Targeted financing funds are reflected in account 86 “Targeted financing”. In accounting, targeted financing includes: government assistance and similar funds (for example, grants and technical assistance from international organizations); targeted funds received by the developer for the construction of the OS facility from investors; as well as any funds received by non-profit organizations for the conduct of their statutory activities. The procedure for applying account 86 depends on the type of organization (commercial or non-profit).

Introductory information

The current legislation does not contain clear definitions of the concepts of “targeted funds” and “targeted revenues”. However, Article 251 of the Tax Code establishes closed lists of income that can be classified as targeted financing and targeted revenues. It is necessary to remember that specialists of the Ministry of Finance are guided by the legal position according to which Article 251 of the Tax Code of the Russian Federation contains an exhaustive list of income that is not taken into account when determining the tax base for income tax (for example, letters of the Ministry of Finance of Russia dated August 16, 2011 No. 03-03-05 /88, dated 06/01/11 No. 03-03-06/4/62). Therefore, any attempt at an expanded interpretation of the lists of targeted financing and targeted revenues may lead to a dispute with the tax authority.

Types of targeted funds and revenues

Special-purpose financing. Funds of targeted financing include property received by the taxpayer and used by him for its intended purpose, which is determined by the source of targeted financing (organization or individual), as well as by the legislation of the Russian Federation.

The main types of targeted financing of budgetary institutions include the following types of income:

- limits on budgetary obligations (budget allocations);

- subsidies provided by the budget system of the Russian Federation;

- funds received by medical organizations (except for government institutions) carrying out medical activities in the compulsory health insurance system, with the exception of medical services to insured persons from insurance organizations providing compulsory medical insurance to these persons.

Targeted funding in the form of limits on budget obligations (budget allocations) can be provided to government institutions.

Budgetary and autonomous institutions, on the basis of paragraph 1 of Article 78.1 of the Budget Code, from budgets of different levels may be provided with subsidies for reimbursement of regulatory costs associated with the provision by them in accordance with the state (municipal) assignment of state (municipal) services (performance of work), as well as subsidies for other goals.

Targeted revenues. Targeted revenues that are not taken into account when taxing profits are understood as revenues used for the intended purpose for the maintenance of non-profit organizations and the conduct of their statutory activities, received free of charge or on the basis of decisions of authorized bodies, or from other organizations and (or) individuals.

This type of targeted income such as donations deserves special attention. According to paragraph 1 of Article 582 of the Civil Code, a donation is the gift of a thing or right for generally beneficial purposes. Donations can be made to citizens, institutions (medical, educational, charitable, scientific and educational, related to social protection, culture, etc.), foundations, museums, public, religious and other non-profit organizations in accordance with the law, as well as to the state and other subjects of civil law specified in Article 124 of the Civil Code.

Accounting

In accounting, reflect funds for targeted financing in account 86 “Targeted financing”. What kind of property the investor provides is determined by the contract (Article 421 of the Civil Code of the Russian Federation). This can be either money or material assets (for example, fixed assets, inventories).

Situation: how to determine in accounting the value of property (for example, fixed assets) acquired by an organization as a property within the framework of non-state targeted financing?

Since, as part of non-state targeted financing, an organization receives property free of charge, its value must be determined in accordance with the general procedure applicable to assets received free of charge (clause 10.3 of PBU 9/99). For more information, see:

- How to reflect in accounting the receipt of fixed assets free of charge;

- How to record the receipt of materials in accounting.

Tax accounting of target funds and revenues

When taxing profits, funds for targeted financing are not taken into account (clause 14, clause 1 of Article 251 of the Tax Code of the Russian Federation), as well as targeted revenues (clause 2 of Article 251 of the Tax Code of the Russian Federation). Detailed lists of income that can be classified as targeted financing and targeted revenue are contained in Article 251 of the Tax Code of the Russian Federation.

In addition to the above types of revenues, budgetary and autonomous institutions can be provided with two types of subsidies from the budgets: for reimbursement of regulatory costs associated with the provision of state (municipal) services (performance of work) in accordance with the state (municipal) assignment; subsidies for other purposes.

Subsidies of the first type are not taken into account in income, since subclause 14 of clause 1 of Article 251 of the Tax Code of the Russian Federation can be applied to them. Let us note that this position is supported by the Russian Ministry of Finance in letter dated November 29, 2010 No. 03-07-11/458. But speaking in the same letter about subsidies for other purposes, financial department specialists note that the procedure for accounting for them when taxing profits depends on the legal qualification of the purposes for which the subsidies were allocated.

The rule that allows budget subsidies to be classified as targeted financing is given in the letter of the Ministry of Finance of Russia dated May 30, 2011 No. 03-07-11/151. It sounds like this: the activities of an institution, the financial support of which is provided through subsidies from the budgets of the budgetary system of the Russian Federation, must be carried out in accordance with the state assignment. Only in this case, subsidies allocated to such institutions for other purposes are not taken into account in income when determining the tax base for income tax on the basis of subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation.

Distribution by timing of occurrence

An expanded balance is usually used for reporting so that information can be more fully disclosed.

In turn, other debts may include:

- in section IV “Long-term liabilities” - line 1450;

- in section V “Short-term liabilities” - line 1550.

As the title of the sections suggests, arrears should be classified depending on the period of their occurrence:

- up to 12 months are considered short-term;

- over 12 months are long-term.

Other liabilities collect information at the end of the reporting period, which is taken into account in accordance with the approved Chart of Accounts. This document is a working guide for an accountant. Current other liabilities include the credit balance:

At the same time, you need to know that the information accumulated on the 76th account may relate to other lines of the report, depending on the subaccount, and it should not exceed a significant level. Otherwise, the information reflected in this account must be included in accounts payable.

Note from the author! Subaccounts are second-order accounts that go immediately after the main synthetic account. They characterize a specific area of accounting.

Current other liabilities may include:

- debts to investors when disbursing targeted financing;

- special funds to cover current expenses (account 82);

- deposited wages (account 76.04);

- settlements of claims (account 76.02);

- settlements on bills;

- VAT amounts accepted for deduction upon receipt of advance payment from buyers (account 76.AB).

It is not recommended to reflect VAT amounts on advances in liabilities, as they reduce the balance sheet total. Repayment of VAT from advances, unlike other subaccounts, should bring the information to a collapsed form. Since accounts receivable include prepayments, the credit balance must be reduced to the amount of debit 76.AB “VAT accrued on advances” and show the result in the “Current assets” section under the article “Other current assets” of Form No. 1.

Tax accounting of donations

According to subparagraph 22 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, when calculating income tax, income in the form of property received free of charge for the conduct of statutory activities is not taken into account. And paragraph 2 of Article 251 of the Tax Code of the Russian Federation states that when determining the tax base, targeted revenues are not taken into account (with the exception of targeted revenues in the form of excisable goods), among which donations are also named.

In addition to donations in the form of property (including cash), donations can be in the form of gratuitous work, but provided that the results of the work are used in accordance with their intended purpose. According to Article 5 of the Federal Law of September 11, 1995 No. 135-FZ “On Charitable Activities and Charitable Organizations,” charitable donations can be expressed in the form of disinterested (free of charge or on preferential terms) performance of work, provision of services by philanthropists - legal entities in the interests of the beneficiary. In our opinion, this means that performing work for free can be regarded as a donation.

It should be noted here that a gratuitous agreement is an agreement under which one party undertakes to provide something to the other party without receiving payment or other consideration from it (Clause 2 of Article 423 of the Civil Code of the Russian Federation). Consequently, the contract must necessarily indicate that it is a donation, otherwise it will be considered compensated.

Popular

Accounting reporting Deadlines for submission of reports in 2021: table

Payments to staff Funeral benefits in 2021

Personal Income Tax Certificate 2-NDFL: new form 2019

Maternity leave Maternity benefits in 2021

Statistical reporting Statistical reporting

Personal income tax Help 2-NDFL: new form-2018

Environmental payments Submission of the SME report for 2021

Personnel records management Production calendar 2019 with holidays and weekends

Insurance premiums of the Pension Fund of the Russian Federation Sample of filling out SZV-STAZH and ODV-1

Insurance contributions to the Social Insurance Fund Confirmation of the type of activity in the Social Insurance Fund 2021: deadlines

Transport tax Transport tax rates by region 2018 (table)

Taxes and fees Accountant calendar: 2021

Pension Fund insurance premiums ODV-1 - new form

Insurance premiums of the Pension Fund of Russia How to find out the SNILS number

Accounting for target revenues

Most of the funds (property, rights) received by state (municipal) institutions for tax accounting purposes can be qualified as targeted revenues (targeted financing).

The need for separate accounting of target funds and revenues for tax accounting purposes is provided for in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, paragraph 2 of Article 251 of the Tax Code of the Russian Federation. The Ministry of Finance reminded about this need in the letter of the Ministry of Finance of Russia dated 03/05/12 No. 03-03-06/4/18. In the absence of separate accounting of target funds and revenues, this business transaction is subject to taxation from the date of receipt of income.

The instructions for the use of the Unified Chart of Accounts (approved by Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n, hereinafter referred to as Instruction No. 157n) provide certain tools for organizing separate accounting of income and expenses in the context of certain types of target funds. According to paragraph 21 of Instruction No. 157n, when generating an account number code in the 18th category, accounting entities indicate codes for the type of financial support (1 - budgetary activity; 2 - income-generating activity, etc.).

Reflection of donations in accounting.

Let's look at accounting for target revenues in accounting using the example of donations.

Example

As part of its charitable activities, a construction organization repaired a playground in a preschool institution free of charge. The cost of repair work on the playground, carried out by the organization as part of charitable activities, should be reflected in the debit of account 2 401 20 225 “Expenses for work, property maintenance services” and the credit of account 2 401 10 180 “Other income” using account 2 205 81 000 “Settlements with payers for other income.”

1. The repair of the playground, provided free of charge, is reflected: Dt 2,205 81,560 “Increase in accounts receivable for other income” Kt 2,401 10,180 “Other income” Dt 2,401 20,225 “Expenses for work, property maintenance services” Kt 2,302 25 730 “Increase in accounts payable for work, property maintenance services”

The basis for reflecting this operation are such primary documents as the Certificate of Acceptance of Work Completed and the Certificate of Cost of Work Completed and Expenses.

2. Calculations for repairs are reflected: Dt 2 302 25 830 “Reduction of accounts payable for work, services for property maintenance. Kt 2,205 81,660 “Reduction of accounts receivable for other income.”

Explanation of balance sheet asset lines

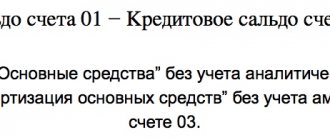

10 “Materials”, 11 “Animals for growing and fattening”, 14 “Reserves for reducing the cost of material assets”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”, 20 “Main production”, 21 “Semi-finished products own production”, 23 “Auxiliary production”, 28 “Defects in production”, 29 “Service production and facilities”, 41 “Goods”, 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 97

50-3 “Money documents”, 94 “Shortages and losses from damage to valuables”

How to organize accounting and tax accounting of target funds and revenues?

However, to organize reliable accounting of target funds for both accounting and tax accounting purposes, the tools provided for by Instruction No. 157n are not enough. Therefore, the accounting policy of a state (municipal) institution must provide tools for organizing separate accounting of transactions carried out with property (including cash), the receipt of which was previously qualified as a target for tax and (or) accounting purposes. Such tools include:

- use of additional codes when generating analytical accounts (by introducing an additional digital code into the account number);

- organization of accounting in the context of certain analytical indicators;

- organization of additional off-balance sheet accounting.

Reporting on the use of targeted funds and proceeds

Organizations that have received targeted funding, targeted revenues and other funds specified in paragraphs 1 and 2 of Article 251 of the Tax Code of the Russian Federation must submit to the Federal Tax Service a “Report on the targeted use of property (including funds), works, services received as part of charitable activities , targeted revenues, targeted financing” - sheet 07 of the Income Tax Declaration.

Codes of types of income for filling out sheet 07 of the Declaration are given in Appendix No. 3 to the Procedure for filling out a tax return for income tax (approved by order of the Federal Tax Service of Russia dated March 22, 2012 No. ММВ-7-3 / [email protected] ). In addition, for income in the form of work (services) received free of charge by non-profit organizations, performed (rendered) on the basis of relevant contracts, the type of income code is 130.

This report does not include funds in the form of limits on budgetary obligations (budgetary allocations) communicated in the prescribed manner to government institutions, as well as in the form of subsidies provided to budgetary and autonomous institutions (clause 15.1 of the Procedure for filling out sheet 07 of the Income Tax Declaration).

On what basis should it be included in the balance sheet?

Other liabilities are usually called everything that does not fit into the format of other balance sheet items and at the same time is too insignificant to be included in a separate line.

At the end of the reporting year, any organization is required to submit financial statements based on the results of its economic activities. These are Form No. 1 “Balance Sheet” with appendices, Form No. 2 “Report on Financial Results” and others. What the balance sheet consists of is described in PBU 4/99.

The balance is divided into two parts:

- Assets.

- Liabilities.

Assets take into account the property of the enterprise, and liabilities - its obligations to third-party and internal counterparties. Significant debts are located in specially designated lines. Non-material indicators are in other liabilities that collect a variety of accounting data.

Note from the author! The materiality level is set at 5%. This means that an indicator is considered significant if without it the information in the report would be undisclosed. An amount that is less than 5% in relation to the total balance sheet section is considered insignificant.