for performing control functions. This norm is especially important for organizing order and reliability in accounting for fuel and lubricants.

Info

The availability of fuel is checked by a commission, which is appointed by the manager and consists of heads of departments, accounting departments, and technical workers. Remaining withdrawals are made monthly. According to the report, a statement is drawn up, which establishes the result of using fuel and lubricants for the month. This act is drawn up in one copy and filled out manually or using computer technology.

When entering information, you must indicate the date on which the document is drawn up and the composition of the commission.

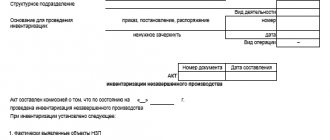

Form of order to conduct inventory according to form No. INV-22

If for some reason this form is not suitable, you can develop your own. The main thing is that it is enshrined in the company's accounting policy. An arbitrary sample order for inventory of material assets 2021 may look something like this:

In any case, the document must contain the following mandatory details and information:

- company name;

- date of preparation and document number;

- the purpose of the inspection and what it will concern: goods, fixed assets, tangible assets, accounts receivable, all property of the company;

- divisions and departments of the company in which the inspection will be carried out: warehouse, store, accounting or the entire company as a whole;

- period and duration of the event - from what date to what date, when to provide the results of verification actions;

- composition of the commission and full name its chairman (the commission, in addition to the company’s employees, can include third-party auditors);

- details of the manager who signed the document.

After publication, the local act must be registered in a special journal to record control over the implementation of such decisions. Its recommended form can be taken from Goskomstat Resolution No. 88 (Form No. INV-23) or developed independently. All employees listed in it must be familiarized with the order. They can sign the acquaintance directly on the form or on a separate sheet of acquaintance with the document, which is filed with the order.

Step-by-step instructions for drawing up an order

Step 1. Specify the name of the document.

Step 2. In the appropriate fields, enter the name of the organization (IP), indicate OKPO, and write the date of compilation.

Step 3. Fill out the main part of the order. Here you should clarify the type of inspection and its purpose, as well as list the members of the inventory commission participating in the event and its chairman. Their first and middle names can be abbreviated.

Step 4. We indicate which material assets and in which departments and separate divisions of the company should be checked.

Step 5. We indicate the exact timing of the inspection with its start and end dates.

Step 6. We inform you about the reasons for the need to inventory valuables.

Step 7. We indicate the deadline for submitting the audit results to the accounting department.

Step 8. We certify the document from the manager.

Step 9. Assign a number and register it in a special journal.

Step 10. We introduce it to all interested parties, including employees of departments and divisions where the inspection will take place.

How it goes

The procedure for conducting a property inventory takes place in four stages:

- Preparation. During the preparatory stage, the organization develops a sample order for inventory before the annual report, for example, and also creates an inventory commission, sets the deadlines for the process and determines the OS objects that will be checked.

- Direct verification activities. Members of the commission study the quantitative and qualitative properties of OS objects, check their actual condition and availability, and draw up an inventory.

- The analytical stage, during which accounting data is compared with the results of the assessment process. If discrepancies are discovered by members of the commission, statements are drawn up and results are summed up.

- Registration of the results of checking the availability and current condition of property. Accounting brings accounting data into conformity with the commission's reports, those responsible for the errors are identified, and a measure of responsibility is established.

Please note that during the procedure it is necessary to issue not only an order for inventory according to the new standards, but also other orders.

The act of removing fuel residues from car tanks

Important

Persons responsible for the safety of fuels and lubricants give a receipt stating that by the beginning of the inventory, all expenditure and receipt documents for fuels and lubricants were submitted to the accounting department and all fuels and lubricants that arrived at the warehouse under their responsibility were recorded, and those disposed of were written off as expenses. 7.8. In the event of a change in financially responsible persons, both persons are present during the inventory, and in the act of removing the remains of fuel and lubricants, the person who accepted the fuel and lubricants signs for their receipt, and the person who handed them over signs for their delivery. Reception and transfer of fuel and lubricants is carried out according to their actual quantity, taking into account the natural loss and error of measuring instruments.

7.9. Before conducting an inventory, pipelines must be completely filled or emptied. Control is carried out using air valves installed on elevated or lower sections of the pipeline.

How to draw up an order to conduct an inspection

Before directly assessing an institution’s property, it is necessary to develop a sample order for an inventory of 2021. The manager’s order can be prepared either in any form on the organization’s own letterhead, or using the unified form INV-22 (Resolution of the State Statistics Committee of the Russian Federation No. 88 of August 18, 1998).

In the sample order for inventory 2021, it is necessary to include the details of the document, its name, number and date, information about verification activities, the reason for the assessment of property objects, indicate those values that will be subject to control, and set the deadlines for this process. The document also defines the composition of the commission with the name and job description of each member. One of the common questions is how to correctly indicate the reason for inventory in the order; an example for an annual audit could be: “the need to prepare annual financial statements.” For another case, you can write, for example, “control check”.

A sample order for inventory 2021 is signed by the head of the institution, and then information about it is entered into the INV-23 registration log.

Each employee must put next to his full name. and his/her signature confirming the fact of familiarization with the assessment order. Maximum responsibility for the control activities carried out lies with the chairman of this council.

Inventory of fuels and lubricants at the enterprise

7 List of used literature.. 7. After approval, the commission submits one copy of the Act to the financial department, and the second to the head (storekeeper) of the fuel and lubricants warehouse. 7.20. In cases of detection of shortages or surpluses in excess of permissible measurement errors, the commission conducts a thorough investigation. Those responsible for this will be held accountable. For all shortages and surpluses, the commission must receive written explanations from financially responsible persons. Explanations are attached to the act of withdrawal of balances. In the case when, when setting off shortages with surpluses by re-grading, the cost of the missing fuel and lubricants is higher than the cost of the fuel and lubricants found in surplus, this difference in cost should be attributed to the guilty parties. The procedure for writing off shortages and receiving surplus fuel and lubricants is determined by the current “Regulations on Accounting Reports and Balance Sheets.” 7.21.

Results

An administrative document that launches the procedure for checking the availability of property can be created either in a free form or on a unified form of the INV-22 form. It contains all the basic data necessary to carry out an inventory. Its details will be present in all documents drawn up during the audit.

Sources

- https://assistentus.ru/forma/akt-na-spisanie-gsm/

- https://proautomasla.ru/stati/kak-opredelit-kolichestvo-benzina-v-bake.html

- https://vlad-expert.ru/kak-pravilno-snjat-ostatok-topliva-v-bake-avtomobilja-10309/

- https://clubtk.ru/forms/dokumentooborot/kak-sostavit-prikaz-o-provedenii-inventarizatsii

- https://gosuchetnik.ru/shablony-i-formy/kak-sostavit-prikaz-o-provedenii-inventarizatsii

- https://assistentus.ru/forma/akt-kontrolnogo-zamera-rashoda-topliva/

- https://zhemchuzhina-salon.ru/nasledstvo/15846-inventarizaciya-topliva-v-bakakh-avtomobiley-obrazec.html

- https://arbatcredit.ru/inventarizatsiya-gsm-v-bakah/

- https://nalog-nalog.ru/buhgalterskij_uchet/dokumenty_buhgalterskogo_ucheta/prikaz_o_provedenii_inventarizacii_obrazec_zapolneniya/

How to measure gasoline in a tank during inventory

In cases where the chairman of the commission is temporarily unable to perform his duties for valid reasons (illness, vacation, study, etc.), by order of the head of the airline, a temporary new chairman is appointed from among the members of the inventory commission. 7.4. Members of inventory commissions for entering into the act of removal of residuals deliberately incorrect data on the actual balances of fuel and lubricants in order to conceal their shortages, waste or surpluses are subject to liability in the manner prescribed by law. 7.5. The inventory of fuels and lubricants is carried out on the first day of each month following the reporting month in the presence of the head of the fuels and lubricants warehouse or another financially responsible person. The inventory must be carried out with the full composition of the inventory commission. Fuel and lubricants in the warehouses of VT enterprises are carried out in order to compare the actual availability of each brand of fuel and lubricants, measured in units of mass on the day of inventory in tanks, process pipelines, refueling means (TZ, MZ), small containers and other containers, with accounting data on movement and storage of fuels and lubricants for the reporting period. 7.2. Inventory is carried out without fail: - within the time limits established in accordance with the “Regulations on Accounting Reports and Balance Sheets” (for oil and petroleum products - at least once a month); - in case of a change of financially responsible persons - on the day of acceptance and transfer of cases; - when establishing facts of theft, robbery, theft or abuse, as well as damage to fuel and lubricants - immediately following the establishment of such facts; - after a fire or natural disaster (flood, earthquake, etc.) - immediately after the end of the fire or natural disaster. 7.3. During the inventory, working and “dead” (Appendix 1) fuel residues are determined at actual humidity and for “dry” weight (minus operating humidity). 1.7. After the inventory, an act is drawn up in accordance with Appendix 2, in which the results of measurements and calculations are entered. The act is approved by the director of the power plant. 1.8. Fuel is taken as a “dead” residue: - in supply tanks - at a level exceeding by 20 cm the mark at which the pumps fail at the nominal hourly fuel consumption at the power plant, taking into account the flow rate in the recirculation line; - in reserve tanks - what remains after the failure of one pump-out pump at 30% supply; — in receiving tanks — at a level 10 cm higher than the mark at which one transfer pump fails at its nominal flow. 1.9. Total balance: at actual moisture content 14385.421 tons; for dry weight 14037.042 tons. Note. In columns 9 and 10, the mass of fuel is indicated as a fraction: in the numerator - at actual humidity, in the denominator - per dry mass. The measurement was carried out by the Chairman of the commission Signature Members of the commission Signature Measured parameters, operation Name of the device, GOST Characteristics of the device Additional instructions Fuel level in the tank Float level gauges with spring balancing according to GOST 13702-78 and TU 25-070374-79.

Measuring metal tape 10 and 20 m long according to GOST 7502-80 Measurement error at local reading ±4 mm. The division value is 1 mm. The use of other types of level gauges with the specified error is allowed. Sampling Samplers in accordance with GOST 13196-85 and GOST 2517-85. Portable samplers in accordance with GOST 2517-85 Provides the collection of combined samples.

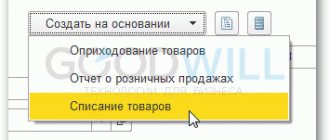

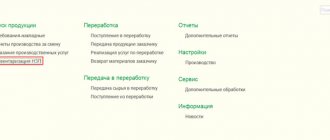

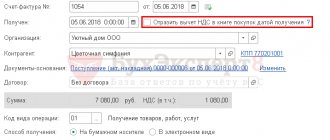

Practical advice on accounting and write-off of fuel and lubricants

Organizations using their own or rented cars keep records of the receipt and consumption of fuel and lubricants. There are standards that must be followed when disposing of fuel. As practice shows, accountants do not always clearly understand how to correctly apply these standards. In particular, people are confused about how to write off gasoline: according to the number of liters actually consumed or according to the standard. We will begin the answer to this question with a remark: it should be noted that the purposes of the standards in accounting and tax accounting do not coincide.

Maintain accounting and tax records for free in the web service

Accounting

In accounting, fuel and lubricants must be written off as actual. But the difficulty is that the car does not have a device that would record the amount of gasoline in the tank. Accordingly, it is very difficult to determine “by eye” how much fuel was spent on a particular trip. Therefore, most often actual fuel consumption is calculated as the number of kilometers on the speedometer multiplied by a certain standard.

Tax accounting

The application of the standard in tax accounting is a controversial issue.

A few years ago, officials argued that when writing off fuel and lubricants as expenses, organizations must adhere to the limits approved by the Methodological Recommendations put into effect by Order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. Specialists from the Russian Ministry of Finance have repeatedly reminded us of this (see.

, for example, letter from the Ministry of Finance of Russia and dated November 17, 2011 No. 03-11-11/288). Also, representatives of this department insisted: if an organization uses a machine for which the standard is not approved, it is necessary to develop its own limit and use it to write off fuel and lubricants as expenses (letter dated June 10, 2011 No. 03-03-06/4/67).

However, there is no such right in the Tax Code. Therefore, many companies did not adhere to any standards and reduced the tax base by the full cost of gasoline consumed. This approach was supported by the judges (decision of the Supreme Arbitration Court of the Russian Federation dated August 14, 2008 No. 9586/08, resolution of the Federal Antimonopoly Service of the West Siberian District dated January 27, 2009 No. F04-7730/2008 (17508-A03-46)).

Later, officials agreed that although it is desirable to apply the established standards, it is not necessary (see, for example, letter of the Ministry of Finance of Russia dated January 27, 2014 No. 03-03-06/1/2875; “Taxpayers are not required to standardize the cost of gasoline for official vehicles” ).

Thus, today companies can easily account for fuel not according to standards, but based on actual consumption. The only thing you should not do is ignore the limits developed by the organization itself.

The judges believe that since the company has approved the standard, it must be guided by it, otherwise it will face a fine (Resolution of the Administrative Court of the North Caucasus District dated September 25, 2015 No. A53-24671/2014).

Let us add that taxpayers who nevertheless decide to apply a standard (approved by the Ministry of Transport or independently developed) for tax accounting purposes are allowed to apply the same standard in accounting. In other words, use the same limit value when calculating the gasoline consumed and when reducing the tax base.

How to calculate your own standard

If there is no limit approved by the Ministry of Transport for a machine, or the organization decides to use a different value, it has the right to calculate its own limit. Typically, in such a situation, companies act in one of two ways.

The first way is to borrow information about fuel consumption from the technical documentation for the car. This approach corresponds to the position of the Russian Ministry of Transport (see “The rules for determining fuel consumption standards for passenger cars have changed”).

The second way is to create a commission and take measurements. To do this, you need to pour a certain amount of gasoline into the empty tank of the car, for example, 100 liters. Then the car should be driven until the tank is completely empty. Based on the speedometer readings, you need to determine how many kilometers it took to completely empty the tank. Finally, the number of liters must be divided by the number of kilometers. The result will be a figure showing how much gasoline the car consumes when driving one kilometer. This indicator should be recorded in the act and signed by all members of the commission.

Since fuel consumption depends on travel conditions, it is better to make control measurements “for all occasions”: separately - for a loaded and empty car, separately - for summer and winter trips, separately - for idle time with the engine on, etc. All obtained results should be reflected in the act drawn up and signed by the commission.

What is shortage

Important! Shortage is understood as the difference between accounting data and the actual balance at the current time, identified during a full or partial recalculation of any group of goods.

The main document regulating the procedure for taking inventory is Order No. 49 of the Ministry of Finance. According to this document, the initial actions of the inventory commission when receiving results are:

- Establish the degree of responsibility of each person involved.

- Reclaim receivables that are in doubt, transfer unfinished barter and existing debts.

- Make an inventory of valuables deemed unsuitable or unrecoverable.

- Identify the reasons for surpluses or shortages.

- Receive an explanation of the shortage.

Similar chapters from other works:

Audit of non-cash payments using the example of PTF Rodnik LLC

Features of the audit of PTF Rodnik LLC

Audit of bankrupt enterprises

CHAPTER 2. FEATURES OF AUDITING INSOLVENT ENTERPRISES

Taking into account the target orientation of the various stages of bankruptcy, defined by the Federal Law “On Insolvency (Bankruptcy)” dated October 26, 2002 No. 127-FZ, we can conclude...

Accounting in the organization Master-Food LLC

2.1 Procedure for conducting inventories

The rules for conducting an inventory are determined by the Methodological Guidelines for the inventory of property and financial obligations, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 in accordance with a number of adopted regulations...

The importance of inventory in the formation of accounting

Problems of lack of control

If there is a negligent attitude towards reporting and calculating fuel costs and a complete lack of control, the company may face a number of problems associated, first of all, with the dishonesty of drivers. Examples include:

- Drain off the remains. After a work shift or during downtime of a company vehicle, the driver can drain unused gasoline or diesel fuel and use it for further resale or refueling his own car.

- Working with “left” checks. This method is used in cases where fuel is purchased at the expense of the drivers themselves, and the costs are reimbursed by the company’s accounting department against the provided check. By purchasing “left” checks, the driver gets the opportunity to “cash out” the difference between them and the actual cost of refueling.

- Personal trips. If the vehicle's route is not tracked by the company, the driver may use fuel for his own needs and trips.

- Inflating readings. When the vehicle is idle, drivers can also increase the odometer, compensating for the difference between its readings and the true values in their favor.

This is not a complete list of ways to deceive a company, so organizations that are responsible about spending and saving resort to various methods of tracking the gasoline consumption of company vehicles. Most often, specialized fuel consumption monitoring systems are used for this.