Employers are required to transfer insurance premiums against industrial accidents and occupational diseases to the Social Insurance Fund and to the tax office in case of temporary disability or maternity of employees. Companies often reimburse benefits paid to their employees from social insurance. This is possible if contributions were transferred in a larger volume than was returned in benefits. In such cases, interim reporting must be submitted to the fund. What is it and what are the basic principles of its compilation, we will consider below.

Title page

The title page is filled out by the policyholder, except for the subsection “To be filled out by an employee of the territorial body of the Fund.”

Attention! If the policyholder is registered in the SBIS system, then almost all fields of the title page are filled in automatically.

“Adjustment number” field is filled in as follows: if the calculation is primary, then “000” is indicated, if it is a corrective calculation, then the adjustment number “001”, “002”, etc. is indicated.

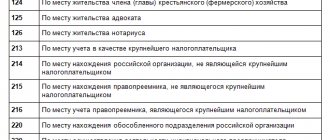

“Reporting period (code)” field is filled in in accordance with the codes given in the directory. In this case, the first two digits are the code of the reporting period (for example, if the calculation is made for the first quarter, then the code “03” is selected, for the half year “06”, etc.), and the last two digits indicate the number of requests from the policyholder for the allocation of funds for payment of insurance compensation (one appeal - 01, etc.).

“Calendar year” field automatically indicates the year for the reporting period for which the calculation is presented.

Attention! The “Cessation of activities” field is filled in only if the organization’s activities are terminated due to liquidation or termination of activities as an individual entrepreneur.

Field “Full name of the organization, separate division/full name” individual entrepreneur, individual" is filled in automatically in accordance with the name (full name) specified in the policyholder's registration card. When filling out this field, the full (without abbreviations) name of the organization (separate division) is reflected, corresponding to that indicated in the constituent documents or the last name, first name, patronymic (if any) of the individual entrepreneur.

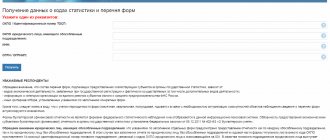

The fields “TIN” , “KPP” and “OGRN (OGRNIP)” are filled in automatically from the client’s registration card in the program.

In the “OKVED Code” , select the code of the main type of activity of the policyholder in accordance with the all-Russian classifier of types of economic activity. These codes are determined by organizations and individual entrepreneurs independently and are contained in extracts from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs.

In the “Budget organization”

The policyholder's attribute is selected in accordance with the source of financing:

- 1 - federal budget;

- 2 - budget of a constituent entity of the Russian Federation;

- 3 - municipal budget;

- 4 - mixed financing.

Attention! The attribute in this field is indicated only by policyholders who are budgetary organizations.

When filling out the “Contact telephone number” , the policyholder’s telephone number specified during registration is reflected.

In the “Registration Address” , organizations indicate their legal address, and individual entrepreneurs (individuals) indicate their registered address at the place of residence.

The field “Average number of employees” indicates the average number of employees.

The corresponding fields indicate the number of working disabled people and workers employed in hazardous industries.

Attention! All headcount indicators are indicated as of the reporting date, i.e. on the last day of the reporting period for which the calculation is submitted.

When filling out the field “Calculation is presented on ____ page.” The number of pages on which the calculation is compiled is indicated.

The field “with supporting documents or their copies on ___ sheets” reflects the number of sheets of supporting documents and (or) their copies (if any). Such documents may be: the original (or a certified copy) of a power of attorney confirming the authority of the policyholder’s representative (if the calculation is submitted by a representative of the insurance premium payer), etc.

In the section of the title page “I confirm the accuracy and completeness of the information specified in this calculation:” the following is indicated:

1 - if the document is submitted by the policyholder,

2 - if the document is presented by a representative of the policyholder;

3 – if the document is presented by the legal successor.

Next, indicate the last name, first name, patronymic of the head of the organization, individual entrepreneur (individual) or representative of the policyholder.

In the “Document confirming the authority of the representative” , the type of document confirming the authority of the signatory is indicated (for example, a power of attorney, its number and date).

Sample of the annual report 4-FSS

A sample of filling out 4-FSS for the year is available on our website.

However, let us immediately make a reservation that when creating the above example of filling out 4-FSS for the year, we did not use all the tables of the existing report, since our task is limited to reflecting the design principles. Therefore, the given sample 4-FSS for the year can be used as a form for this report only when there is no need to fill out the tables missing from it. If there is such a need, then it is better to initially take the full version of the form to enter data into the 4-FSS report for the year, filled out according to your own real data.

ConsultantPlus experts explained how to reflect various payments in Form 4-FSS. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

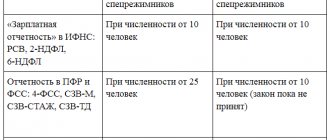

Only those insurers whose average number of employees does not exceed 25 people (Clause 1, Article 24 of Law No. 125-FZ of July 24, 1998) can prepare a report for submission to the Social Insurance Fund in paper form. The rest will prepare it electronically using software, using the report form contained in the program. The program will automatically exclude unfilled tables from the generated report.

We will tell you in this article when you need to report for 2021.

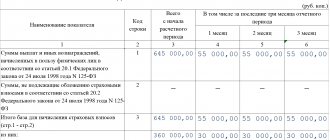

Table 1. Calculation of the base for calculating insurance premiums

The indicators in the table are reflected as follows:

- in column 3 - on a cumulative basis from the beginning of the billing period;

- in columns 4-6 - for the last three months of the reporting period.

In line 1, the total amount of payments and other remunerations subject to insurance premiums is automatically calculated:

page 1 = page 2 + page 3

Line 2 indicates payments that are not subject to insurance premiums (if any). In this case, the value in column 3 is calculated automatically as follows:

page 2 gr. 3 (for 1 quarter of the billing period) = (column 4 + group 5 + group 6) page 2

page 2 gr. 3 (for other reporting periods) = page 2 gr. 3 calculations for the previous reporting period + (column 4 + group 5 + group 6) page 2 calculations for the current reporting period

Line 3 reflects the base for calculating insurance premiums. In this case, the value in column 3 is calculated automatically as follows:

page 3 gr. 3 (for 1 quarter of the billing period) = (column 4 + group 5 + group 6) page 3

page 3 gr. 3 (for other reporting periods) = line 3 gr. 3 calculations for the previous reporting period + (column 4 + group 5 + group 6) page 3 calculations for the current reporting period

Attention! When filling out line 3 , you should pay attention to the fact that the following equality must be satisfied:

page 3 = page 1 – page 2

Line 4 indicates payments made in favor of disabled people. In this case, the value in column 3 is calculated automatically as follows:

page 4 gr. 3 (for 1 quarter of the billing period) = (column 4 + group 5 + group 6) page 4

page 4 gr. 3 (for other reporting periods) = page 4 gr. 3 calculations for the previous reporting period + (column 4 + group 5 + group 6) page 4 calculations for the current reporting period

Line 5 indicates the size of the tariff that is established for the organization or its separate division.

Attention! Line 5 is filled out on the basis of a notice of the amount of insurance contributions for compulsory social insurance against accidents at work and occupational diseases, which is issued to the policyholder by the branch of the Federal Social Insurance Fund of Russia.

If the organization has the right to a discount on the insurance rate, then it is reflected in line 6 . The percentage of discount to the insurance rate is set by the territorial body of the Social Insurance Fund for the current calendar year and depends on the state of labor protection (including the results of a special assessment of working conditions, as well as mandatory medical examinations) and the cost of insurance coverage.

If the organization uses a premium to the contribution rate, then line 8 reflects the date of the order of the territorial branch of the Social Insurance Fund to establish the premium, and line 7 indicates the percentage of the premium. The percentage of the premium to the insurance tariff is set by the territorial body of the Social Insurance Fund for the current calendar year.

The maximum discount (surcharge) cannot exceed 40% of the approved insurance rate.

In line 9, the final rate of insurance premiums is automatically calculated taking into account the discount or surcharge using the following formulas:

- if the payer of insurance premiums does not have discounts (surcharges) to the insurance rate:

page 9 = page 5

- if the payer of insurance premiums has a discount on the insurance rate:

page 9 = page 5 – page 5 * page 6 / 100

- if the payer of insurance premiums is given a premium to the insurance tariff:

page 9 = page 5 + page 5 * page 7 / 100

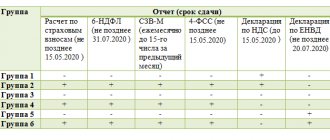

In what cases is an interim report submitted?

In order to cover the costs of payments to employees who have received injuries or occupational diseases through contributions, the employer submits an interim calculation of 4-FSS to the Social Insurance Fund of the Russian Federation. The report is drawn up only if the amount of contributions from the NSiPZ, according to the calculations of the policyholder, is less than the amount of benefits paid to employees for this period.

In this case, the report is filled out when the indicated payments were made in the first or second month of the reporting quarter - hence the name “interim”, since it is submitted in the interval between quarterly reports. If payments are made in the third month, then the expenses incurred are reflected in the quarterly 4-FSS and interim reporting is not submitted.

Important! The interim FSS report is submitted to the social insurance fund if the region in which the employer is registered is not included in the FSS pilot project. Participants in the pilot project submit the required list of documents to the Social Insurance Fund, and payments to the employee are made directly from the fund, while the insurer transfers contributions from the National Social Insurance Fund in full.

Section No. 2

Only those policyholders who apply special tax regimes need to fill out section No. 2. When drawing up a report in this case, indicate:

- Policyholder code.

- The amount of money received from the Social Insurance Fund.

- The amount of debt for the Social Insurance Fund.

- Expenses for temporary disability benefits.

- The total amount of expenses associated with the payment of benefits for pregnancy, childbirth and child care.

An insured who combines the general taxation regime with the payment of UTII should fill out sections No. 1 and No. 2 on the basis of separate accounting data in relation to the relevant types of activities.

Share this article

with your friends on social media. networks:

Section No. 2

Only those policyholders who apply special tax regimes need to fill out section No. 2. When drawing up a report in this case, indicate:

- Policyholder code.

- The amount of money received from the Social Insurance Fund.

- The amount of debt for the Social Insurance Fund.

- Expenses for temporary disability benefits.

- The total amount of expenses associated with the payment of benefits for pregnancy, childbirth and child care.

An insured who combines the general taxation regime with the payment of UTII should fill out sections No. 1 and No. 2 on the basis of separate accounting data in relation to the relevant types of activities.

Share this article with your friends on social media. networks:

What is it for?

Form 4 of the Social Insurance Fund reflects the calculation of all insurance premiums in the event of unexpected injuries to employees of the enterprise. The form is needed to clearly reflect complete information about benefits paid in the event of accidents and the amounts spent on medical examinations. Based on the reports received, workplace assessments can be carried out.

Entering information about sick leave