The business transaction “cash withdrawal” can take place in absolutely any organization. In this article we will look at the features of accounting and recording in 1C the operation of withdrawing cash by check.

You will learn:

- what document in 1C reflects the withdrawal of cash from the bank and its posting to the cash desk;

- what settings affect cash withdrawal transactions.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Is it worth opening a bank account for an individual entrepreneur?

Considering that cash flow may raise questions for a credit institution, entrepreneurs often decide to work without a current account. This is convenient because you don’t have to wait for the bank to transfer the money. In addition, some contractors offer a discount when paying in cash.

The law does not oblige individual entrepreneurs to open a bank account, but this is a convenient tool for entrepreneurs who run a legal business. In addition, large payments (from 100 thousand rubles) to counterparties can only be made in cashless form. This rule does not apply to cash payments with clients and customers in smaller amounts.

In general, a bank account is reliable and convenient. Funds in the account can be used to pay for goods and services, rent, employee salaries, interest on loans, taxes, etc. This makes it easier for an entrepreneur to control the receipt and expenditure of funds, and in a credit institution money is safer than, say, in the cash register of an enterprise. Of course, it happens that banks close, so it’s worth choosing a credit institution to open a current account not only based on the size of the commission, but also on reliability.

Bank account for individual entrepreneurs - a convenient financial management tool

How much money should I keep in my current account?

It is worth remembering that individual entrepreneurs’ funds in banks are insured for up to 1.4 million rubles. True, entrepreneurs will receive compensation only after all obligations to individuals have been covered. Therefore, experts recommend storing available funds not in the individual entrepreneur’s account, but in the personal account of the individual.

Things to consider

When withdrawing cash, consider the following nuances:

- There is a commission for cashing out from a bank account.

- All transactions must be carried out taking into account cash discipline. Failure to comply with current rules may lead to claims from tax authorities.

- In case of withdrawal from 100 thousand rubles. the bank may require confirmation of subsequent expenditures of these funds within the framework of 115-FZ.

Fee for withdrawing cash from a current account

The size of the commission is set by banks based on the purpose of cashing out. For example, when withdrawing money to pay salaries, the commission is usually small - up to 1 percent. When cashing out for other purposes, the fee is higher - from 2% and higher, depending on the bank’s conditions. The larger the withdrawal amount, the higher the commission will be, which in some banks reaches 15%.

Do I need to pay taxes?

The tax is paid if money from the account is transferred to the name of a third party (it also pays the tax). The fact is that the transferred amount will be considered the property of the recipient, that is, his income, regardless of the type of activity. Therefore, the bank retains a certain percentage during the transaction process.

And if you transfer funds to a personal account and indicate the appropriate justification (for the personal needs of an individual), then the tax office will not have questions for you.

Reporting and postings

There is no need to generate separate reports on cash withdrawals, but it is advisable to keep documents on cash flow in case of audits.

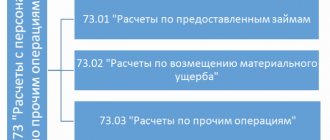

Cash withdrawals from the account are displayed in transactions as follows:

| The individual entrepreneur calculated the profit received | Dt 84 Kt 75 |

| Providing funds from the cash register | Dt 75 Kt 51 |

| Fixation of calculated profit | Dt 76 Kt 91 |

When issuing funds from an account, the operation is not recorded in the individual entrepreneur’s accounting, but is reflected only in financial accounts. institutions.

Individual entrepreneur's liability for illegal withdrawal of money

There is no direct punishment for illegal cash withdrawal from a bank account, but almost every such operation has the goal of tax evasion. Responsibility for such actions is enshrined in Art. 199 of the Criminal Code of the Russian Federation.

What are the consequences of non-payment of taxes:

- The fine, the amount of which depends on the size of the evasion, can reach 100 thousand rubles.

- Forced labor for a period of 1 to 3 years.

- Administrative arrest for up to 6 months.

- Imprisonment for up to 3 years.

The punishment may become more severe if the state's losses are recognized as particularly large.

What the law says

Since an individual entrepreneur has the status of an individual, and not a separate organization, all funds are his personal property, which he can use as he pleases. In accordance with the Civil Code of the Russian Federation (Article 209), the owner has the rights to own, use and dispose of property, which includes the money of an individual entrepreneur.

It is worth considering that there is Law No. 115-FZ “On combating the legalization of proceeds from crime,” according to which banks must identify suspicious transactions and verify them. Withdrawing large amounts from an individual entrepreneur's account may arouse the interest of a credit institution, especially if you often withdraw cash in large amounts - from 600 thousand rubles. In this case, the bank may ask what you spend the money on, so it is useful to have documents confirming the expenses.

An entrepreneur who has paid the budget on time and in full can freely use the remaining funds for personal needs.

Payments for corporate cards in 1C: Accounting 8.3

Content:

1. Setting up a program to record settlement transactions on a corporate card.

2. Transfer of funds to the card.

3. Cash withdrawal and payment by corporate card.

4. Confirmation of expenses on a corporate card.

5. Return of unused funds to the organization’s cash desk.

A bank card in the modern world has become the main method of payment, which could not but affect the accounting of corporate expenses of companies.

Nowadays, the use of corporate payment cards is very actively practiced, since paying with a corporate card for business expenses, business trips and simply withdrawing cash from ATMs is convenient.

Let's look at the main transactions on corporate cards that an accountant faces when a company employee receives a corporate card.

Setting up a program to record settlement transactions on a corporate card.

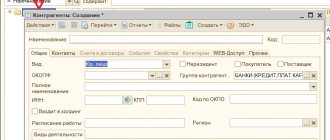

In the “1C: Accounting 8.3” configuration, to record settlement transactions on corporate bank cards, you need to link the corporate card to a special card account and assign an accountable person to it. Then, when loading a bank statement regarding the debiting of funds, the accountable person who made the payment or cash withdrawal will automatically be determined.

If the card is attached to a special card account of the organization, then account 55.04 will be used to reflect accounting transactions.

If the card is attached to a current account, then account 51 will be used to reflect accounting transactions.

The corporate card is activated through the “Organizations” card (section Main - Organizations).

Follow the Bank accounts link, create a new account or select an existing one for which corporate cards have been issued.

In the bank account card, click the arrow next to the Corporate cards item and check the box in the “Corporate cards are linked to the account” field.

Click the “Add” button in the tabular section, fill in the card number and accountable person.

Now you can click the “Save and Close” button.

Transferring funds to a card.

You can top up your corporate card by transferring funds to the card. In the “1C: Accounting 3.0” program, this operation can be reflected through the document “Write-off from the current account” (section Bank and cash desk - Bank statements).

Click the “Write-off” button to generate a document. If documents for debiting funds are created directly in the “Client-Bank” system or loaded into it from another program, then open the previously created/downloaded document.

Now you need to fill in or check the already filled in fields of the document.

Please note that in the “Type of transaction” field you need to select “Transfer to another organization account”.

In the “Recipient Account” field, you need to select an account linked to a corporate card.

In the “Account” field you need to select an account:

· 51 - if the card is issued to the organization’s current account

· 55.04 - if the card is issued to a special card account of the organization

In the “Expense Item” field, you must indicate “Internal movement of funds” with the movement type blank. If there is no such item in the list of expense items, then create it.

If there is no such item in the list of expense items, then create it by filling out the fields as shown in the screenshot.

In the “Write-off from current account” document, check whether the “Confirmed by bank statement” 1C checkbox is checked.

After this, you can post the document using the “Post” or “Post and Close” button.

When carrying out this document, the transaction is reflected in accounting by posting:

Cash withdrawal and payment by corporate card.

When an employee withdraws money from a corporate card or pays with it, he takes this money from the organization, that is, into account. The employee will be required to report expenses incurred on the corporate card.

Expenses for withdrawing cash from a corporate card through an ATM or paying for goods, works, or services with a card are reflected in a special card account, which can be seen in bank statements.

Document “Write-off from the current account” (section Bank and cash desk - Bank statements). This document can be generated either on the basis of a payment order, or downloaded from the “Client Bank”, or created as a new document.

Click the “Write-off” button to generate a document, or open a previously created/downloaded document via “Client-Bank”.

In the “Type of transaction” field, select “Transfer to an accountable person.”

Now you need to fill in or check the already filled in fields of the document.

In the “Recipient” field, you must select the accountable person to whom the card was issued (if the document was downloaded from “Client Bank” and the corporate card is linked to a bank account in the program settings, the accountable person will be determined automatically).

In the “Amount” field, enter the amount to be debited from the card.

In the “Expense Item” field, you need to select the desired cash flow item. This may be the article “Other payments for current operations”, or “Payment for goods, work, services, raw materials and other current assets”, or any other, depending on the direction of use of funds.

If there is no such item in the list of expense items, then create it by filling out the fields as shown in the screenshot.

In the “Write-off from current account” document, check whether the “Confirmed by bank statement” checkbox is checked.

After this, you can post the document using the “Post” or “Post and Close” button.

When carrying out this document, the transaction is reflected in accounting by posting:

Reflecting a payment transaction with a corporate card is similar to a cash withdrawal transaction through an ATM. The only difference is in the indication of the purpose of payment.

Confirmation of expenses on a corporate card.

After the cardholder has made expenses, he must make a confirmation of the expenses. In the “1C: Accounting 3.0” program, this operation can be reflected through the document “Advance report” (section Bank and cash desk - Advance report).

When creating a document, you must select the “Advance report” transaction type.

Enter the date of generation of the expense report in the “From” field.

In the "Organization" field, enter your organization.

In the “Accountable person” field, select the employee who is the accountable person.

In the “Warehouse” field, indicate the warehouse to which the inventory items will be allocated.

On the “Advances” tab, fill out the tabular part using the “Add” button.

Using the “Select data type” form, select the document type – “Write-off from current account”. Then select the document that reflects the issuance of the accountable amount. If there were several documents for issuing accountable amounts, then you need to select them one by one.

On the “Products” tab, fill out the tabular part with the purchased inventory items using the “Selection” button or the “Add” button.

You must specify:

· details of primary documents;

· quantity;

· price;

· supplier;

· VAT rate.

If the accountable person brought an issued invoice from the supplier, then check the box in the Invoice column, indicate the number and date in the Invoice Details field, when posting the document, a new Invoice received document will be automatically created.

On the “Other” tab, you can reflect payment for work, services and other costs (for example, per diem).

After this, you can post the document using the “Post” or “Post and Close” button.

When carrying out this document, the transaction is reflected in accounting by posting:

Return of unused funds to the organization's cash desk.

Funds unused by the accountable person must be returned to the organization's cash desk.

The amount of the balance (overspend) of the advance payment can be viewed in the “Advance Report” document in the line where the total data is displayed under the tabular part. Also, to determine the balance of an accountable person, you can use one of the standard reports - Account Analysis, Account Balance Sheet, etc.

The balance in our example, with which the unused funds must be returned to the organization’s cash desk, is equal to 450 rubles.

In the “1C: Accounting 3.0” program, the return of imprest amounts can be reflected through the document “Cash receipt” (section Bank and cash desk - Cash documents).

To create a document, you must click the “Receipt” button.

In the “Type of transaction” field, select the “Return from an accountable person” option.

In the “Accountable Person” field from the “Individuals” directory, indicate the employee who returns the balance of unspent funds.

In the “Amount” field, you must indicate the amount that the accountable person returns.

In the “Income Item” field, indicate the cash flow item with the type of movement “Other receipts from current operations.”

In the “Details for the printed form” block, information for the printed form of the cash receipt order is indicated.

After this, you can post the document using the “Post” or “Post and Close” button.

When carrying out this document, the transaction is reflected in accounting by posting:

To ensure that the data is reflected correctly, it is necessary to regenerate any standard accounting report for account 71.

We have looked at the reflection of the most basic transactions on corporate cards in 1C: Accounting 3.0, but there are still many nuances. Therefore, close attention and detailed study are needed here. If you encounter a problem, then leave a request on our website and we will definitely help you!

Specialist Elena Kabanova

Withdrawing funds for personal needs

An entrepreneur can withdraw funds from his current account for personal needs at any time. At the same time, the position of an individual entrepreneur is much more advantageous than that of an LLC: the owner of a limited liability company can cash out funds only by paying them to himself in the form of dividends. This can be done provided the company makes a profit and no more often than once every three months, while personal income tax is withheld at 13%.

The funds that remain in the current account of an individual entrepreneur after paying taxes, fees and obligatory payments can be used by him for personal purposes. The Tax Code does not provide for taxation of amounts of funds transferred from the current account of an individual entrepreneur to the account of an individual.

Deputy Director of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of the Russian Federation Ruben Sahakyan

letter of the Ministry of Finance of Russia dated August 11, 2014 N 03–04–05/39905

You can withdraw funds for personal needs in any amount - it is not limited by law, but banks often set a limit on withdrawals per day or per transaction.

There is a restriction that does not allow the withdrawal of individual entrepreneur funds for personal needs. If an individual entrepreneur has debts to the budget for taxes or insurance premiums, it will not be possible to withdraw funds. By order of the tax inspectorate, the bank will block them until you pay off your debts.

Blocking a current account can result in a suspension of payments and a ban on cash withdrawals for an entrepreneur.

Withdrawal methods

Cashing out can be done in the following ways:

- Receiving money at the cash desk. institutions on the basis of a payment document - a procedure similar to withdrawing cash to pay salaries to employees or to settle accounts with counterparties. Money is provided on the basis of an expenditure order.

- Transfer to an individual entrepreneur’s personal account and a linked payment card - after completing the transaction, the funds can be cashed out at any ATM.

- Transfer to a deposit or savings account - with this option, you can cash out at the time of closing the deposit agreement.

There is another way - transferring money to a checkbook. But at present this option is used extremely rarely.

Individual entrepreneur withdraws money from the current account: transactions

An individual entrepreneur is not required to keep accounting records; accordingly, he does not need to know the accounting entries. But no one prohibits individual entrepreneurs from conducting accounting, as this ensures more effective control over funds.

Individual entrepreneurs may not keep accounting records

Table: examples of typical IP postings

| Contents of a business transaction | Account by debit | Loan account |

| Received at the cash desk from the current account - posting | 50 | 51 |

| An advance payment has been received from the buyer of products/services | 51 | 62.2 |

| Payment received from the buyer of products/services | 51 | 62.1 |

| Cash was deposited into the bank through collection | 51 | 50 |

| The previously listed advance payment was returned from the supplier | 51 | 60 |

| Money returned from the budget/FSS | 51 | 68 (69) |

| Payment for products has been transferred to the supplier | 60 | 51 |

| The buyer's prepayment was returned | 62.2 | 51 |

| Taxes transferred to the budget (injury contributions to the Social Insurance Fund) | 68 (69) | 51 |

| Salaries were issued to employees on cards/accounts | 70 | 51 |

| Money was issued to employees for reporting on cards/accounts | 71 | 51 |

| Bank services for cash settlement services written off | 91 | 51 |

There are other options for accounting for the expenditure of individual entrepreneurs’ funds. Thus, the chief expert of the Accounting Online forum, Alexander Pogrebs, believes that to account for funds it is not at all necessary to use standard transactions from 1C, since the Chart of Accounts is approved only for organizations, and it does not apply to individual entrepreneurs. You can keep records using a ledger for recording income and expenses - this is quite enough. Income and expenses are recorded line by line in the ledger.

Using standard transactions intended for organizations for individual entrepreneurs can lead to the preparation of unnecessary documents, for example, expense reports.

Cash received by an individual entrepreneur from a bank account can be spent on personal needs without restrictions. Drawing up an advance report on the amounts of cash spent directly by an individual entrepreneur for any purpose is not carried out.

And. O. Director of the Cash Circulation Department of the Bank of Russia Yuri Loboda

letter of the Bank of Russia dated August 2, 2012 N 29–1-2/5603

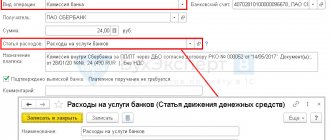

Bank services: transactions without VAT

Operations for opening and servicing a current account, cash transactions (except for collection), making payments, issuing a bank guarantee, servicing a bank client and others listed in clause 3 of Article 149 of the Tax Code of the Russian Federation are not subject to taxation.

Services of credit institutions without VAT should be reflected in correspondence with the cash account:

Dt 91.02 Kt 51, 52, 55, 57.

Bank transactions for services without VAT:

| Operation | Debit | Credit |

| Commission for execution of payment order | 91.02 | 51 |

| Commission for RKO in March | 91.02 | 51 |

| Fee for using a bank client | 91.02 | 51 |

| Commission for execution of payment in foreign currency | 91.02 | 52.02 |

| Acquiring fees | 91.02 | 57.03 |

| Refund of erroneously charged commission | 51 | 91.01 |

If an organization deposits funds in excess of the cash limit to a bank for crediting to a current account independently, without involving collectors, then the service for receiving and recounting cash is not subject to VAT.

Delivery of proceeds to the bank, postings:

| Operation | Debit | Credit |

| Cash deposit to current account (revenue) | 51 | 50 |

| Cash conversion fee | 91.02 | 51 |

| Cash acceptance fee | 91.02 | 51 |

A banking offer called “salary project” has become quite popular, which allows organizations to save accounting time on issuing wages, shortens and simplifies the procedure for paying wages.

Many credit organizations charge a commission within the framework of a salary project for transferring funds to employee cards; this type of commission is not subject to VAT. The accounting entry when paying for servicing a salary project:

Dt 91.02 Kt 51.

To what account should personal expenses be attributed to individual entrepreneurs?

Contents Now we have one of the most extensive and sometimes very complex topics. Perhaps, even in five, or even ten visits, it is impossible to study it all.

Today we will only talk about it in general, outline the paths, highlight the main points around which we will build further study of accounting. Today we are considering a topic in which the terms “costs and expenses”, “grouping by costs and expenses”, “classification” are constantly encountered.

How to understand where is what? When I looked at books on accounting, each time I caught myself asking myself the question: “In the examples, are these costs or expenses? What is the correct term to use? It seems that the author uses costs and in the next sentence already uses the term costs.

Confusion, that's all. Let us now repeat the meaning of these terms once again, so that later we can clearly perceive what we mean when we say them.

Fine? Costs are the exchange of monetary resources for something else that a business can store and use. For example, a company bought goods and materials.

Spent money, but did not lose it, because “money turned into other resources.” The transfer of materials to production or household needs occurs as follows:

- and this amount comes to the cost accounts (20, 23, 25, 26, 44)

- until the end of the month, such accumulated amounts can safely be said to be expenses

- the cost of these materials is calculated, for example, the average cost.

- Due to posting, materials are reduced by 10th account in the calculated amount and quantity

But when the process of closing the month begins and these costs begin to participate in the calculation of the financial result, then they turn into the concept of expenses, i.e.

these are costs taken into account for the financial result to calculate profit, from which “Income Tax” is then taken. Not all desired costs of an enterprise can be classified as expenses. Those. not all costs can be included in the financial result formula for calculating profit. Permission for certain types of expenses is stipulated in the Tax Code (Tax Code of the Russian Federation).

How can an individual entrepreneur withdraw money from a current account for personal needs in 2020?

Individual entrepreneurs quite often use a current account to pay taxes and fees, transactions with counterparties, and other things.

However, there are situations when it is necessary to withdraw money from an individual entrepreneur’s current account for personal needs. This is not prohibited by current legislation, but there are still some risks.

It is necessary to carry out the procedure correctly so as not to arouse suspicion from the Federal Tax Service and the financial institution.

What factors need to be taken into account

Withdrawing cash from a current account is the legal right of an individual entrepreneur. However, a number of circumstances should be taken into account:

- The bank may charge a transaction fee. Its size depends on the contract that was concluded. On average, about one percent of the amount. In this case, the commission will depend on the purpose for which the funds are withdrawn. So, for settlements under a contract this may be one figure, and for personal needs – another;

- despite the fact that most individual entrepreneurs are not required to maintain cash documents (at least in 2021), failure to comply with the basic rules may lead to a dispute with the Federal Tax Service;

- if funds are withdrawn regularly and the amounts exceed 100 thousand rubles, the bank may require documents confirming the purpose of the funds. This is provided for by Federal Law No. 115-FZ of 08/07/2001 to counter the legalization of illegally obtained finances and counter terrorism.

The following problem arises. On the one hand, the funds completely belong to the individual entrepreneur; he has the right to dispose of them as he sees fit. On the other hand, he does not fully have such an opportunity. The bank has some control. The bank carries it out not for its own needs, but because of legal requirements.

Postings when paying personal expenses from an individual entrepreneur’s account

They bring in statements, and there are “red and white”, “such and such a restaurant”, etc. in the counterparties.

Therefore, if an individual entrepreneur wants to share this information with someone (accountant, tax authorities), I personally do not mind).

Alrami LLC8(343)2010422 2016-09-15 22:43:51 Sharing information about your personal purchases with accountants and economists is not illegal) not even immoral) It would be more specific if we refer to the rules of law and sources of this law Russian legislation allows paying for personal needs from a current account. And please explain the wording “after all taxes have been paid.”

As I understand it, the current account indirectly relates to the payment of taxes; the Federal Tax Service Inspectorate only checks the tax base using it.

You can also pay taxes and fees in cash through an ATM. Info Payments of private entrepreneurs, as well as organizations, in most cases are carried out in non-cash form, since this is a practical and convenient method that does not require registration of cash transactions. However, in some situations, an entrepreneur may need cash for personal needs or for payments.

In this material, we will look at how an individual entrepreneur can withdraw money from a current account in 2021, how to formalize it correctly, and whether the banking institution charges a commission for such operations.

Key aspects Making non-cash payments is very convenient and safe for entrepreneurs, but there may be situations when they need to withdraw a certain amount of finance for settlements with counterparties or for personal expenses. Let's figure out what methods you can legally cash out, what legal norms regulate this issue.

Important The reason for this is to counter illegal fraud and fraudulent schemes regarding the illegal withdrawal of funds for unacceptable expenses. Despite the fact that after making all taxes and contributions to the budget, the entrepreneur has the right to spend funds at his personal discretion, it is still not worth wasting this capital uncontrollably from the account. By withdrawing funds from a current account, an entrepreneur bears the risk of reducing turnover.